The Power Development Board’s sale of electricity out of its overall production to the industrial sector has reduced by 10 percentage points over the incumbent government’s 15-year tenure, indicating slower-than-expected economic growth.

In 2023, the PDB data showed that 27.63 per cent of the overall electricity produced—79,270 units—was sold to the industrial sector, down from 37.1 per cent sold in 2019 out of 21,955 units produced.

In 1994, the industrial sector used 45.72 per cent of the total power—6,148.8 units—produced by the PDB.

Energy experts have been rather depressed, particularly by the fact that the massive power sector investment of $39 billion has failed to create a power system meeting industries’ demand.

‘The government’s hope of industrialization never materialised due to unreliable and low-quality power supply,’ said energy expert Mohammad Tamim, who advised the chief advisor of a caretaker government on power, energy, and mineral resources.

The introduction of captive power by the incumbent government further incentivised industries not to use power supplied through the national grid, he explained.

A unit of electricity produced in a captive power plant by using gas at a subsidised rate costs Tk 4.5, Tamim estimated, whereas a unit of electricity from the national grid costs about Tk 8.

‘Who will use costly grid power while captive power opportunities are there,’ Tamim wondered.

Captive power refers to electricity produced by industries using their own power from plants set up on their industrial premises.

The installed captive power capacity is 2,800MW, or about a third of the average electricity supply through the national grid during winter.

Captive power was meant to be a temporary arrangement while the incumbent government developed its capacity to supply reliable and quality power.

But that apparently did not happen.

In October, the Centre for Policy Dialogue, in a report citing official data, said that power outages due to interruptions in the grid increased from approximately 2,410 cumulative hours in June 2023 to 5,016 cumulative hours in August 2023.

Load-shedding at evening peak hours increased to 26 days in the month of August from about 20 days in July, the report said.

The CPD said that Bangladesh’s grid operation was highly inefficient.

Smooth electricity supply was a priority infrastructure that the incumbent government had wanted to build since assuming power to achieve its ambitious plan of setting up 100 economic zones by 2030.

So far, only 10 economic zones have been established, with only a fragment of their capacity being used.

Assuming a rapid increase in power demand in the planned economic zones, the government since 2009 has increased Bangladesh’s installed power generation capacity by six times to 25,951 MW until last month.

The average maximum amount of electricity the existing grid system can handle is 14,000 MW.

After industries, the sale of electricity to the agriculture sector also dropped significantly.

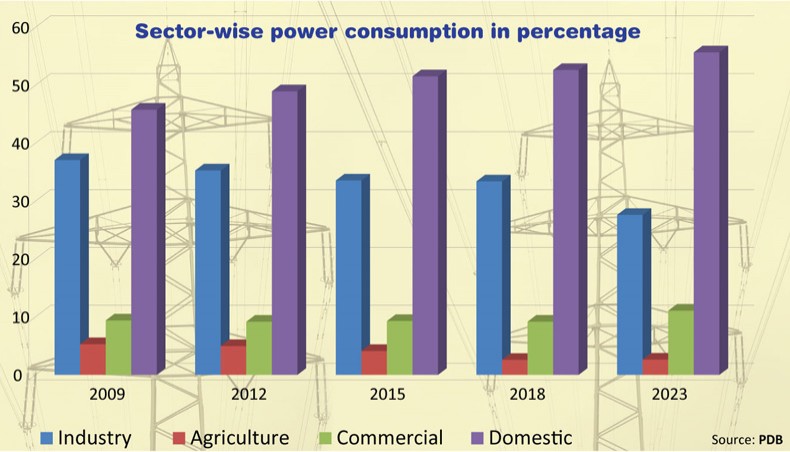

In 2023, the agriculture sector accounted for 2.64 per cent of power sold by the PDB, down from 5.3 per cent sold to the sector in 2009.

The use of electricity in the agricultural sector greatly varied year to year, fluctuating between 6 per cent and below 3 per cent, indicating the sector’s continued reliance on manual labour.

‘It means the productive use of electricity did not increase as planned,’ said Tamim.

Productive use of electricity means an optimum economic return on the use of electricity, which saw its production costs go through the roof under the incumbent government.

Bangladesh’s electricity is also highly subsidised.

Bangladesh cannot afford to use more power in luxury and comfort than in production because of its monstrous, still-mounting power sector debt, energy experts said, referring to the rise in electricity use in the domestic sector.

Domestic power consumption increased by 10 percentage points in 2023 to 55.69 per cent from 45.8 per cent consumed by domestic consumers in 2009, PDB data showed.

Energy experts believe Bangladesh’s current cooling load is about 4,000MW, the difference in power demand between the summer and winter seasons.

Commercial use of gas also increased by two percentage points, with 11 per cent of overall electricity produced in 2023 consumed in the commercial sector.

The commercial sector represents the service sector.

‘Bangladesh pursued a very ambitious target with wrong planning,’ said energy expert Ijaz Hossain, who teaches chemical engineering at BUET.

The power sector is now buried under debt, generating massive interest, with a huge amount of money required to be paid in capacity payments every year, he explained.

Capacity payment guarantees profit to power sector investors, irrespective of the amount of electricity produced.

While Bangladesh has paid Tk 100,000 crore in capacity charges over the last decade, its annual debt obligation is about $2 billion.

Power Cell director general Mohammad Hossain, however, said everything went ahead in accordance with the plan.

‘Our target is to ensure energy security and development,’ he said.

‘Only a diverse source of power can smoothly get us to our goal,’ he added.

But the power source is not actually very diverse, with about 95 per cent of it produced from fossil fuels.

The incumbent government ignored the call to invest in renewable energy, with less than 5 per cent of its existing installed capacity coming from renewable sources.

Bangladesh has one of the lowest per capita electricity consumptions with 488 kwh, lower than Bhutan with 11,599 kwh, India with 1,218 kwh, Sri Lanka with 734 kwh, and Pakistan with 579 kwh.

New Age