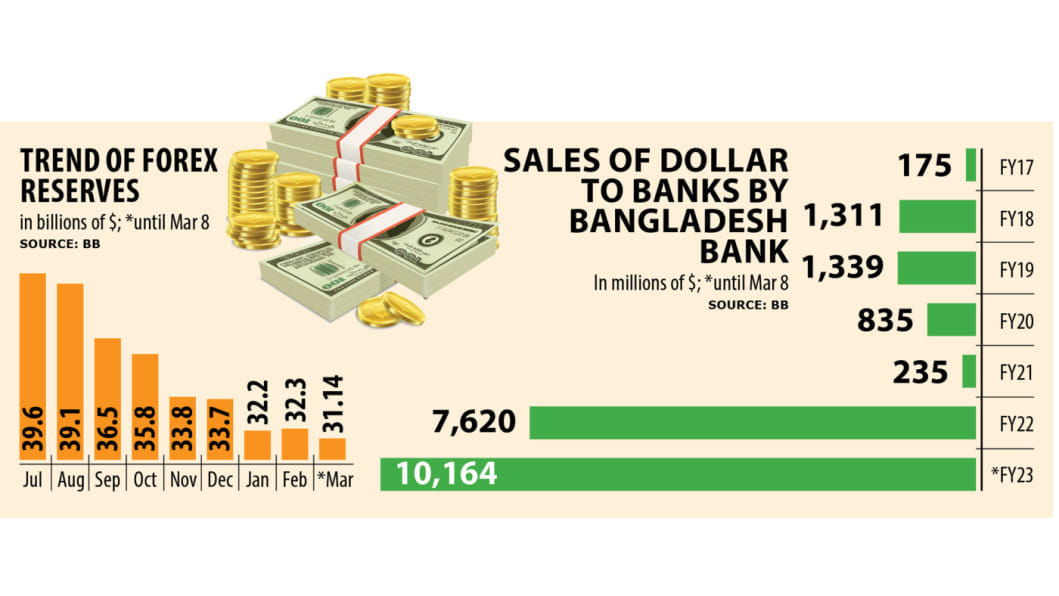

Bangladesh’s foreign currency reserves have slipped to a six-year low of $31.15 billion after the central bank cleared import bills to the tune of $1.05 billion with a number of Asian countries, official figures showed.

This means the reserves have fallen by about 30 per cent from $44.14 billion recorded in March last year.

The current level of the reserves is the lowest since the financial year of 2016-17 when it stood at $33.49 billion.

The BB settled the import payments through the Asian Clearing Union (ACU) on Monday.

The ACU, headquartered in Tehran, is an arrangement to settle payments for intra-regional transactions among member countries: Bangladesh. India, Bhutan, Iran, the Maldives, Myanmar, Nepal, Pakistan, and Sri Lanka. The countries settle bills every two months.

The forex reserves of Bangladesh have witnessed a major slide in recent months after every ACU payment is made, said a central banker.

The reserves surged to $48 billion in August 2021, the highest in history. However, due to the escalated import payments resulting from high commodity prices amid the Russia-Ukraine war, the reserves have been declining since May 2022.

The sharp decrease in foreign exchange reserves has caused macroeconomic instability amid an acute dollar shortage. The taka has lost its value by about 25 per cent against the American greenback in the past one year.

And Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, warned that the reserves might face an additional loss of $10-12 billion before the national election if the ongoing slide continues.

“We are slowly but surely heading towards a bad situation if existing policies are not fundamentally changed.”

Zahid Hussain, a former lead economist of the World Bank’s Dhaka office, says only the withdrawal of the ceiling of interest rate on loans and the introduction of a floating exchange rate can stop the deterioration of the reserves.

Although the deficit in trade and current accounts have decreased significantly in the last couple of months, the shortfall in the financial account widened to a large extent, worsening the volume of the reserves. Under such a situation, the central bank is injecting dollars into banks almost every working day.

The BB supplied a record $10.16 billion to the market between July 1 and March 8 this fiscal year. It injected $924 million in February and $216 million so far this month.

The central bank provided $7.62 billion to banks in the last financial year to help them clear import bills, which rocketed to over $82 billion.

Mansur also said the central bank should withdraw the interest rate ceiling on loans and make the exchange rate flexible.

Bangladesh’s forex reserves might face further squeeze in the coming months as the war shows no sign of coming to an end any time soon while import bills are still more than combined receipts through exports and remittance.

The Federal Reserve, the central bank of the United States, has already indicated that it will further increase its key interest rates, intensifying pressure on all frontier countries, including Bangladesh.

“We will have to make money laundering more expensive through the depreciation of the local currency and the withdrawal of the interest rate ceiling on loans,” Mansur said.

Zahid Hussain says that the recent foreign exchange policies taken by the central bank have not helped the market recover from the economic stress.

“The reserves will decline further and the economy might face a chaotic situation unless time-befitting policies are taken.”

The exchange rate of the Bangladeshi currency stood at Tk 107 for each dollar on March 7, down 26.1 per cent from a year earlier.

“The local currency will face more pressure in the coming days if the decline in the reserves can’t be stopped,” said Hussain.

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, says Bangladesh will have to narrow its trade deficit in order to tackle the current situation.

Between July and January, the trade deficit stood at $13.38 billion, a decrease of 28.8 per cent year-on-year.

“Both remittances and foreign direct investment flow should be geared up to keep the reserves stable,” Rahman said.