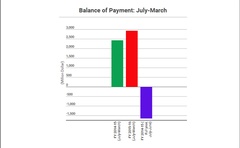

Bangladesh’s current account on foreign trade has recorded a massive Balance of Payments (BOP) surplus at the end of the first nine months of the current fiscal.

According to Bangladesh Bank data released on Thursday, the BOP surplus grew to $2.93 billion during this period (July-March) of FY 2015-16.

At this time last year, it was over $2.43 billion. But the 2014-15 fiscal year had ended with a BOP deficit of $1.65 billion.

Finance Minister AMA Muhith feels the $2.93 billion surplus was a result of a drop in international oil prices and cuts in food imports.

His report on the current fiscal’s budget implementation and progress, presented in Parliament on Apr 27, said despite a trade deficit the primary income shortfall, a significant surplus in secondary income was helping to maintain a current account surplus.

Also, a surplus in the capital and financial accounts was keeping the overall BOP favourable and increasing the foreign currency reserve, Muhith said in the report.

# During the July-March period, $33.61 billion was spent on imports, which was 6.73 percent more than the amount spent during the corresponding time last year

# Over $1.62 billion worth letter of credits (LC) were opened for importing fuel oil in these nine months, which was 40.21 percent less than the figures during the same time last year.

# In the 2014-15 fiscal, over than $2.72 billion worth LCs were opened to import oil.

# During this fiscal’s July-March period, the number of LCs opened to import food products fell by 40.44 percent

# The opening of LCs to import capital machinery and raw industrial materials increased 14 percent and 3 percent, respectively

# Compared to last year, export earnings in the first 10 months (July-April) of the current fiscal year rose by 9.22 percent

# At the same time, remittance from Bangladeshi expatriates dropped by nearly 2.5 percent

Bangladesh’s reserve stood at $28.5 billion on Thursday even after clearing $900 million towards import payments for March-April to the Asian Clearing Union (ACU).

Import payments of the next eight months, $3.5 billion each month, could be cleared with this reserve.

On Wednesday, the central bank had $29.22 billion in foreign reserves, the highest so far.

Economist Zaid Bakht said he was optimistic about the current trend of BOP surplus lasting through the remaining three months (April, May and June) of the current financial year.

The BIDS researcher told bdnews24.com, “Bangladesh’s import costs have gone down because of a drop in international prices of oil and food products, and an increase in export earnings. That’s why this relieving surplus has been achieved.”

He feels the situation will remain in Bangladesh’s favour as there is no hint of any immediate hike in international oil prices.

“It’s also unlikely that the export costs will rise in the rest of the fiscal. A big BOP surplus is possible at the end of the fiscal if the current trend of growth in export earnings can be maintained,” he added.

Source: bdnews24