S Alam Vegetable Oil Ltd and S Alam Super Edible Oil Ltd have unpaid value added tax (VAT) and consequent penalty worth over Tk 7,000 crore, as they allegedly evaded VAT through various means, including by presenting lower purchase and sales data in VAT returns between 2019 and 2022, according to an audit by the NBR’s VAT wing.

During the period, the two companies “evaded” Tk 3,538 crore in VAT, for which they were fined another TK 3,531 crore, the audit report says.

The audit was carried out by the field office of Customs, Excise & VAT Commissionerate, Chattogram, and was subsequently reviewed by a five-member committee headed by an additional commissioner, Chattogram VAT Commissionerate, which drew the same conclusion.

Of the amount, S Alam Vegetable Oil Ltd allegedly evaded Tk 1,917 crore and S Alam Super Edible Oil Ltd Tk 1,621 crore in three years from the financial years 2019-20 to 2021-22, according to the audit report submitted in October 2023 and the subsequent review report submitted in May 2024.

The two companies denied any wrongdoing.

The regulator came up with the unpaid VAT claims after analysing the VAT returns and the financial statements audited by the two companies’ CA firm as well as their written response to the VAT Commissionerate.

The field office audit team submitted its report on October 2 last year. Later, the field office formed a five-member committee to review the audit findings.

The review report, submitted in May 21, said the “VAT dodging allegations have been proven beyond doubt.”

On June 9, the Customs, VAT & Excise Commissionerate, Chattogram, in its adjudication orders asked the companies to pay the “evaded VAT” worth Tk 3,538 crore along with the penalty to the tune of Tk 3,531 crore and applicable interest to the state coffer within 15 working days.

The deadline ends on July 3 and if the companies do not appeal against the order, the regulator will “take steps to realise the evaded VAT, penalty and interest as per the law,” NBR officials said.

S Alam Group Executive Director (Finance) Subrata Kumar Bhowmik told The Daily Star on June 27 that they did not “evade even a single taka of VAT” and that they will appeal the decision.

The two sister concerns of the business conglomerate have 90 days to appeal by paying 20 percent (over Tk 700 crore) of the VAT claim.

Md Mustafizur Rahman, S Alam Group‘s company lawyer, told The Daily Star on June 29 that before they file any appeal, they are seeking an in-person hearing with the VAT authorities to present their full response and the relevant documents that the regulator had sought during the audit and review.

“If they give us a full hearing and allow us adequate time, we will be able to convince them that their unpaid VAT claims against us do not reflect the reality,” he said, adding that they applied for a full hearing on June 6, three days before the VAT authorities asked them to pay the unpaid VAT, but were not allowed the opportunity.

FIELD OFFICE AUDIT FINDINGS

The VAT office came up with the findings by comparing the sales data given in the VAT returns and the annual financial statements from 2019-20 to 2021-22 that the companies submitted to the income tax office in the port city.

In its report on S Alam Vegetable Oil Ltd, the VAT Commissionerate said the company showed “deflated sales in its VAT returns” than that in its annual reports, audited by a Chartered Accountancy (CA) firm, submitted to the tax authorities by the company itself.

“As per the audited reports from the financial years 2019-20 to 2021-22, total sales of the company were Tk 12,725.95 crore. On the other hand, the reported sales by the organisation in the VAT returns during the period were Tk 2,401.92 crore,” the report says.

“This means, the company did not present sales worth Tk 10,324 crore in the VAT returns. By concealing actual sales in VAT returns, the organisation did not pay VAT amounting to Tk 1,346.61 crore during the period which is realisable,” it says, citing the 15 percent VAT rate on sales of edible oil applicable at the time.

The other company — S Alam Super Edible Oil Ltd — did the same, but only on a different scale, the audit found.

During the same period, this company’s “sales value in its audited financial statement was Tk 12,850.48 crore. But in the VAT return, the figure was Tk 3,620.63 crore, which is Tk 9,229.84 crore less than that presented in the audited financial report,” the report says.

Besides, both companies “evaded” revenue by showing lower value of raw material purchase in VAT returns than that reported in their annual reports during the three financial years.

For example, S Alam Vegetable Oil Ltd in its financial statement showed “purchase value of raw materials worth Tk 11,245 crore during those three years. But the VAT returns and other related documents submitted by the company to the VAT authorities show the purchase of raw materials was worth Tk 3,145 crore.”

The amount is Tk 8,100.39 crore less than that shown in the company’s own financial statement.

“It is clear from the comparative analysis of its audited financial statements and VAT returns that in order to evade VAT, soybean and palm oil was sold after producing the item with ingredients procured from local sources or collected by any other means,” the report says.

“In the company report audited by a CA firm, there is information of sales without processing ingredients (CDSO [Crude Degummed Soybean Oil] and RBD palm olein).

“It is clear from data that Tk 8,100.39 crore worth of raw materials have been procured locally against which the company failed to submit any VAT chalan or Bill of Entry.”

During the period, 7.5 percent VAT rate was applicable on such local purchase, and as such “the total amount of unpaid VAT is Tk 607.52 crore, which is collectable from the firm.”

As for the other company — S Alam Super Edible Oil Ltd — its raw material procurement value was shown Tk 11,171.42 crore during the three years, but the VAT returns and other related documents submitted by the company to the VAT authorities put the purchase value at Tk 5,206.53 crore.

“It is clear from data that Tk 5,964.89 crore worth of raw materials have been procured locally against which the company failed to submit any VAT chalan or Bill of Entry,” the report says, adding that the total amount of unpaid VAT in this case was Tk 447.36 crore.

The Customs, VAT Commissionerate, Chattogram, also compared the procurement data of goods and services provided in the annual financial statements and VAT returns in the years from 2019-20 to 2021-22 and found that “S Alam Vegetable Oil paid lower VAT at source, known as VAT Deducted at Source (VDS), than the required amount against its purchase during the period.”

The company’s unpaid revenue against VDS on goods and services, on which 5 percent to 15 percent VAT is applicable, was Tk 5.63 crore in those three years, the report says.

During the same period, S Alam Super Edible Oil had unpaid revenue against VDS worth Tk 1.78 crore.

The Commissionerate report on both the companies says “these sorts of activities of the organisations are a clear violation” of 10 sections of the VAT and Supplementary Duty Act 2012, and six Rules of VAT and Supplementary Duty Rules 2016.

The field office of the NBR also slapped a penalty of Tk 1,911 crore and Tk 1,620 crore on S Alam Vegetable Oil and S Alam Super Edible Oil respectively for “non-compliance” of VAT rules.

“Legal steps can be taken to realise the evaded VAT against the company under sections 85 and 111 of the VAT and Supplementary Duty Act 2012,” the report says about both firms.

During its audit, the field office sought explanations from the companies and asked them to appear in a hearing on October 30, 2023. In the hearing, both companies submitted a written response and sought more time for a detailed written reply.

The Commissionerate office allowed time extension for both companies three times since, and the companies submitted its written response on December 28 last year, seeking withdrawal of the charges after a review.

‘PROVEN BEYOND DOUBT’

Following the written submission by the two companies and their appeal for a review of the unpaid VAT claims, the Customs, Excise & VAT Commissionerate formed a five-member committee, which submitted its report on May 21 this year after examining the audit report by the field office and other related documents as well as the response submitted by the two firms.

“All things considered and having analysed everything, it is clear that the allegations of VAT evasion worth Tk 1,917.39 crore by S Alam Vegetable Oil has been proven beyond doubt,” the review report says, drawing the same conclusion about S Alam Super Edible Oil whose total unpaid VAT is Tk 1,621.92 crore.

RESPONSE TO REVIEW TEAM

Both companies in their written response to the VAT authorities said the allegation of VAT dodging and the demand notice by the regulator is “totally unlawful, baseless, fabricated and not based on data.”

“We have been carrying out business by paying all sorts of applicable VAT as per laws and regulations,” the two companies said in an identical response.

“Every year, we deposit crores of taka in revenue to the state coffer. But bank loans are needed to operate this large company. We have been carrying out business and producing goods with bank loans. For availing bank loans, we have to show excess transactions which is why excess sales and purchase of raw materials have been shown in the financial reports audited by the CA firm,” read both the letters.

“Excess sales value has been presented in the audited reports by the CA firm to get loans from banks. But [VAT] returns have been filed as per the actual sales and VAT has been paid accordingly.”

The two companies also said it was “not even possible to produce the goods shown in their audited financial statements with the raw materials that were imported from 2019-20 to 2021-22.”

“If import and input-output coefficient and imported raw materials data are analysed, it will be clear that the sales data shown in the annual reports audited by our CA firm is not correct. Rather, the sales data presented in the returns and the amount of VAT paid against the sales are correct,” both companies said.

Further, they informed that “the machinery and workforce of the respective companies also do not have the capacity to produce the goods shown in the audited report” and that the “market demand is much lower than the sales value presented” in their financial reports.

They also maintain that the findings by the NBR’s VAT wing that they procured raw materials from local sources is “incorrect”.

“Because, all the raw materials to produce edible oil is import-based. As such, no raw materials have been procured locally. So the demand for VAT at source is not right.”

‘CRIMINAL OFFENCE’

The VAT authorities’ review report says that purchases and sales data of any firm should be the same in all its commercial documents submitted to regulators, bank, income tax and VAT authorities. This means, it is a legal obligation on the part of the firm concerned that its purchase and sales data presented to VAT office, income tax office, banks and in the financial reports audited by CA firms should all be the same.

“It is clear from analysis of the written response from the firm that the said entity concealed information of actual sales/procurement and VAT at source,” the review team said in case of both the companies.

Also, the company authorities “did not provide any proof/documents to support their written response” although they were requested and granted opportunities more than once to submit proofs against their claim. Neither did the companies “nominate any representative to re-examine the evaded VAT amount” though the audit team made such requests in writing to the companies, the review report says.

“They claim that in order to avail loans from banks, they prepared the report by incorporating inflated purchase and sales data. If this is true, they have clearly committed a criminal offence.

“On the other hand, the audit firm that has prepared this report has demonstrated professional dishonesty and aided the accused firm to commit a criminal offence,” the review report says, again about both firms.

The related bank has also “acted very unprofessionally” if it sanctioned loans based on an “imaginary and untrue” financial statement, it added.

“To accept such claims by an accused firm will be to patronise its criminal activities, which no government agency can do.

“The related income tax circle has determined tax liabilities of the firm based on the audited financial reports submitted by the firms. It has no relations with bank loans. So the claim that the report has been prepared to get bank loans cannot be acceptable.”

Howladar Yunus & Co, which audited the financial statements of these two companies for two of the three years in question, said they were the “auditor of the companies, not preparer of the accounts.”

“Our mandate was to audit the accounts along with notes to the accounts prepared by the management. We followed the international auditing standards to conduct the audit and concluding our audit opinion. The question of cooperating with anybody for any reason does not arise at all,” it told The Daily Star in a written statement.

RESPONSE TO THE DAILY STAR

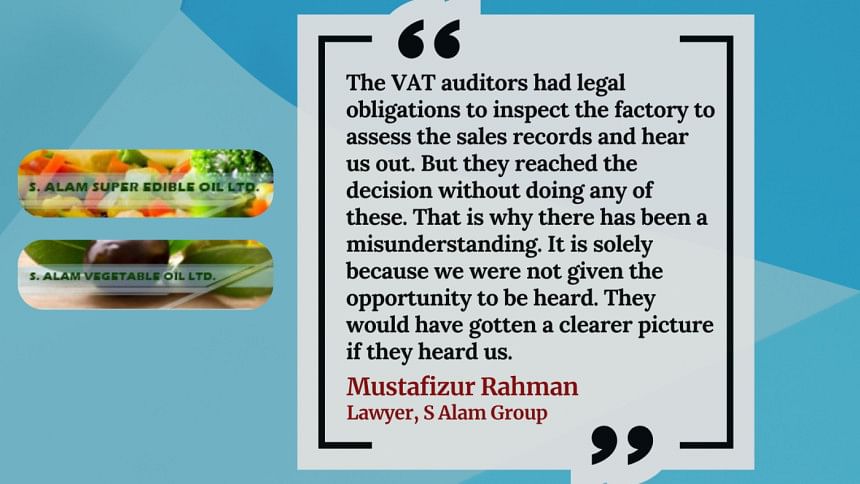

S Alam Group company lawyer Mustafizur Rahman said, “The VAT auditors had legal obligations to inspect the factory to assess the sales records and hear us out. But they reached the decision without doing any of these. That is why there has been a misunderstanding. It is solely because we were not given the opportunity to be heard. They would have gotten a clearer picture if they heard us.”

He admitted that the VAT authorities communicated with them several times in writing during the audit and review and allowed them time to offer their explanations in personal hearing and in writing.

“But that was not enough. They gave us way less time than what we sought. It was not sufficient for us to prepare all the documents that date back to 2019 and a detailed response in a matter as serious involving such a huge VAT claim,” he told The Daily Star on June 29.

About the discrepancies in sales records presented in their financial statements and the VAT returns, he said the financial reports audited by their CA firm contained advance sales as well. “But some of these sales eventually did not take place, and we returned the money to the buyers who were not delivered the goods. We did not conceal anything. We have bank documents showing that we returned the money.”

Regarding the VAT authorities’ findings that the two companies sourced certain volumes of goods from the local market and “dodged relevant VAT” in the process, he said, “The goods in question are not available in local markets, they can only be imported. And the VAT authorities’ own report says that they found our import data correct. So the claim that we procured raw materials from local markets is based on assumption.”

‘LAME EXCUSE’

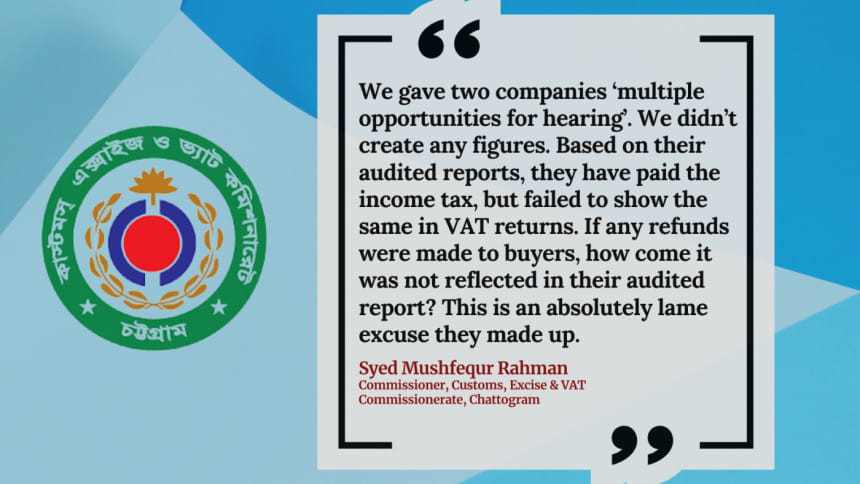

Syed Mushfequr Rahman, commissioner at Customs, Excise & VAT Commissionerate, Chattogram, said they allowed the two companies “multiple opportunities for hearing” which are minutely recorded in the adjudication order.

On the June 6 appeal by the two companies for a fresh hearing, he said they already appeared for hearing and made their submissions during the audit.

“Later, we formed a committee to examine their submissions. Based on the committee reports, we asked them to appear before the hearing twice but they failed. Then when we issued the order, they sent another letter for hearing which couldn’t be entertained. All these details are recorded in my adjudication order.”

On the question of sales figure, he said sales are final figures as per their own audited annual reports.

“We didn’t create any figures. Based on their audited reports, they have paid the income tax, but failed to show the same in VAT returns. If any refunds were made to buyers, how come it was not reflected in their financial statements audited by their CA firms? This is an absolutely lame excuse,” he told The Daily Star on June 29.

On the question of sourcing raw materials, the commissioner said companies are supposed to import the raw materials.

“But they can be procured locally from other manufacturers, which is the only plausible explanation for the higher sales volumes in their financial statements compared to their imports. That is why, we have imposed VAT that is due to be deducted by the two S Alam companies at source while buying from local sellers.”

Daily Star