TBS

The Anti-Corruption Commission (ACC) has sought detailed information from the Bangladesh Bank on banking sector irregularities over the past 15 years, focusing on the role of senior central bank officials in easing loan policies and the conglomerates that allegedly benefited.

This includes details on three former governors, five deputy governors, and a former head of the Bangladesh Financial Intelligence Unit (BFIU), along with 10 business groups.

Over 15 years, Bangladesh’s banking sector faced weak governance and rising loan defaults, with repeated policy relaxations that allowed defaulters to reschedule loans on lenient terms.

In a letter sent to the current governor in late May, the ACC alleged that individuals in key positions had abused their authority to issue policies that favoured defaulters and influential business groups.

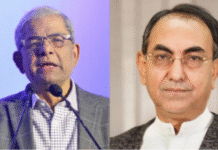

The letter, seen by TBS, names former governors Atiur Rahman, Fazle Kabir, and Abdur Rouf Talukder, accusing them of policy misuse, facilitating loan scams, and failing to prevent major scandals such as the reserve heist, Hallmark Group fraud, and the S Alam Group loan controversy.

The ACC has sought a range of documents, including attested copies of loan rescheduling policies issued before and after 2009, and central bank guidelines related to bank inspections.

In response, the Bangladesh Bank issued letters to state-owned and private banks, requesting loan information related to 10 major business groups that benefited from the policies.

These groups include Beximco, MR Group, Ratanpur Group, Keya Group, Jamuna Group, Thermax Group, Sikder Group, BBS Group, Abdul Monem Group, and Enetex Group.

Banks have been asked to submit detailed records of loans given to these groups, including those issued under proxy names, and most have already responded to the central bank’s instruction.

The ACC has sought comprehensive data on all loan defaults between 2009 and 2024, which marks the tenure of the former Awami League government.

It also requested the central bank’s internal investigation reports on the Hallmark and BASIC Bank loan scams and the reserve theft.

It sought a copy of the 2015 loan restructuring policy issued following a letter from Salman F Rahman, documents related to share purchases, ownership, or control of Islami and Social Islami Banks, the circular on the 9% interest rate, and policies regarding maintaining non-performing loan exemptions.

Additionally, the ACC asked for approval documents of nine fourth-generation banks – including Union Bank and NRB Commercial Bank (NRBC) – which were authorised during former deputy governor SK Suresh’s tenure in 2013. It also requested notes on loan policies issued during former governor Fazle Kabir and deputy governor Abu Farah Md Naser’s terms.

Among the former governors, Abdus Rouf Talukder’s tenure was the most controversial; the ACC sought information on dollar disbursements from reserves to businesses and details of suspicious loans during his time. If any internal investigation reports exist on these matters, the ACC has requested copies.

The letter also asked for details on dollar market disturbances during former deputy governor and BFIU chief Kazi Saidur Rahman’s tenure, money laundering under former deputy governor Abu Hena Md Razi Hasan, and bank inspection information from deputy governor SM Moniruzzaman’s period.

The ACC requested submission of these documents by 11am on 25 June.

Attempts to confirm the submission through repeated calls to Bangladesh Bank spokesperson Arif Hossain Khan went unanswered.

A senior central bank official, speaking anonymously, told TBS that banks had been requested to submit the data, but the 10-day closure during Eid caused delays. Compiling 15 years’ worth of information is a cumbersome task, leading to slower progress for both the central bank and commercial banks.

Attempts were made to contact a deputy director-level official of the ACC over the phone regarding the letter, but he could not be reached.