Income tax fair. UNB File Photo

Income tax fair. UNB File Photo

A weeklong income tax fair will begin across the country on 14 November, aiming to give the taxpayers a hassle-free environment to submit their tax returns and provide them with one-stop tax-related services.

The National Board of Revenue (NBR) has been organising the annual show for the last 10 years in order to raise awareness about the necessity of tax payment for national development and encourage more people to start the practice.

The last date for the submission of income tax returns for individual taxpayers is 30 November, which has been named as ‘Tax Day’.

In the capital, the fair will be held at the Officers’ Club.

According to the NBR, the fair will continue till 20 November in divisional headquarters. It will be held in all the district towns for four days while for two days in 45 upazilas and for one day at 57 growth centres at the upazila level.

The NBR organised the tax fair in 32 upazilas for two days last year.

Like the previous years, the taxpayers will be able to file tax returns and do other related tasks at the fair. Tax officials will extend necessary support in this regard.

New taxpayers can collect electronic tax identification numbers (e-TINs) at the fair while other taxpayers can collect e-TIN through re-registration.

Separate booths will be set up at the fair venues for e-payment as well as for freedom fighters, women, people with disabilities and elderly taxpayers.

Last year, the NBR received Tk 24.68 billion at the weeklong fair which was Tk 1.13 billion in 2010, the maiden year of the fair. The number of tax returns submitted at the fair was 487,000 in 2018 where it was 52,544 in 2010, according to the NBR.

Since its inception, the income tax fair is gaining its popularity as it gives an opportunity to people to submit income tax returns at the quickest possible time without the hassle of visiting tax offices, said an NBR senior official.

“The growing number of taxpayers and income tax-related service-takers show that people are always interested in paying taxes, given a conducive atmosphere,” he said.

He said the chance to extend the time to submit the income tax returns through any executive order has been restricted through the national budget. “So, we request all to submit their income tax returns within the timeframe to avoid fine.”

To remove hassles in paying taxes, the NBR has simplified the income-tax return form aiming to get a better response from taxpayers as well as bag more revenues.

Instead of the old 8-page form, the taxpayers from this year will fill up a three-page form. Of the three pages, the first page contains personal information, while the second page will be used for the source of income and the third page gives the scope for scrutiny.

According to sources at the NBR, interest will be imposed on the income tax returns that will be submitted after 30 November.

“Even the taxpayers who will seek extra time have to give the interest as per 73A rules of the Income Tax Ordinance,” the NBR official said adding as per the rules, the taxpayers have to give two percent interest on his income tax per month.

Currently, the tax-GDP ratio in Bangladesh is just over 10 per cent, which is more than 15 per cent in neighbouring countries.

“NBR is now a self-reliant organisation and steps have been taken to make it a pro-taxpayer one,” the NBR official said.

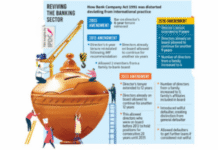

The total revenue collection for the current 2019-20 fiscal has been estimated to be Tk 37781 trillion where the NBR will contribute Tk 3.2566 trillion. Tax revenue from the non-NBR sources have been estimated at Tk 1.4 trillion. Besides, non-tax revenue is estimated at Tk. 377.1 billion.

Of the grand amount for the NBR, Tk 1.1391 trillion will come from income, profit and capital tax, while Tk 1.23067 trillion will be contributed by VAT.

Besides, Tk 481.53 billion will come supplementary tax while Tk 364.98 billion from import duty, Tk 540 million from export duty, Tk 22.39 billion from the excise duty and Tk 16.77 billion from other taxes.

Source: Prothom Alo