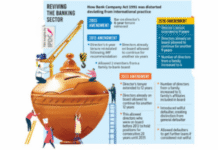

Bangladesh has disbursed 59 per cent of the total credit support unveiled by the government to protect businesses, the economy and the poor since the coronavirus pandemic hit the country more than one-and-a-half years ago.

The government was swift in its response when it came to introducing stimulus packages after Covid-19 was first detected in the country in March 2020.

It started with a Tk 5,000 crore stimulus package for apparel manufacturers, providing them low-cost funds so that they can keep paying wages and salaries to the workers in the country’s largest export-earning sector.

Since then, the government has announced 28 stimulus packages involving more than Tk 187,679 crore. Of the sum, Tk 110,893 crore was disbursed as of November, data from the finance ministry and Bangladesh Bank showed.

The disappointing scenario is largely because of sluggish disbursement of the packages dedicated to small businesses, the expansion of the size of some funds, and the introduction of a number of new schemes that have not given enough time to lenders to disburse.

A finance ministry official says the allocation for the two largest packages for large, medium and small enterprises rose significantly in the current fiscal year. Besides, the government has rolled out some new packages.

In April 2020, the government unveiled a fund of Tk 30,000 crore for large industries and services sector firms. The fund was expanded by another Tk 10,000 crore the same year.

The package has been topped up by Tk 33,000 crore in the current fiscal year, raising the total amount to Tk 73,000 crore. Of the sum, Tk 40,492 crore, or 55 per cent, was disbursed as of November.

In July last year, the government doubled the size of the packages for cottage, micro, small and medium enterprises (CMSMEs) to Tk 40,000 crore from Tk 20,000 crore.

Banks and other lenders lent Tk 18,771 crore till November, representing 47 per cent of the total, finance ministry data showed.

Similarly, the government first introduced a refinance scheme of Tk 5,000 crore for the agriculture sector and Tk 4,295 crore has been disbursed. The fund was later expanded by Tk 3,000 crore.

A central banker says the disbursement was sluggish initially and it later accelerated thanks to the amendment of the policies and the unveiling of some new support packages to address the problems faced by banks, which have been given the task of executing most of the credit support packages.

A Tk 3,000 crore refinance scheme for low-income farmers and businessmen was also taken, and so far Tk 2,117 crore has been disbursed.

Bangladesh Bank suspended the interest of loans to the tune of Tk 16,594 crore for the months of April and May of 2020. The government has allocated Tk 2,000 crore as interest rate subsidies and has released Tk 1,390 crore from its coffer so far.

The pre-shipment credit refinance scheme, which aims at enhancing the capacity of exporters, has witnessed a meagre 10 per cent progress.

The government allocated Tk 5,000 crore under the fund in April 2020, and Tk 502 crore was disbursed.

Similarly, a Tk 2,000 crore credit guarantee scheme for cottage, micro and small entrepreneurs saw only 2 per cent progress as Tk 31 crore was lent.

The Tk 1,500 crore package for creating jobs in rural areas witnessed 50 per cent implementation as of November.

Although the tourism sector has been one of the hardest hit because of the pandemic since their businesses plummeted as people stayed away from the hospitality sector, it did not receive any support initially.

In July last year, the government earmarked Tk 1,000 crore for hotels and motels. But, no hotels or motels have received any loans under the package, according to the finance ministry’s report.

A senior official of the ministry said it had sought an explanation from the central bank. In reply, Bangladesh Bank said that the finalisation of the disbursement guideline took a longer time.

“However, banks have already received proposals from the businesses, and the disbursement will start soon,” he said.

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue, said the overall implementation progress is not at all satisfactory.

He gave the example of the initial Tk 20,000 crore package for CMSMEs.

“If the full fund had been disbursed, it would have covered only 6 per cent of all of CMSMEs in Bangladesh if each of them had received Tk 5 lakh,” Moazzem said.

“The fund was not adequate. Still, everybody welcomed the government’s timely initiative. But because of the weaknesses related to implementation, selection process and design, and banks’ tendency to avoid risks, the package has not produced expected results.”

Of the loans under the credit support packages, half of the interest is being borne by the government.

“It’s a huge amount and banks have begun making claims on the loans. The government has also started disbursement,” said the finance ministry official.

He says many clients are repaying their old loans by availing 0redit support under the stimulus packages.

“It’s the responsibility of banks to prevent such practices. The government will not subsidise the loans that were extended before the pandemic,” he added.

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.