The Bangladesh Petroleum Corporation (BPC) says it cannot encash deposits worth nearly Tk 1,700 crore held with eight private banks, which the government agency blames for causing delays to its development projects and disrupting regular operations.

Following the political changeover in August last year, which led to major shake-ups in bank boards, the BPC sent multiple letters to the commercial lenders over the past four months seeking encashment of the deposits.

But, the banks have neither responded to the letters nor returned the funds deposited with their branches in Chattogram.

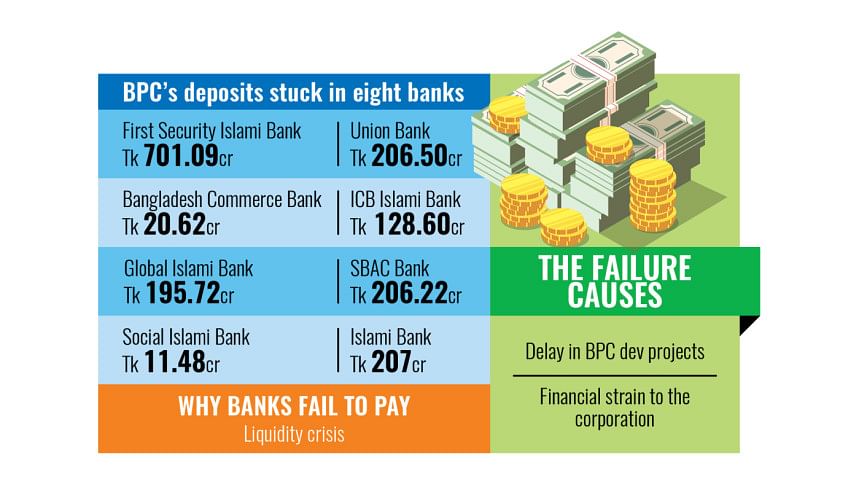

The banks holding the corporation’s deposits are: First Security Islami Bank (FSIB) PLC, Bangladesh Commerce Bank, Global Islami Bank, Social Islami Bank, Union Bank, ICB Islami Bank, South Bangla Agriculture and Commerce Bank and Islami Bank Bangladesh.

Contacted by The Daily Star, some of the banks cited ongoing cash crunches for their failure in returning BPC’s funds.

After the political changeover, seven of these eight banks had their boards reconstituted amid allegations of loan irregularities, mismanagement and being controlled by the Chattogram-based conglomerate S Alam Group.

The BPC’s investments with the banks, amounting to Tk 1,677.23 crore, are in the form of fixed deposits receipts (FDRs) and short-notice deposits. This means interest is also payable on these investments.

“We are trying to liquidate the deposits we have in various banks. Our balance in these banks could exceed several thousand crores of taka,” Md Amin Ul Ahsan, chairman of the BPC, told The Daily Star.

The BPC sent letters for encashment in October and November last year.

“The BPC carries out various activities using the interest or profit earned from bank deposits. Many development projects are being delayed due to the non-availability of funds,” said Ahsan.

Of the deposits, the highest amount, Tk 701.09 crore, is with First Security Islami Bank PLC. Another Tk 206.5 crore is with Union Bank PLC, while Tk 195.72 crore is with Global Islami Bank PLC.

“Due to a liquidity crisis, we are unable to encash the FDRs at the moment,” said Mosharraf Hossain, manager of the FSIB’s Agrabad branch.

“The BPC is one of our major corporate clients. We are providing them with some profit amounts periodically. We have informed them about the situation in response to their letter,” he claimed.

“Due to a fund crisis, we are unable to encash the BPC’s FDRs, but we are paying profit amounts regularly,” said Rezaul Karim, manager of Union Bank’s Khatunganj branch.

He also claimed that they are maintaining continuous communication with the BPC and all other depositors.

“We are unable to release the funds due to a liquidity crisis. The relevant BPC officials have been informed verbally,” said Md Mainuddin, operations manager of Global Islami Bank’s Agrabad branch.

“Furthermore, we are waiting for approval from the Bangladesh Bank to release the profit amount to the BPC,” he added.

Islami Bank holds Tk 207 crore of the corporation.

Although the Shariah-based lender cannot encash the entire amount right now, it has been meeting the state-run entity’s financial needs by opening letters of credit for the import of fuel oil and lubricants and subsequently adjusting the balance.

BPC Chairman Ahsan said, “Some banks are paying us the interest or profit, whatever you call it. You are aware of the current situation of the banks. We are also trying our best to recover the funds.”

“We are in regular communication with the banks,” he added.