Sadeq Khan

The ruling elite of Bangladesh, uninterruptedly pampered as its members are over nearly a decade with lots of flash money and license to break the law toting pistols in their pockets, has become totally insensitive and stoical about ordinary people’s sufferings. Ministers, parliamentarians, local government heads and members all seem obsessed with only one mission, how to extract ‘pin money’ from multifarious levels of government or local government control in development spending as well as in revenue earnings, apart from extortion rackets that they may be individually running in respective turfs of public influence.

Opposition voices have been coercively rendered harmless, and the civil society either cowed down or bought over. Even the media loudly harps the tune of the incumbent power elite, with or without news value, while relegating to the backstage the perils of the people. Commodity market worldwide has slumped, but in our city markets, cost of consumables for daily household needs have skyrocketed although supplies are generally adequate.

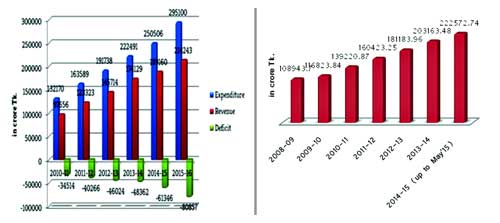

Debt and Deficit: Trends and Challenges, Bangladesh Economic Update.

People being hard hit

Disruption within the city and intercity transportation has assumed awesome proportions, traffic congestions as well as water logging in heavy rains virtually immobilizing metropolitan civic order. Perils of common people in the countryside, with whole communities in the north and the southeast of the country marooned and suffering hunger and diseases in make-shift shelters or damaged homesteads under flooded terrains, appear to have been entirely forgotten by the power elite, their cornered contenders, and even by any flurry of charities this year. Economic conditions of the middle and lower income group people across the board have deteriorated as prices have escalated for basic requirements of living space, healthcare and education.

No one cares. Bombasts on the other hand are carried on aplenty in TV talks and newspaper columns about growing affluence. And the government authorities did not find it necessary to bat an eyelid in choosing this hour to raise the prices of gas and electricity. The decision to enhance power and gas tariffs provoked massive public protests. Economic analysts and business leaders are all in agreement that the raise will seriously affect the industries, increase costs of local products, and make way for cheaper foreign imports.

Bangladesh Energy Regulatory Commission (BERC) increased gas tariff by 26.29 percent and power tariff by 2.93 percent. According to the new rate, each cubic metre of gas for industries will cost Tk 6.74 as against previous Tk 5.86. For the tea gardens gas price has been raised from Tk 5.86 to Tk 6.45. For the industrial consumers, the new rate of gas will be Tk 11.36 as against previous Tk 9.47.

Production cost to rise

In addition, price of electricity has also been raised. Earlier, the small industries could purchase per unit of power at Tk 7.42, but now they will have to pay Tk 7.66. For the big industries, the price of power earlier was Tk 7.32 per unit, but now it will be Tk 7.57. The offices of the factories and all commercial establishments selling commodities will also have to pay more. In the commercial field, BERC has raised the price of power from Tk 9.58 to Tk 9.80 per unit. The most serious pressure will fall on the captive power plants as the price of per cubic metre of gas for them has been doubled from Tk 4.18 to Tk 8.36.

FBCCI president Abdul Matlub Ahmed said, “The export-oriented industries will trail behind in competition due to price hike of gas and power at this moment. Especially, those who generate electricity with captive power will be in more trouble. As a result of the price hike, the cost of production will increase and the prices of the commodities will also rise.”

Expressing grave concern over the hike in gas and electricity tariff, Dhaka Chamber of Commerce and Industry urged the government to review the decision in greater interest of the country’s economic growth. The trade body handout said:

“The hike will have severe impact on businesses. The industrial sector will be affected badly as any hike in utility prices push up the costs of doing business.

“The tariff hike might also affect the economy by fueling inflation to a double digit. Price of LPG remains higher than in the international market. DCCI thinks it will add sufferings to the poor and middle-income people as the hike in utility prices will increase cost of living.

“The tariff hike should have been justified taking into account the income and socio-economic condition of the general people and above all, the rapid and ambitious industrial and economic growth targets in line with the government’s Vision 2021.”

Price hike irrational

The trade body also observed that the hike was not rational as the current power and gas supply has been failing to meet the growing and diverse needs of various industries, trade and other economic activities. Being the largest user of captive power, growth in textile and RMG sector will be immensely challenged by the tariff hike, the trade body added.

The overall picture of economic health is equally disturbing. The government merrily goes on borrowing for the power elite’s loot from extravagant public spending. Productive businesses, trade, manufacturing and service industries are starved of financing support. The brakes thus imposed on the dynamics of economic growth of the nation-state are slow-poisoning our financial order. But who cares?

The Unnayan Onneshan, an independent multidisciplinary think-tank, in its monthly publication of ‘Bangladesh Economic Update’ September 2015, reveals that increases in per capita debt and debt service payment are likely to lower development finance and escalate intergenerational debt burden in the months ahead. The economic update notes that in FY 2014-15 (July-May), the total outstanding domestic debt has increased by 13.7 percent while the total outstanding external debt burden increased to by 8.5 percent in FY 2013-14. And during the period from FY 2012-13 to FY 2013-14, the debt service payment increased by 18.6 percent.

Government borrowed more from non-banking system than the banking system in FY 2014-15, but deficits are continuing to be financed by government borrowing from the banking system. The domestic debt stood at Tk. 2,22,573 crore in FY 2014-15 (July-May) crore in FY 2013-14, which was Tk. 2,03,163 crore, Tk. 1,81,184 crore, Tk. 1,60,423 crore and Tk. 1,39,220 crore in FY 2013-14, FY 2012-13, FY 2011-12 and FY 2010-11 respectively. Debt has increased by Tk. 26,788 crore during the period from FY 2013-14 (July-May) to FY 2013-14 (July-May).

Rise in deficit and debt

The external debt has increased by $319 million in FY 2013-14 compared to FY 2012-13. In FY 2014-15 (July-February), external debt stood at $1,495 million. The total outstanding external debt, however, stood at $27,036 million in 2013-14, whereas it was $24,907 million in FY 2012-13.

Increasing government borrowing from domestic sources may crowd out private investment by causing the interest rate to rise. In July-May period of FY 2014-15, total domestic debt has increased by 32.93 percent from the corresponding period of the FY 2013-14.

Financing of budget deficit in July-May period of FY 2014-15 stood higher at Tk. 33,883.09 crore compared to Tk. 27,379.43 crore during the corresponding period of FY 2013-14, representing an increase of 23.8 percent. Unnayan Onneshan called for an immediate debt management strategy and harmonization of the macroeconomic policies to check the inevitability of ominous effects of debt and deficit.

Source: Weekly Holiday