India may offer Bangladesh fresh loans under a new framework, as implementation of the projects under the existing loan programme is proving difficult due to some strict loan conditions.

The issue will be discussed during Prime Minister Sheikh Hasina’s official visit to India next week, a top finance ministry official said yesterday.

Hasina and her Indian counterpart Narendra Modi will have a one-on-one meeting followed by delegation-level talks on June 22 at the Hyderabad House, a state guest house, in New Delhi.

However, signing of any new loan agreement is unlikely during Hasina’s visit, although an announcement to this effect may come in a joint communique, the official added requesting anonymity citing diplomatic confidentiality.

Over the last few months, Dhaka and New Delhi have been discussing a new loan framework and its amount and conditionalities, official sources say.

The discussion comes as Bangladesh faces challenges to utilise the existing conditional loans from India.

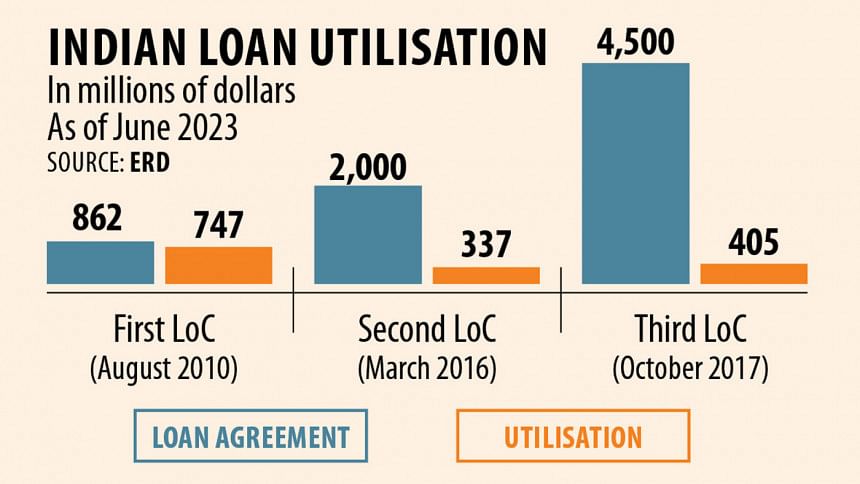

Since 2010, India committed $7.36 billion in loan to Bangladesh. Of this, Bangladesh has been able to utilise only $1.73 billion, or 23 percent of the commitment, till April this year.

The conditions of the existing Indian Line of Credit (LoC) are very strict. For example, around 65-75 percent of goods or services for each project must be procured from India, causing delay in project implementation, according to officials.

Appointment of Indian contractors along with bureaucratic red-tape on both sides also limits the project’s progress.

Though Bangladesh signs project-based loan agreements with other development partners, in case of India, credit deals have been inked for a cluster of programmes under a framework.

This means, once a loan deal is signed, implementation period of all projects under that deal gets started. Also, as per the loan conditions, the loan repayment period for all projects under the deal starts on the day the first tranche of the loan for a single project is released, according to official sources.

“It makes things difficult for Bangladesh,” said one of the finance ministry officials.

Under the new framework, India will give an overall loan commitment and the two sides will sign project-based loan deals. It is expected to solve the problems around the loan repayment.

China has promised Bangladesh a $20 billion loan, but all the loan deals signed so far are project-based.

Finance ministry officials said that other conditions of the Indian loan will also be relaxed to make project implementation easier.

The existing interest rate of the Indian loan is 1 percent and the repayment period is 15 years, including five years of grace period.

The first Indian LoC of $862 million for 15 projects was signed in 2010 while the second loan agreement was signed in 2016 for $2 billion for 12 projects. The third credit deal was signed for $4.5 billion for a cluster of 15 projects.

There are 42 projects under the three LoCs. Of that, 14 projects have been completed involving $410 million or around 6 percent of the overall commitment in the first two credit deals. As per the deal, all project-related materials were procured from India.

The rest of the projects are construction-related, so they are taking time. Many projects have yet to start.

Eight construction projects worth around $2.73 billion are underway. Three projects have started the process of hiring consultants while seven projects are looking for contractors.

The delay has already pushed up the project cost. Many projects under the existing LoCs that are not in implementation phase will be transferred to the new framework, officials said.

Daily star