The Bangladesh Bank has rushed a meeting and formed a committee to find out the causes for the alarmingly high default loan and ways to curb it.

The central bank called chief executives of seven banks that have had the highest default loan figures to the meeting on Tuesday at the behest of Finance Minister AHM Mustafa Kamal, according to officials.

The move came a day after media reports citing latest central bank data said the amount of default loans in the banks are at an all-time high.

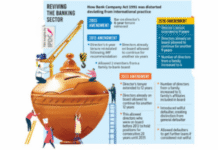

The central bank recently relaxed loan write-off policy for the banks in a bid to show the situation less worse than what it is in reality following the finance minister’s announcement.

It also announced facilities for ‘good’ borrowers like 10 percent rebate from total interests on their loans and a scheme for those who were unable to pay but can ‘adequately justify’ their situation allowing them to pay off the loans with a 2 percent down payment on the loan amount and 9 percent interest over 10 years.

But the moves have apparently failed to improve the situation as the latest data show the total amount of default loans exceeded Tk 1.5 trillion or 11.87 percent of total loans disbursed by the end of March.The amount includes about Tk 392.5 billion in written-off debts.

“The banks have been asked to cut default loan by any means within the current month,” an official said.

After taking charge in January, Kamal had announced that the bank loan default figure will not increase “by a single taka”.

Financial Institutions Secretary Ashadul Islam attended the meeting chaired by Governor Fazle Kabir.

“Managing directors of seven banks were called as default loans have increased. They’ve said many borrowers are not paying instalments even after rescheduling their debts which has pushed the amount of default loans up,” central bank spokesman Serajul Islam told bdnews24.com

“A committee was formed in the meeting to identify the reasons behind the rise in default loans and lessen these. Some central bank departments will be on the committee,” he added.

The seven banks that had their chief executives in the meeting are state-owned Sonali, Agrani, Janata, and Rupali, and private banks Al-Arafah, Islami and National.

Source: bdnews24.