Halima Khatun, a 55-year-old widow, has to rely on income from fixed deposit receipt (FDR).

A couple of years back, she had to sell the family’s mortgaged land to repay the loans her husband had taken to start a business that ended in failure. She was left with Tk 5 lakh, which she kept as FDR with a private bank.

Halima, a mother of three, has been on her own since her husband died several years back. She doesn’t get any financial support from her daughter and two sons who can barely make ends meet.

Her financial woes are likely to get worse, as the new budget proposes raising the excise duty on bank deposits.

Thousands of people, who have some savings in the form of bank deposits for their uncertain future, would have to pay the government Tk 800 per Tk 1 lakh from the next fiscal year, instead of Tk 500 now.

Seeking anonymity, an NBR official said excise duty has been there for many years under the Excise and Salt Act of 1944. But after the introduction of VAT in 1991, the government started phasing out excise duties.

It, however, retained excise duty on two things — air tickets and bank deposits.

Bank officials say there is no such duty on deposits anywhere in the world.

The burden of excise duty on deposits adds to the financials constraints of people like Moklesur Rahman (not his real name).

Being a petty private job holder with no post-retirement pension benefits, Moklesur saved some money in the form of bank deposit schemes. He is now worried about the future of his two children with the government desperate to earn more revenues from even small deposits.

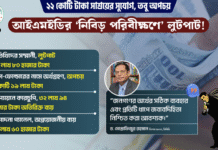

Finance Minister AMA Muhith, however, has his own logic.

“It is very difficult to define the rich. People with deposits of Tk 1 lakh or more are affluent enough. They have the ability to bear the additional burden of the increased excise duty,” he said.

According to the proposed budget, a bank account with balance of up to Tk 1 lakh would be exempted from excise duty.

An excise duty of Tk 800, up from the existing Tk 500, will be imposed on an account with debit or credit balance between Tk 1 lakh and Tk 10 lakh.

For a bank balance between Tk 10 lakh and Tk 1 crore, the excise duty would be Tk 2,500, about 67 percent higher than the current rate.

Some Tk 12,000 in excise duty, instead of the existing Tk 7,500, will be slapped on a bank balance between Tk 1 crore and Tk 5 crore. And for a bank balance exceeding Tk 5 crore, the excise duty will be Tk 25,000, up from Tk 15,000 now.

NBR officials explained that even if deposits at a bank account cross different threshold levels several times in a given year, excise duty would be deducted for only once.

Many depositors have raised voice for waiver of excise duty altogether while others feel such different slabs and increase in duty on deposits would erode their financial capability.

They find it unjust to hike excise duty on thousands of bank depositors and suggested that the government better expand tax net and bring many solvent yet untaxed people under income tax net.

NBR sources said around Tk 1,500 crore in yearly revenue comes from excise duties — Tk 1200 crore from bank deposits and the rest from air tickets.

According to BB officials, excise duty was collected from about 83 lakh bank accounts as of December last year.

Source: The Daily Star