Bangladesh’s power purchase from Adani Power contributed to the massive profit the Indian conglomerate made in the first nine months of the 2023-24 fiscal year.

In November 2017, Bangladesh inked a deal with Adani Power Jharkhand, a wholly-owned subsidiary of the multinational company headquartered in Ahmedabad, to import electricity amid criticism from analysts that the deal would benefit the Indian company more.

In April-December of 2023-24, Adani Power’s continuing revenue rose 40 percent to 37,173 crore rupees (Tk 48,911 crore). The Jharkhand unit contributed 5,326 crore rupees, or 14.3 percent of the total.

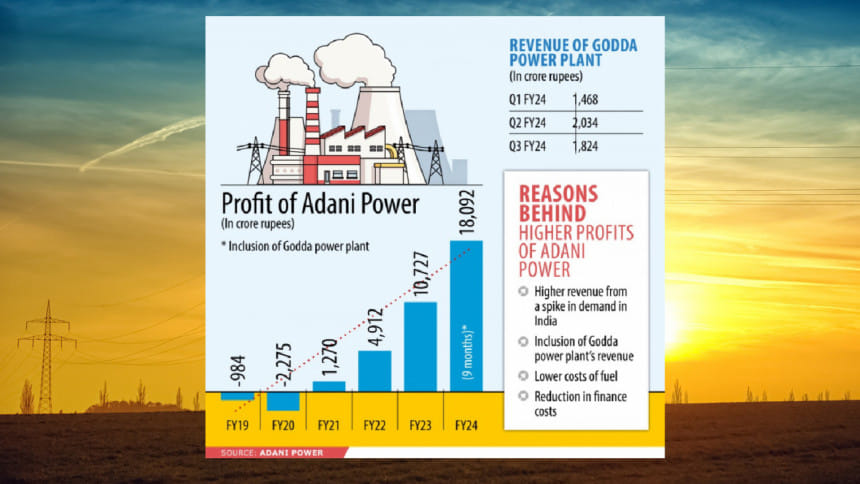

Thus, Adani Power’s profits rose 230 percent year-on-year to 18,092 crore rupees (Tk 23,805 crore) in the nine months, according to the company.

Bangladesh turned to the neighbouring country to meet its growing demand for electricity and supply power cost-effectively to the northern part that does not have large power units.

When the deal was struck with Adani, Bangladesh’s power production capacity stood at 12,922 MW, with the highest generation standing at 9,507 MW, according to the website of the Bangladesh Power Development Board.

The plant, located on 425 hectares of land in the Godda district of the Indian eastern state of Jharkhand, started commercial production in the first quarter of India’s fiscal year that begins in April.

During the earnings call last week, Shailesh Sawa, then chief financial officer of Adani Power, said the company achieved sales growth in the third quarter. The operating and financial performance of the incremental capacity of 1,496 megawatts of the Godda power plant was included.

The continuing revenue of Adani Power increased 72 percent year-on-year to 13,405 crore rupees in the October-December quarter. Profit skyrocketed to 2,738 crore rupees from 9 crore rupees during the period, figures disclosed by the company showed.

The company attributed the heavy net profits to the surge in revenue and lower finance and fuel costs.

“The revenue growth came thanks to the higher operating capacity after commissioning of the Godda plant and improved power offtake following the growth in demand and lower imported fuel prices,” the company said in its presentation made to analysts.

The inclusion of the Godda power plant added 1,824 crore rupees to the revenue of Adani Power in the third quarter.

The multinational’s EBITDA (earnings before interest, taxes, depreciation, and amortisation) rose 242 percent year-on-year to 5,059 crore rupees in the quarter. EBITDA indicates how well a company is managing its day-to-day operations.

The company said the EBITDA grew on the back of a higher contribution on account of the lower fuel cost and strong merchant prices.

In the second quarter spanning July to September, Adani Power’s revenue climbed 61 percent to 12,155 crore rupees thanks to the 2,034 crore rupees contributed by the Godda plant.

In the first quarter, Godda plant added of 1,468 crore rupees to the revenue.

Apart from the addition of the Godda plant, higher volumes were also contributed by the Mundra, Udupi, Raipur and Mahan plants, Sawa said.

“A reduction in the prices of imported coal helped us improve the offtake of power from Mundra and Udupi plants. Adani Power’s merchant capacity enjoyed a strong logistic cost advantage for being located close to the main coal belts of India.”

“This allows us to gain the maximum benefit from the current surge in power demand.”

The electricity from Godda to Bangladesh is coming through a dedicated transmission line of about 106km up to the Indian border.

The commercial operation began on April 4 last year. In the next three months to June 30, it produced 159.8 crore units of electricity (kilowatt-hour). The per unit cost was Tk 14.02.

Daily Star