The Daily Star

Last update on: Thu Aug 21, 2025 12:21 AM

The government’s revenue collection rose 24 percent year-on-year in the first month of the current fiscal year, aided by a more stable political situation compared to the unrest during the uprising last year.

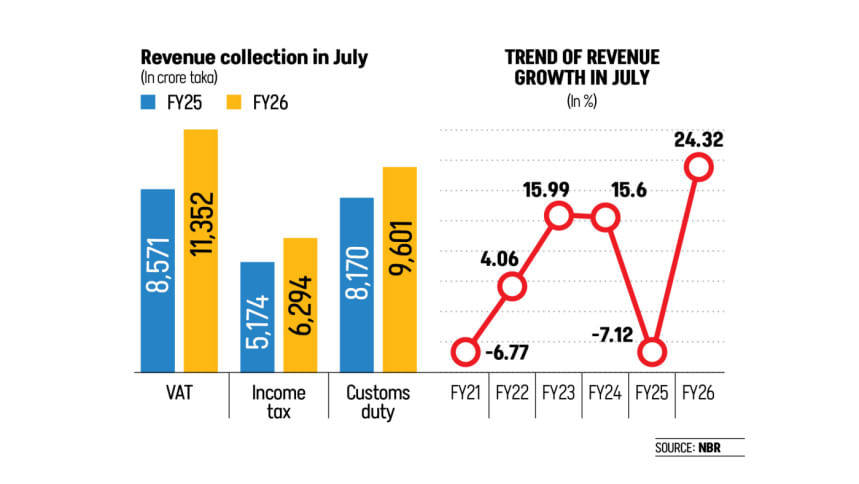

The National Board of Revenue (NBR) collected Tk 27,247 crore in July, the first month of fiscal year 2025-26, according to provisional data released yesterday. Higher receipts from value-added tax and income tax drove the overall revenue growth.

In July 2025, local-level value-added tax (VAT) led the collection. Revenue from this source reached Tk 11,352 crore, up from Tk 8,571 crore in July 2024, marking a 32.45 percent growth.

Income tax and travel tax also contributed significantly, with collections reaching Tk 6,295 crore, a jump of Tk 1,120 crore compared to the same period last year.

Besides, the collection of duties from international trade rose 17.51 percent to Tk 9,601 crore due to higher imports.

Tax analysts and NBR officials attributed the rise in revenue to a relatively stable political environment, compared to last year when the country was reeling from shutdowns and protests during the uprising.

Despite the increase in collection, NBR fell short of its July target by 9.5 percent. The target was Tk 30,110 crore for the month. For the entire fiscal year, the NBR has set a revenue collection goal of Tk 499,000 crore

The intense political unrest in July and August, which culminated in the ouster of the Awami League government on August 5 last year, severely disrupted economic activities, including trade through the country’s ports.

“It’s good news that NBR has returned to its regular positive growth,” said Muhammad Abdur Razzaque, chairman of local think-tank Research and Policy Integration for Development (RAPID).

But this is not enough to meet its revenue target by the end of the year, he noted.

Despite the increase in collection, NBR fell short of its July target by 9.5 percent. The target was Tk 30,110 crore for the month. For the entire fiscal year, the NBR has set a revenue collection goal of Tk 499,000 crore.

“To speed up revenue growth, the government should implement the NBR reform activities quickly, which have already slowed down,” Razzaque suggested.

Besides, the NBR has to focus on horizontal equity, ensuring that people with the same ability to pay are treated equally.

Meanwhile, NBR, in a statement, said that to maintain this momentum of revenue collection, it would implement various initiatives to further strengthen the work of officials and staff responsible for collecting income tax, VAT, and customs duties.

The tax authority expressed hope that taxpayers would continue playing a vital role in nation-building by complying with tax laws and paying the correct amount of taxes.

Seeking anonymity, a top NBR official said that along with a stable environment, the recent drive against tax evaders is likely to boost revenue collection.

“Apart from this, last year’s delayed bills were also submitted in July, which is likely another contributing factor,” the official added.

However, Bangladesh Bank Governor Ahsan H Mansur yesterday expressed frustration at an event, organised by Care Bangladesh, over the low tax-GDP ratio in Bangladesh.

“Bangladesh is not doing a good job in terms of revenue collection. We need to focus on that constructively,” he said.

As global aid flows shrink and traditional donor priorities turn inward, Bangladesh must focus on domestic resource mobilisation, he said.

“Some initiatives are being taken by the government, but there’s resistance from within,” Mansur said, citing an example of the recent fallout from a strike at the revenue board, where officials essentially wanted to maintain the status quo.

“But the status quo is not an option. We have to break out of it and move towards higher revenue generation,” he said.