Mingtiandi; Asia Real Estate Intelligence

Alpha is selling the Ibis Novena Hotel for a S$20 mil mark-up over the 2013 price

Alpha Investment Partners has sold a 241-room hotel in Singapore’s Novena area for just under S$170 million ($125.6 million), according to sources familiar with the transaction who spoke with Mingtiandi.

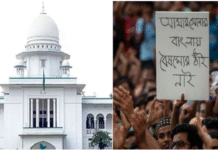

The private equity division of Keppel Capital has already handed over the Ibis Novena Hotel to companies controlled by Bangladeshi tycoon, Mohammed Saiful Alam, chairman of Chitttagong-based conglomerate S Alam Group, Mingtiandi understands, in a deal which closed on Wednesday.

Through the off-market transaction, the buyer is acquiring the freehold property in Singapore’s heartland region for just over S$705,000 per room, as investors continue to scramble for income earning property assets in Singapore.

Keppel PE Unit Sells Assets as Fund Matures

Alpha is selling the eight-year-old hotel approximately five years after purchasing the Ibis Novena in 2013. The private equity firm is said to be selling at a cap rate of around 3.0 percent with the transaction motivated by the impending end of one of Alpha’s property funds. The transaction was first reported by Singapore’s Business Times.

Bangladeshi mogul Mohammed Saiful Alam has now picked up his third Singapore hotel

In April of this year AIP, together with its joint venture partner City Developments Ltd, had agreed to sell 7 and 9 Tampines Grande, a pair of eight-storey office blocks in eastern Singapore, to a fifty-fifty joint venture between listed-developer Metro Holdings and privately held Evia Real Estate for a reported S$395 million. The Keppel unit had participated in the office park development in northeastern Singapore through its Alpha Asia Macro Trends Fund (AAMTF) II strategy.

Alpha had started off the year with a disposal from its AAMTF II portfolio by selling the Manulife Centre on Singapore’s Bras Basah Road, another asset held by its cooperative investment strategy with CDL, to a joint venture between ARA Asset Management and London’s Chelsfield for S$555 million.

Keppel reached a $1.1 billion final close on AAMTF III in January of this year, with the company now understood to be selling off the assets of its earlier fund to realise returns for investors.

Selling Off a Greener Hotel

During the time that Alpha held the hotel, the private equity firm invested in upgrading the asset, including giving the property an eco-friendly make-over, including LED lighting and replacing the air conditioning system to enable the Ibis Novena to receive the Building Construction Authority of Singapore’s Green Mark Platinum Award for energy efficiency in 2015.

Galven Tan of CBRE Singapore

Reports in January of this year indicated that the private equity firm was seeking the sum of S$240 million for the hotel at 6 Irrawaddy Road, with Alpha said to have chosen the best available bid after receiving a number of unsolicited offers for the property.

The capital markets team at CBRE in Singapore is understood to have brought together the buyer and the seller, with executive director Galven Tan said to have acted as lead broker. Contacted by Mingtiandi, sources at CBRE declined to comment on the market report. Following the acquisition, the property will continue to be managed by Accor Group, which owns the Ibis brand, under the existing hotel management agreement.

Alpha had purchased the Ibis Novena from the family of Michael Kum Soh Har, executive chairman of M&L Group and property developer Grandline International, for S$150 million in 2013, with the property appreciating in price by $20 million over the five year period.

Inquiries by Mingtiandi to Alpha Investment Partners had brought no response by the time of publication.

Singapore Market Among 2019 Stars

As trade war anxiety and tighter funding have brought clouds over the Greater China market in 2019, Singapore has emerged as one of the region’s property investment hotspots. During the first three months of the year, commercial real estate investment volumes were up 72 percent in the city-state, compared to the same period of 2018, according to data from Real Capital Analytics.

In the case of the Ibis Novena, the buyer, who already owns two other hotel properties and some retail space in Singapore, is said to have found the hotel’s freehold property rights to be a compelling selling point.