The country’s external sector, which started to deteriorate two years ago amid faster erosion of foreign exchange reserves, has become stable after the July revolution riding on steady remittance and export earnings thanks to dollar rate adjustment in line with market demand.

However, investment activities remained at a standstill due to political uncertainty and cautious bank lending amid the contractionary monetary policy taken by the Bangladesh Bank to rein in persistently elevated inflation.

When talking with The Business Standard, Mirza Elias Uddin Ahmed, managing director of Jamuna Bank said that new investments have stalled on both the lender and borrower sides.

Banks are cautious in lending due to the contractionary monetary policy adopted to control inflation. On the other hand, investors are hesitant to expand businesses because of political uncertainty, he said.

“However, this is temporary,” he hoped, adding that the policies introduced by the Bangladesh Bank for greater exchange rate flexibility, inflation control, and stricter default loan management are expected to improve the macroeconomic situation once political stability is restored.

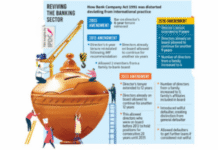

Elias said that private sector credit growth has dipped to its lowest level as banks focus on recovering previous investments amid rising default loans, rather than providing fresh loans. The new default loan policy, which classifies loans as defaults after three months of non-payment, has further prompted banks to adopt a cautious approach to lending.

As a result, lending rates have remained stable at a maximum of 13% when interest rates on government bills and bonds started to come down, which will help reduce fiscal pressure, he added.

The private sector credit growth, which reflects the overall business scenario in the country, dipped to 8.3% in October which was above 10% in July this year, central bank data shows.

The LC (Letter of Credit) opening for capital machinery import declined to negative growth of 32.79% in July-October of the current fiscal year (FY25) reflecting stagnancy in business expansion.

A senior executive of DBL Group, one of the biggest exporting companies, told TBS on condition of anonymity that they dropped their expansion plan for the time being as banks are not allowing them to get new financing.

He said banks are only rolling out their existing financing limit to keep business running.

Moreover, borrowing costs increased unusually after lifting the single-digit lending rate which prompted the business conglomerate to be regular in payment amid tight default loan policy, he added.

Even in this situation, the Bangladesh Bank is still planning to continue the contractionary monetary policy to tame inflation following the suggestion of the International Monetary Fund (IMF) which will push up borrowing costs further.

At the same time, the central bank moved for greater exchange rate flexibility allowing banks to trade dollars in line with market demand which is expected to put further strain on inflation.

Describing the government’s intention, a senior central bank executive told TBS that national policy is not growth-oriented for now.

He said growth will be slowed down in the coming year but it will be solid growth. The further tight monetary policy suggested by the IMF will hurt business, interrupting growth but cooling down inflation is the highest priority.

He said the external sector is now stable, and there is no longer any concern about reserves, which the central bank considers a major development in the macroeconomy.

This is because, had reserve erosion not been halted, the country could have faced a debt crisis, he explained.

The IMF in its Third Review of Bangladesh’s Extended Credit Facility, Extended Fund Facility, and Resilience and Sustainability Facility Arrangements projected that GDP growth to slow to 3.8% in FY25 due to output losses caused by the public uprising, floods, and tighter policies but is expected to rebound to 6.7% in FY2026 as policies relax.

It also anticipated inflation to remain around 11% annual average year-on-year in FY25 which reached 11.38% in November.

Inflation will decline to 5% in FY26, supported by tighter policies and easing supply pressures, said the IMF. However, the outlook remains highly uncertain, with risks skewed to the downside.

Agreeing with the IMF projection, the central bank executive said downward global price pressure will help to tame inflation in the domestic market next year.

Fall in revenue collection is concerning

The high gap in revenue collection from the target is another concerning issue but it will be overcome soon as tax reformation suggested by the IMF, he said.

Revenue collection fell nearly Tk31,000 crore short of the target in the first four months of the current fiscal year, which experts attribute to an economic slowdown and political instability stemming from the July-August uprising.

“To address the emerging external financing gap and persistently high inflation, near-term policy tightening is crucial. Fiscal consolidation should prioritise the swift implementation of additional revenue measures, such as removing tax exemptions while restraining non-essential spending,” said IMF in its press release after visiting Bangladesh from 3 to 18 December.

tbs