The Business Standard 15 February 2023

Bangladesh’s outstanding external debt to gross domestic product (GDP) ratio declined to 13.78% at the end of fiscal 2021-22, compared to 16.9% in the previous fiscal year, mainly due to variations in exchange rates, according to recently released data by the Economic Relations Department (ERD).

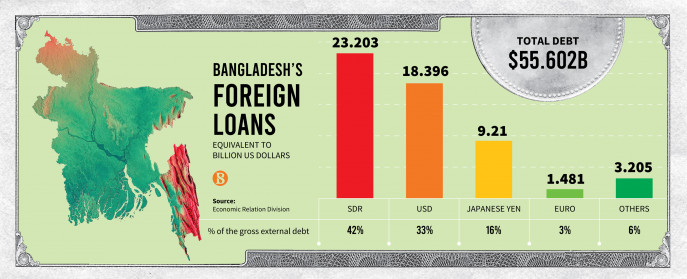

It resulted in a $4.03 billion decline in the gross foreign loan, and the outstanding amount stood at $55.60 billion last year.

The outstanding external debt was supposed to be a record $59.647 billion in the last financial year. But the amount dropped as the dollar appreciated amid the Russia-Ukraine war and other foreign currencies, including special drawing rights (SDRs), depreciated against the greenback.

In the last fiscal year, $10 billion was released in foreign debt. And Bangladesh has repaid loans of $1.526 billion to various development aid agencies.

As a result, the remaining $8.767 billion was supposed to be added to the outstanding debt. But the total foreign loan dropped by $4 billion in the calculation of the ERD.

According to ERD officials, Bangladesh’s debt liability has decreased due to the reduction of outstanding debt. This has also reduced the external debt to GDP ratio, which is good for the country.

According to officials, the government is currently in a profitable position on paper. But later, when the dollar rate stabilises, this $4 billion can return to being outstanding.

It is like the stock market. A share of Tk100 increased by Tk200 today, and it will be seen that it has decreased by Tk100 tomorrow. The reason for a valuation adjustment is profit or loss; it must be determined on the basis of facts. When the share is cashed, the amount of profit or loss depends on that time, they added.

Zahid Hussain, former lead economist of the World Bank’s Dhaka Office, said that outstanding foreign debt is decreasing in books. Whether Bangladesh has actually benefited will depend on the exchange rate at the time of debt repayment.

“For example, suppose we took a loan in Japanese yen. The agreement stipulates that the loan must be repaid in yen. If one dollar costs 100 yen when I borrow, my liability is 100 yen,” he said.

“If the price of one dollar becomes 110 yen at the time of return, then, by buying 100 yen for less than one dollar, we can give back. As the yen depreciates, we will benefit,” he added.

The noted economist said that if the dollar depreciates after six months, the debt will increase again.

“Whether we make a profit or a loss depends on the exchange rate at the time of the refund,” he added.

According to the people concerned, the dollar has skyrocketed over the past year and a half due to the situation brought on by the Russia-Ukraine war. Again, there is a sign of stabilisation over the last three months.

In this situation, the profit or loss of Bangladesh on its non-dollar-denominated debt, including SDR, depends on the rise and fall of dollar price in the international market.

According to ERD data, of its total foreign loan, Bangladesh has taken the highest 42% in SDR until fiscal 2021-22, followed by 33% in dollars, 16% in Japanese yen, and 3% in euros.

According to officials and economists, due to the exchange rate, Bangladesh often receives an additional amount when taking out loans. In such a recent example, the country is getting $200 million in addition to the loan it had sought from the International Monetary Fund (IMF).

Originally, the IMF loaned 3.3 billion SDR to Bangladesh, which was first estimated at $4.5 billion. But the country now expects to receive $4.7 billion as the dollar appreciates.

Bangladesh will receive the IMF loan in seven instalments over three and a half years. Whether the country will get the $4.7 billion depends on the exchange rate at the time of the loan’s release. The value of SDRs against the dollar may reduce Bangladesh’s borrowing capacity. And it may increase the capacity again.