Finance Minister AMA Muhith on Monday said the government would go for constructing an expressway from the capital’s Zero Point to Mawa on a Public-Private-Partnership (PPP) initiative with an estimated cost of around US$ 1.5 billion.

“The agreement on an expressway from Zero Point to Mawa (on PPP basis) will be finalised within this year with a cost of roughly $ 1.5 billion where our government’s involvement would be around $ 100 million,” he said.

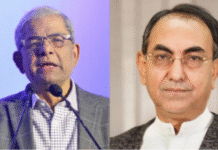

The Finance Minister came up with the remarks when the newly office bearers of Dhaka Chamber of Commerce & Industry (DCCI) met him at his secretariat office. DCCI president Mohammad Shahjahan Khan led the delegation.

Asked about the details of the expressway project, Muhith said that the PPP office would soon inform about it.

The Finance Minister, however, said that the government could not advance much on the PPP initiative despite too much of efforts in the first year of the immediate past government as there were some weaknesses from the government’s part.

He said although the PPP guideline is there, there is a need for freeing the PPP initiative from the PPR process, and discussions to this end with stakeholders will be held next month as the PPP unit has already drafted a proposal in this regard.

About the slow pace in the implementation process of the country’s two big ongoing projects –- upgradation of Dhaka-Chittagong and Dhaka-Mymensingh highways into four–lane ones, Muhith blasted the contractors for the slow pace of works. “There’s no problem regarding fund and design. But, the contractors concerned don’t work properly and there is less control over them.”

About the high bank interest rates as raised by the DCCI leaders, the Finance Minister said there is a need to think differently on this issue. “Perhaps, we should try to go into a system where there would be a relation between interest rate and bank rate.”

Muhith said the high bank interest rate has turned into a common phenomenon in Bangladesh, but as per economic consideration there should be minor differences between interest rate and inflation rate which is a global practice. “But, in Bangladesh, there is no relationship in these two,”

“I’ve talked about his issue 30 years back that the interest rate should be related to bank rate and inflation rate,” he said.

Source: UNB Connect