The government is on track to meeting the International Monetary Fund’s tax collection target for March but may miss the mark in June.

As part of the $4.7 billion loan, the Washington-based multilateral lender has stipulated a minimum tax collection goal as an indicative target.

Failure to meet an indicative target largely does not lead to any hold-up in the approval of further tranches; the IMF executive board makes exceptions if it is convinced that the programme is on course to meet the objectives.

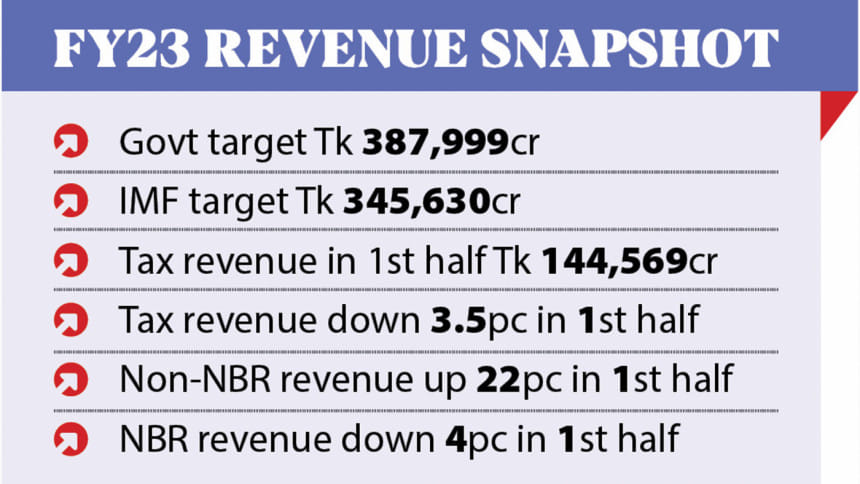

By March, the government needs to collect at least Tk 207,380 crore in tax, as per the IMF’s task sheet for Bangladesh. Come to the end of June, tax collection needs to be at least Tk 345,630 crore.

As of February, the National Board of Revenue has collected Tk 196,037.5 crore. The non-NBR tax collection stands at Tk 3,563 crore in the first half of fiscal 2022-23, according to data from the finance ministry.

Data on collections up to March is not available yet, but from the trends in NBR and non-NBR receipts, it is safe to infer that March’s target would be met comfortably.

“We are hopeful of getting close to June’s target,” said a finance ministry official on the condition of anonymity as he is not authorised to speak with the media.

This fiscal year, the government has set a tax revenue collection of Tk 387,999 crore, with the NBR tasked with bringing in Tk 370,000 crore. Another Tk 17,999 crore has been targeted from non-NBR sources.

The non-NBR revenue collection has been revised down to Tk 16,000 crore, which is the same as in fiscal 2021-22.

To achieve the NBR’s target — which was not revised — receipts need to be 28.8 percent more than fiscal 2021-22’s collection of Tk 287,223 crore.

In the past five years, NBR’s average collection growth has been 12.12 percent.

Going by the trend, tax revenue collection would be in touching distance of the IMF’s floor on tax revenue.

“The IMF target is very unambitious and quite achievable — our inability to collect tax is the problem,” said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

Complicating matters is the drop in tax collections from November last year on the back of reduced economic activities on account of strained dollar reserves and elevated inflation.

On March 29, foreign currency reserves stood at $31.1 billion, down 29.9 percent from a year earlier, according to data from the Bangladesh Bank. This is enough to cover up to four months’ import bills.

In the first eight months of the fiscal year, inflation averaged 8.74 percent, way above the budgetary target of 5.6 percent, according to data from the Bangladesh Bureau of Statistics.

“Imports are falling and corporate profits are shrinking. This is a matter of concern. Where would the extra tax revenue come from? The macro environment is not good, so not much revenue growth is not possible,” said Mansur, also the chairman of Brac Bank.

He went on to forecast that the tax collection would be in the neighbourhood of Tk 336,000 crore.

“When the NBR chairman and the finance ministry put pressure on the tax commissioners, they might manage the Tk 10,000 crore needed to cross the line.”

But that would come at a cost: the NBR would crank up the pressure on the taxpayers and get people to pay advance taxes by dangling the carrot of paying lesser amounts of tax next year.

This means next year’s tax receipts will be impacted.

“It will be tough to meet IMF’s target — the revenue situation should not collapse further,” said Mansur, also a former economist of the IMF.

In the first half of the fiscal year, tax revenue was down 3.5 percent year-on-year, while NBR’s revenue was 4 percent lower than a year earlier.

The trend seen up to March and the growth typically seen in the fourth quarter indicate that the IMF’s tax revenue target for June is unlikely to be achieved, said Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue.

There is a three-pronged beating on the NBR’s revenue collection: a drop in imports to safeguard the strained dollar stockpile, shrunken aggregate demand for elevated inflation, and reduced development works for fiscal tightening.

Development spending in the first eight months of the fiscal year has been the lowest in 12 years, according to data from the Implementation, Monitoring and Evaluation Division.

In the first seven months of the fiscal year, imports were down 5.7 percent year-on-year.

Letters of credit openings, which is an indicator of future imports, at the end of December were down 22.5 percent from a year earlier, according to data from BB.

Save for petroleum, LC openings for consumer goods, capital machinery, intermediate goods, industrial raw materials and others dropped, indicating further diminishing economic activities in future.

Tax collection growth so far has not been more than the rate of inflation, according to Rahman.

“It shows the collection is bad.”

Subsequently, it might be necessary to revise the tax revenue targets with the IMF in June, Rahman added.

At the end of April, an IMF mission is due in the country to monitor the progress of the programme.