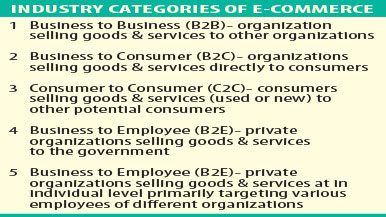

With regard to the Bangladesh e-commerce sector, the major subsectors, thus far, have been B2B, B2C, C2C, and B2E segments, according to the study on e-commerce in Bangladesh published by the Centre for Enterprise and Society at the University of Liberal Arts, Bangladesh.

B2B websites were once the biggest constituents of the e-commerce sector in Bangladesh. However, this has changed and recent trends indicate that their representation in the sector at large is expected to lessen. Several B2B websites in Bangladesh are engaged in providing manufacturing and supply-chain solutions.

For instance, BGMEA has actively deployed B2B e-commerce solutions for international RMG orders and procurement, as do several RMG companies. There are also B2B websites that feature business directories, trade deals and information about suppliers such as BangladeshBusinessGuide, Addressbazaar and Bizbangladesh, which, at present, have limited popularity.

B2C websites have also become very popular as evidenced by the growth and commercial success of online-based home delivery of food, such as HungryNaki and FoodPanda. This has come as a panacea to citizens given the high levels of traffic in areas such as Gulshan and Dhanmondi in Dhaka at a time when people like to go out to dine. Other examples of B2C initiatives include Facebook-based commerce platforms such as Shopr.bd and ShoptoBd which allow Bangladeshi customers to purchase products from leading online shopping sites in the US, UK, India and even China, e.g., Amazon.com, ebay.co.uk, Amazon.in, and Alibaba. Although the competition between local players and foreign-backed players in the B2C market, in particular, the food delivery business, is expected to determine the future structure of the B2C sector, what appears to be inevitable is its sustained growth.

Meanwhile, C2C businesses, thus far, have been the life force of the e-commerce sector in Bangladesh. The leading players in this category include Bikroy, Ekhanei, and ClickBd. There has already been a reorganization of this sector with CellBazar being bought by Telenor, followed by the acquisition of the foreign market playeOLX by Ekhanei.com. These businesses consist of individual and auction-baseonline marketplace similar to eBay. Clwas the country’s first auction platform, while Cellbazaar was the first to use Sbased transactions.

With regard to B2E businesses, emplorecruitment, particularly in the private sein Bangladesh, has more or less shifteonline, thanks to companies such as bdjobs.com, prothom-alojobs.com, and jobsA1. Although internal hiring and lobbying are widely prevalent, vacancannouncement takes place through the largest and most accepted web recruitmportal Bdjobs, while many others like prothom-alojobs.com and jobsA1, etc aenjoy growing popularity.

Growth Rates & Usage Statistics

Overall, the current trends and e-commgrowth statistics can be seen in the following table.

As is evident, the current growth rates, quarter-on-quarter, as of 2014 are already very high. Growth rates of over 30% quarter-on-quarter are not commonplace for most sectors in Bangladesh. The predicted growth rates for 2015 and 2016 are even higher and imply a persuasive case for more market entry and business expansion in this sector.

Source: Dhaka Tribune