The country’s stock market, now showing a positive trend, will remain vibrant in the coming months, if the ongoing peaceful political atmosphere persists and companies offer satisfactory dividends, market analysts say.

However, they suggested the investors to remain careful about buying ‘junk shares’ to avert any financial loss.

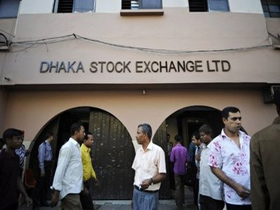

“The current trend will hopefully continue in the coming months, at least in February and March,” Ahasanul Islam, President of the Dhaka Stock Exchange Ltd (DSE), told UNB on Saturday.

A good number of registered companies will offer dividends within the next three months which will play a role in keeping the market vibrant, the DSE chief explained saying after that things will ‘depend on the situation’.

Responding to a question, Islam said the market that faced liquidity crunch is now getting huge ‘surplus money’ from the banking sector giving a boost to the market.

Asked about the investors’ participation, the DSE chief said the participation of investors has marked a ‘substantial rise’ as the market has made a turnaround following the return of calmness in the country’s political landscape.

Talking to UNB, capital market analyst Prof Abu Ahmed said there is a ‘renewed hope’ in the market following the peaceful political atmosphere.

There is a hope among the investors that things will move well and the economy will be functioning smoothly, he said.

Prof Ahmed, however, said the investors should not buy ‘junk shares’ and advised them to go for quality ones to avert loss.

Responding to a question, the financial analyst said the sustainability of the current rising trend in the market depends on fruitful discussions between the government and the BNP-led alliance.

He said the market would have hit 5000 (DSE Index) if the political stability could have been ensured earlier.

Asked how investors’ confidence could be boosted further for long-term benefits, Prof Ahmed said the proposed Financial Reporting Act (FRA) to monitor the accountancy profession would have to be settled soon.

“It’s (FRA) very important to build up confidence among investors (in the long term). The Finance Minister had a frustration as he couldn’t do it. Now it’s should be done without further delay. Investors deserve it,” he explained.

Responding to another query, the analyst said the regulatory body will have to ensure that margin loan (credit against stock) does not play any dubious role what it did in the past. “The margin loan should not play any dubious role. It caused harm (to investors) in the past. The regulatory body should remain alert in this regard.”

Meanwhile, Bangladesh Capital Market Investors’ Oikya Parishad has sought ‘realistic’ steps from the new government apart from ‘redesigning’ the ‘organs’ of the capital market for bringing the investors into confidence.

“We’re not fully confident yet and the government needs to remain careful so that the capital market doesn’t suffer from hetric of fall (during AL tenure),” Parishad General Secretary Ataullah Nayem told UNB on Saturday.

He said the government should engage professional people in various organs related to the country’s stock market to ensure successful implementation of unimplemented initiatives of the government taken since 2010.

In the last six trading sessions after the much-talked-about January 5 elections, the DSE index witnessed a 198-point rise. The index, which was 4296 points on January 6, stood at 4519 points on Thursday.

Source: UNBConnect