People’s wealth in Bangladesh has increased threefold in the past 15 years, while that of adult citizens has doubled.

This has been revealed by a research done by the international financial service organisation, Credit Suisse.

A report released by it says global inequality is on the rise with half the world’s resources concentrated in the hands of one percent of the world’s population.

According to Credit Suisse data, Bangladesh’s adult population was 70.2 million in 2000, which grew to 100.7 million by the middle of 2015.

Correspondingly, the wealth the people of Bangladesh possessed in 2000 was $78 billion, which increased to $237 bn in 2015.

The people of the US, the world’s richest country, commanded a wealth of $85,901 billion, the highest among all nations.

People of India, which is a rising economy, have wealth to the tune of $3,447 billion.

Of the other South Asian countries, the people of Pakistan have $495 bn, Sri Lanka $73 billion, and Nepal $37 bn.

The per capita wealth of Bangladesh’s adult population has increased from $1,069 to $2,201 over the past 15 years.

In this, the amount of economic wealth has risen from $441 to $795, and the quantum of immovable wealth from $652 to $1,470.

But debts too have grown alongside wealth. At present Bangladeshis carry a debt burden of $64 each, which was $24 fifteen years ago.

Credit Suisse estimates Bangladesh’s population to be 170.5 million at present.

The per capita wealth in the hands of 97.7 percent of the adult population is said to be $10,000 or a little less than Tk 780,000.

Credit Suisse has identified 1.2 million Bangladeshis as members of the middle class, who are said to have wealth amounting to at least $17,886 each.

Despite the growth in people’s wealth, Bangladesh’s position has not changed much in the global perspective.

One percent owns 50 percent of world wealth

The Guardian says in a report quoting Credit Suisse that the world’s middle class is becoming increasingly smaller, though China’s middle class (100.9 million) has left that of the US (90.2 million) behind.

Credit Suisse CEO Thidjane Thiam said the economic progress of the world’s middle class had been steady before the economic downturn.

After recovery, the wealth of the rich increased by leaps and bounds but the middle class made only a very slow progress.

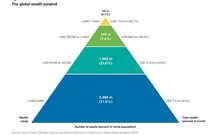

A person possessing $3,210 can be considered to be within 50 percent of the world’s rich people. But to enter the club of the top 10 percent, one must have $68,800.

And each of those in the top one percent of the list own at least $759,900.

In calculating the wealth volume of the rich, Credit Suisse took into account their market investments besides their movable and immovable assets.

It says 70 percent of the world population or about 3.4bn people have a per capita wealth of less than $10,000, while the wealth of one billion people ranges from $10,000 to $100,000.

Eight percent of the people (383 million) have wealth amounting to over $100,000 each. Of them, 34 million are US residents, of whom 45,000 possess wealth over $100 million each.

The report says the wealth disparity is becoming more pronounced since 2008 with one percent of the world’s people owning 50.4 percent of the global wealth.

If this trend persists, Credit Suisse feels the number of millionaires in the world will increase to 40.4 million.

Earlier, an Oxfam report estimated that by 2016 the world’s top one percent people would possess wealth exceeding the amount owned by the rest 99 percent.

After the Credit Suisse report, Oxfam official Mark Goldberg said it looked as if this was going to come true. He said the extremely poor were slipping out of their reach.

Goldberg said, though the UN had adopted sustainable development goals to eradicate poverty, he doubted if the world leaders were serious about reducing inequality.

According to the Credit Suisse study, the total world wealth in 2015 was $250 trillion, 12.4 percent less than that of the previous year.

This was the first time the wealth value fell after 2008.

The Credit Suisse report attributes this to a fall in the value of the US dollar.

Source: bdnews24