China, the largest apparel exporter worldwide, is becoming a major destination for Bangladeshi garment items due to duty benefits offered by the Asian economic giant and a rising middle-class there.

Garment exports to China, the second largest Asian apparel market for Bangladesh after Japan, accelerated 73.48 percent year-on-year to $241.37 million in fiscal 2013-14, according to the Export Promotion Bureau.

The earnings were $136.5 million in July-December this fiscal year, with 24 percent growth year-on-year.

After garments, Bangladesh’s jute and jute goods and leather and leather products are also becoming popular in China, fetching $100 million and $60 million, respectively, in fiscal 2013-14.

“Our garment exports to China will cross $1 billion in three to four years,” said Syed Sadek Ahmed, managing director to Space Sweater.

Space Sweater that started exporting sweater to China in 2013 ships $1 million worth of products a year, Ahmed said, adding that he plans to sell other garment products as well.

Due to rising production cost, Chinese businesses are moving away from producing low-end garments, which has created an opportunity for Bangladesh, he said.

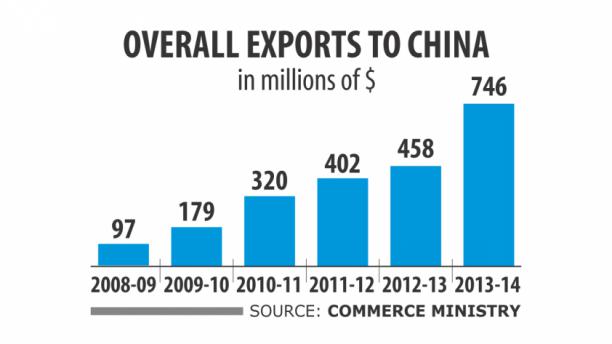

Overall exports to China have also been on the rise: $746.19 million came in 2013-14, with a whopping 63 percent rise year-on-year. In July-March, total exports to China were worth $579.13 million.

Because of the duty benefits and low production cost in Bangladesh, Chinese consumers can save up to 15 percent if their garments are bought from Bangladesh.

In July 2010, China offered a zero-duty benefit for exports of 4,721 types of Bangladeshi products, of which the majority are garments.

Exporters said they enjoy an added advantage in the Chinese market as 90 percent of the garments they ship to China without paying any duty include T-shirts, jeans, sweaters and casual trousers, and Bangladesh has an edge over its competitors for these products.

Bangladeshi garment items enter China in three ways — by international retailers such as H&M and Walmart, by Chinese manufacturers operating in Bangladesh, and by Chinese retailers and brands, exporters said.

China is losing its share in the global apparel business due to its higher production cost, including labour wage, a lack of skilled workforce and a shift of its manufacturing base towards technological products.

The average wage for Chinese garment workers is around $500 per month, while the amount is between $70 and $100 in Bangladesh.

This is why Chinese businesses source garments from countries like Bangladesh and Vietnam.

The apparel market size in China is $300 billion a year, of which more than $150 billion is export-oriented, according to China National Garment Association.

China has a population of 1.3 billion, most of whom fall in the middle-income bracket and rely on low-end clothing.

“We have a big opportunity in the Chinese market,” said Shahidullah Azim, vice-president of Bangladesh Garment Manufacturers and Exporters Association, the garment exporters’ platform.

“We are trying to remove the barriers to exports to China,” Azim said.

The balance of bilateral trade between the two countries is heavily in favour of China due to higher imports by Bangladesh.

In fiscal 2012-13, Bangladesh imported goods worth $6.32 billion from China, against $6.44 billion in the previous year, according to the commerce ministry.

Before the duty benefits were offered, Bangladesh’s main export items to China were jute, jute goods, fish and frozen fish, leather and leather goods, Azim said.

India is another major Asian market that is becoming lucrative for Bangladeshi apparel exporters.

Garment exports to India have also been rising, though at a slower pace than those to China, since the neighbour allowed zero-duty benefits for Bangladeshi garment items in November 2012.

In fiscal 2013-14, Bangladesh exported apparel items worth $96.26 million to India, with a 21.86 percent rise year-on-year.

Source: The Daily Star