Last update on: Sun Jun 23, 2024 12:42 AM

The National Board of Revenue (NBR) has revised rules, including raising the capital requirements, for businesses to be listed as authorised economic operators (AEO), a status an increasing number of firms are expressing interest in.

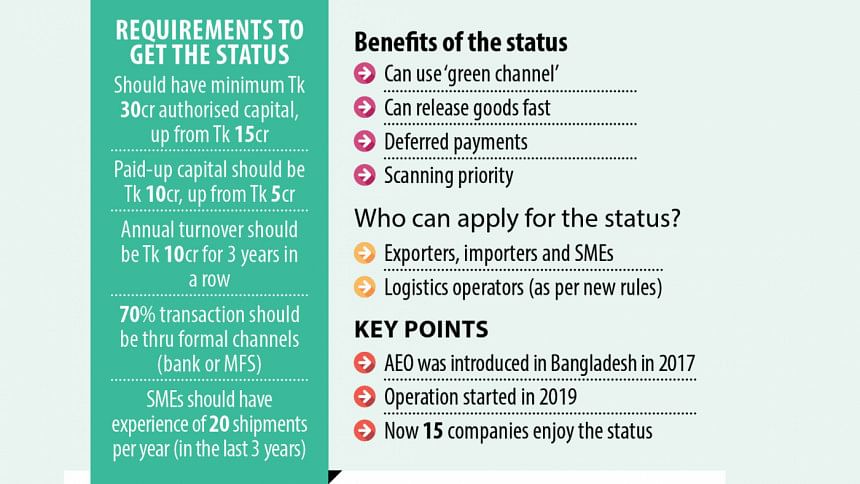

An AEO can directly deliver cargo from ports to factories or warehouses through a green channel without having to get those through physical checks, thereby cutting time spent at port yards alongside costs and enhancing overall efficiency.

Most importantly, if a country has relevant arrangements with other countries, its AEOs can enjoy similar benefits in those countries.

A major share of the clearance time, that is around 72 percent to 78 percent, is spent on collecting and submitting import documents and thereby necessitates automation, states a 2022 NBR study on release of goods from ports.

World Customs Organization introduced the AEO system in 2007 to enhance international supply chains and facilitate faster trade.

The US, the European Union, Japan, Singapore, India and China have already introduced the AEO system. Among them, India already has 5,000 AEOs, according to NBR officials.

Bangladesh initially planned to introduce the AEO in 2013 and it became mandatory after two-thirds of World Trade Organization members ratified a Trade Facilitation Agreement, following which the NBR finally issued an order in 2018.

In 2019, three pharmaceutical companies — Square, Beximco, and Incepta — were granted the status.

As of June 2024, 15 firms now have AEO status, according to the NBR.

The NBR’s Customs Valuation and Internal Audit Commissionerate is sorting out applications from nearly 60 companies seeking the status.

The 15 include Popular Pharmaceuticals, Jihan and Shoeniverse Footwear, Fair Electronics, ACI Godrej Agrovet Private, Towa Personal Protective Device Bangladesh, Cutting Edge Industries, Omera Cylinders, MBM Garments, M/S Footsteps Bangladesh, GHP Ispat and BSRM.

According to the revised rules issued by the customs authorities in the middle of this month, firms that want to be listed as AEOs must have an authorised capital of at least Tk 30 crore and paid-up capital of Tk 10 crore.

Earlier, it was Tk 15 crore and Tk 5 crore respectively.

Moreover, they must have a minimum annual turnover of Tk 10 crore for three years in a row.

If the firm is not into manufacturing, their annual export or import must be of at least Tk 10 crore for three years in a row.

However, the revenue board has included some criteria enabling small and medium enterprises (SMEs) alongside logistics operators to avail the status.

One criterion for the SMEs says they must have conducted 20 annual shipments on an average over the past three years whereas another for logistics operators say they must have run operations in Bangladesh for the past four years.

According to the new rules, all companies will have to ensure at least 70 percent of transactions through formal channels like banks and mobile financial services.

Interested companies must have operations of at least five years and clean records in duty, VAT and income tax payments.

Companies that have been fined more than 1 percent of the total goods or service price on revenue-related cases and have not paid all due revenues are ineligible.

Welcoming the move, M Masrur Reaz, chairman of Policy Exchange Bangladesh, said it would help the country be more competitive in global trade.

“This is a timely initiative of inclusion of the logistics operators as it will speed up the trade facilities,” he said.

Besides, compliant firms will get benefits fast, he added.

However, Reaz drew attention to comparatively small traders and sought to ensure their accessibility to the status.

“As the NBR has tightened the rules for companies to get the status, we have to take notice of whether compliant firms with good records are being deprived,” according to Reaz.