Last update on: Wed Mar 5, 2025 12:02 AM

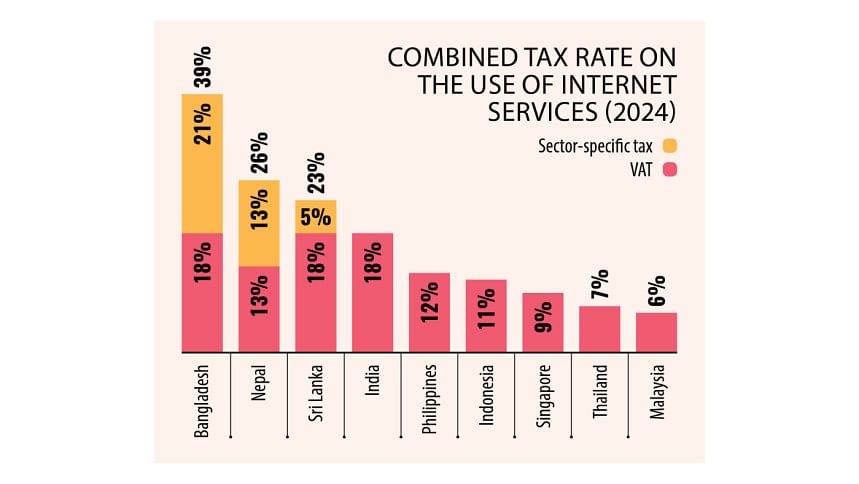

Bangladeshi citizens were burdened with some of the highest taxes on internet usage in Asia in 2024, with a combined tax rate of 39 percent on internet services, according to a recent report by GSMA, a non-profit organisation that represents the interests of mobile network operators worldwide.

This high tax rate, comprising 21 percent in sector-specific taxes and 18 percent in VAT, exacerbates the digital divide and poses a significant barrier to the country’s digital transformation efforts, the report said.

The report, titled “Enabling Mobile Network Investment: Policy Reforms for Bangladesh”, reveals that Bangladesh’s internet tax rate far exceeds that of its regional peers.

Nepal imposes a 26 percent tax on internet services, Sri Lanka 23 percent, India 18 percent, the Philippines 12 percent, and Indonesia 11 percent.

The GSMA report highlights that the telecom sector in Bangladesh faces additional financial challenges, including notably higher corporate income tax rates compared to other industries.

Publicly traded telecom companies are taxed at 40 percent, while non-publicly traded companies face a 45 percent rate—higher than rates in India and comparable to those applied to industries like tobacco.

Furthermore, telecom operators are subject to a minimum turnover tax of 2 percent, significantly higher than the 0.6 percent applied to other sectors.

The lack of a credit mechanism for input taxes further increases operational costs, reducing profitability for telecom operators. For instance, operators incur an additional 7.5 percent cost because the Bangladesh Telecommunication Regulatory Commission does not register them for VAT.

The report underscores that Bangladesh stands at a critical juncture in its journey towards becoming a trillion-dollar economy and achieving developed nation status.

The telecom sector, as a vital enabler of this transformation, is expected to drive economic growth, foster innovation, and ensure digital inclusion.

However, achieving these goals will require substantial investments in telecom infrastructure, which are currently hindered by high taxes and regulatory challenges.

Key obstacles identified in the report include a complex licensing framework that increases administrative burdens, restrictions on infrastructure ownership and sharing that create inefficiencies, and short licence durations that complicate long-term investment planning.

Additionally, opaque penalties, retrospective audits, and prescriptive regulations create uncertainty for investors and limit market-driven growth.

To address these challenges, the GSMA recommended creating an attractive business environment by streamlining licensing processes, extending licence periods, and allowing mobile operators to deploy their own infrastructure.

It also suggests reforming the fiscal framework by reducing sector-specific taxes, aligning corporate taxes with other industries, and introducing transparent tax policies.

Establishing a progressive regulatory framework with market-driven regulations and improving transparency is another key recommendation.

Finally, the report calls for government enablers for investment, including regulatory stability, fiscal support, and prioritised digitalisation initiatives.

The report emphasises the need for collaboration among government bodies, telecom operators, and investors to build a future-ready telecom ecosystem.

“By addressing these challenges and implementing these reforms, Bangladesh can unlock the full potential of its telecom sector, ensuring it becomes a cornerstone of the nation’s journey to a developed and digitally inclusive economy,” the report concludes.