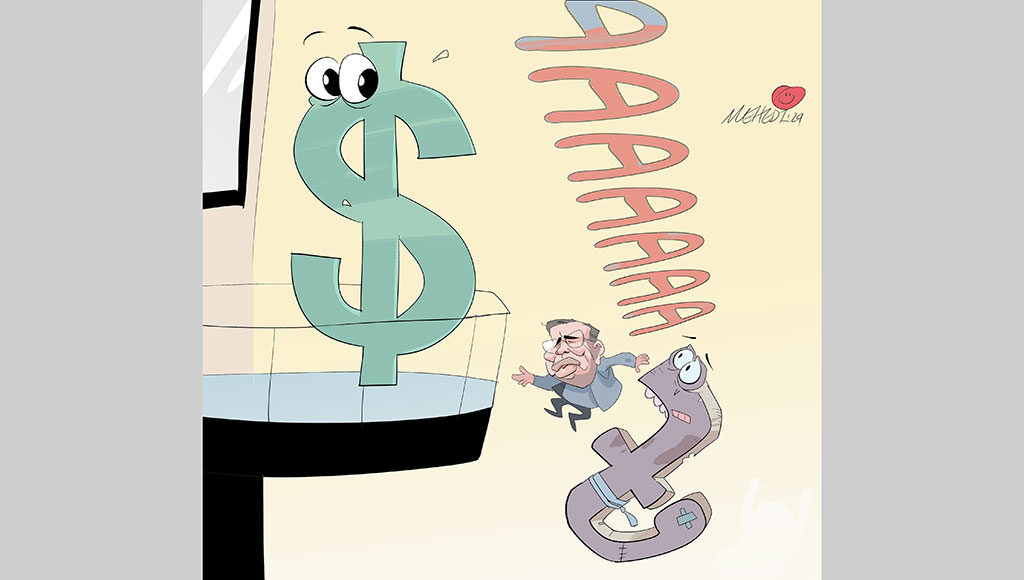

The Bangladesh Bank has been struggling to control high inflationary pressure, primarily due to ineffective policies and failures in implementing monetary policy, economists said.

They attribute the inability to control inflation to the central bank’s delayed decisions on interest rates and the dollar rate, as well as its failure to address foreign reserve depletion, rising default loans, and capital flight.

Despite initiating several measures to control inflation and stabilise the economy, the central bank has had to revise its strategies repeatedly as they have proved ineffective.

BB governor Abdur Rouf Talukder made promises to reduce inflation to 8 per cent in various meetings, but these targets were not achieved.

The Bangladesh Bureau of Statistics recorded headline inflation of 9.81 per cent in March, up from 9.67 per cent in the previous month.

Inflation has remained consistently high at over 9 per cent since March 2023.

Although the Bangladesh Bank used contractionary monetary policy to contain the money supply in the market, it was continuously printing money to finance the government, which eventually raised inflation.

Due to the economic downturn, widespread inflation was observed not only in Bangladesh but also in other South Asian countries.

However, while most countries have recovered from it, Bangladesh has failed to follow suit.

Despite facing a debt crisis about two years ago, Sri Lanka managed to cut inflation to 5 per cent from 49 per cent in 2022.

In addition to economic factors, economists attribute Bangladesh’s high inflation to its failure to control money laundering and market syndicate activities.

Zahid Hussain, a former lead economist of the World Bank’s Dhaka office, criticised the central bank for its failure to control inflation.

He attributed it to delayed decision-making, noting that other countries facing similar inflationary pressures had promptly raised interest rates significantly as opposed to Bangladesh Bank’s slow and modest response.

Hussain also criticised the central bank’s introduction of an artificially controlled dollar rate, which he deemed a failure as it did not effectively address the dollar crisis in the market.

He highlighted that businesses were suffering from continuous import restrictions.

He further criticised the central bank for continuously printing money to finance government spending, citing its recent announcement to issue bonds to repay the government’s due payments.

On April 1, 2020, the Bangladesh Bank imposed caps on both loan and deposit rates, initially set at 9 per cent and 6 per cent, respectively.

Economists and financial experts in the past advised lifting the cap on interest rates to allow market forces to determine rates, but the BB did not act.

Powerful business organisations have always opposed flexible interest rates, arguing that they will shrink private investment and affect economic growth.

Private investment, though, remained stagnant at 23 per cent for many years, despite the 9 per cent cap on interest rates.

The low-cost loan raised the supply of cheap money in the economy, contributing to inflation.

Amid growing criticism from various quarters, the Bangladesh Bank finally lifted the ceiling in July 2023, introducing a SMART rate system that it scrapped on Wednesday amid pressure from the International Monetary Fund, allowing banks to determine their own interest rate.

In addition to cheap money in the economy, the money supply was also increased, and the BB was forced to print money to meet government demand for borrowing.

In the past financial year 2022–23, the government’s borrowing from the country’s banking sector amounted to Tk 1.24 lakh crore, with Tk 98,826 crore borrowed from the central bank and Tk 25,296 crore from commercial banks.

If the money multiplier effect, which is 5 times, was taken into account, the total money supply from BB to the government would reach approximately Tk 4,94,130 crore, again significantly contributing to inflation.

Mustafizur Rahman, executive director of the Centre for Policy Dialogue, said that the government must address market mismanagement and enhance the supply of essential goods to curb inflation.

He suggested reducing business costs, controlling unnecessary expenditures, and completing projects on time.

Ensuring transparency and accountability is also essential, he said.

Rahman highlighted the need to improve macroeconomic governance and control capital flight to enhance the current economic situation.

He also suggested the government spend more on poor and low-income families and strengthen its social protection in order to reduce the impact of inflation on them.

New Age