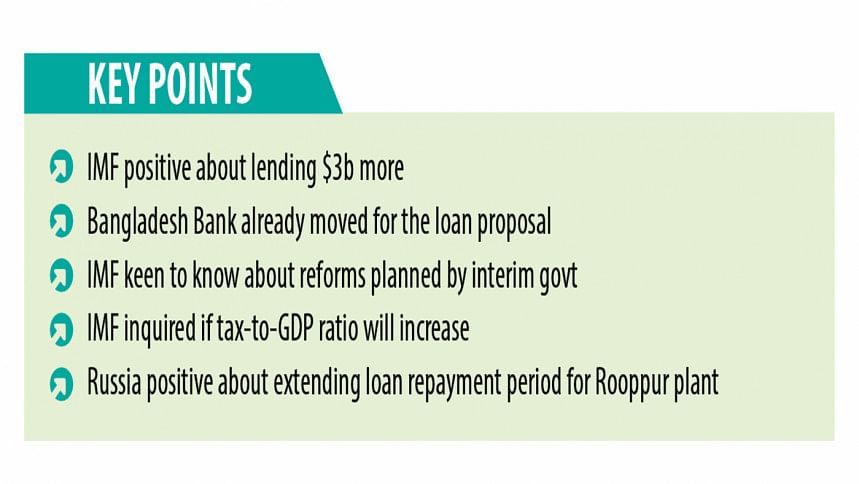

The International Monetary Fund (IMF) is positive about lending an additional $3 billion to Bangladesh but the multilateral lender wants to know what reforms the interim government is planning to take.

The topic came up during Finance Adviser Salehuddin Ahmed’s maiden meeting with the Washington-based lender on Thursday.

Chris Papageorgiou, chief of the IMF staff mission that is overseeing the $4.7 billion loan programme for Bangladesh, led the IMF team at the virtual meeting, which was also attended by Finance Secretary Khairuzzaman Mozumder.

Speaking with journalists at the Secretariat yesterday, Salehuddin said the IMF wanted to know about reform plans and whether the tax-to-GDP ratio would increase.

“I told them ‘definitely’,” he added.

He said the Bangladesh Bank has already moved for the $3 billion loan proposal, adding that details would be discussed when an IMF mission visits Bangladesh later this month.

Following his appointment as Bangladesh Bank governor last month, Ahsan H Mansur initiated talks over an additional loan from the IMF to repay foreign liabilities and boost foreign exchange reserves.

IMF officials informed the finance ministry and central bank officials that they are assessing how much it can lend to Bangladesh without exceeding the quota for the country.

According to finance ministry calculations, Bangladesh can take another $3 billion without exceeding the quota.

A meeting on the loan arrangement could be held on the sidelines of the World Bank-IMF annual meeting in Washington in October, an event Bangladesh’s finance adviser and central bank governor are likely to be a part of.

The IMF has so far released $2.3 billion under the $4.7 billion loan programme since it was approved in January last year.

The interim government took charge amid high inflation and depleting foreign currency reserves, issues that have been prevalent for almost two years.

Inflation remained high in July, with the consumer price index rising by 1.94 basis points to 11.66 percent while food inflation crossed 14 percent in July for the first time in 13 years.

Meanwhile, Bangladesh’s foreign exchange reserves, which stood at more than $40 billion in July 2022, almost halved to $20.5 billion on August 21, according to the IMF’s BPM6.

The interim government has taken some measures to tackle the situation, such as hiking the policy rate and implementing some strict measures for the banking sector.

Earlier, the IMF mission suggested various reform measures.

Considering Bangladesh’s low tax-to-GDP ratio, the multilateral lender said it is imperative to prioritise sustainable revenue generation to bolster investments in social welfare and development initiatives.

To this end, tangible tax policy and administrative measures should be incorporated in the FY25 budget to augment tax revenues by 0.5 percent of the GDP, it added.

At the same time, a medium-and-long-term revenue strategy, with an accompanying implementation framework, should guide future reforms.

The IMF also recommended that reducing subsidies, improving expenditure efficiency, and managing fiscal risks will allow for additional spending on social safety nets and growth-enhancing investment.

“Reducing banking sector vulnerabilities remains a priority. Efforts to implement the non-performing loan reduction strategy should help support the growing financing needs of the economy,” it said.

At the same time, the Bangladesh Bank should continue the transition to risk-based supervision to enhance financial sector resilience while continuing legal reforms to improve corporate governance and regulatory frameworks, it added.

Looking ahead, domestic capital market development will be instrumental in mobilising long-term financing to support growth, it further said.

ROOPPUR PLANT REPAYMENT PERIOD MAY BE EXTENDED

Finance Adviser Salehuddin also shared yesterday that Russia is positive about extending the loan repayment period for the Rooppur Nuclear Power Plant project.

However, they will only make a decision after the plant begins operations, he said.

Following a recent reshuffle to the advisory council of the interim government, Salehuddin was additionally charged with the Ministry of Science and Technology.

He started holding meetings with ministry officials yesterday.

Last week, Russian Ambassador to Dhaka Alexander A Nikolae paid a courtesy call to Salehuddin.

Responding to a query from journalists on the loan repayment schedule for the Rooppur plant, Salehuddin said: “We told them about the issue, and they told us to start operations [of the plant].”

Asked whether any cost-cutting initiatives would be taken, he said they are yet to assess it. He added that the plant would be operational soon.

The total loan for the project is $12.65 billion, according to an agreement signed with Russia in 2016.

At present, Bangladesh is paying $110 million yearly in two instalments with interest.

The 10-year grace period for the loan will end in March 2027. After that, Bangladesh must pay $390 million in two instalments every six months against the principal amount.

Recently, Bangladesh proposed to start making repayments against the principal amount in 2029 instead of 2027.

Daily Star