Official GDP (aggregate output) figures for the second quarter (April, May, June) from the U.S. Bureau of Economic Analysis (BEA) are going to drop on Thursday, possibly literally as well as figuratively. Twitter is aflutter in anticipation, but more over the definition of recession than the probability of a negative number.

As of 19 July, the Federal Reserve Bank of Atlanta’s GDPNow, which uses a methodology similar to that of the BEA, read negative 1.6 percent, the same as the BEA’s third estimate of the economy’s performance in the first quarter (January, February, March). Any negative number from the BEA this week will mean that the U.S. economy shrank for two straight quarters, adjusting for inflation, population growth, and seasonality.

Some pundits say that two straight quarterly declines means that the economy is in recession. Others say that isn’t necessarily the case, especially when labor markets are strong. So, we should wait for the National Bureau of Economic Research (NBER) to weigh in on the matter before using the “R” word.

Traditionally, NBER calls recessions and other phases of business cycles, but only retrospectively, and mostly just for scholars. Nobody actually involved in trading securities or making policy waits for its decisions and voters certainly won’t.

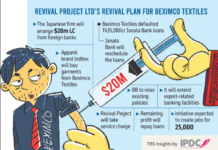

The legal definition of recession from the USC (the US Code) is two straight quarters of a shrinking economy. A search of the code via the Office of Law Revision Counsel’s website returns just 17 hits on the word “recession,” pictured below:

Some refer to non-economic events, like the “recession” of Devil’s Lake in North Dakota in 16 USC 674a. Some mention economic recession without defining it. 12 USC 2701, for example, states that “the Nation is in severe recession and that the sharp downturn in economic activity has driven large numbers of workers into unemployment and has reduced the incomes of many others.” (Remember the italicized part later on!) Others, as in 19 USC 2252 and 20 USC 1001, define recession loosely as an “economic downturn.”

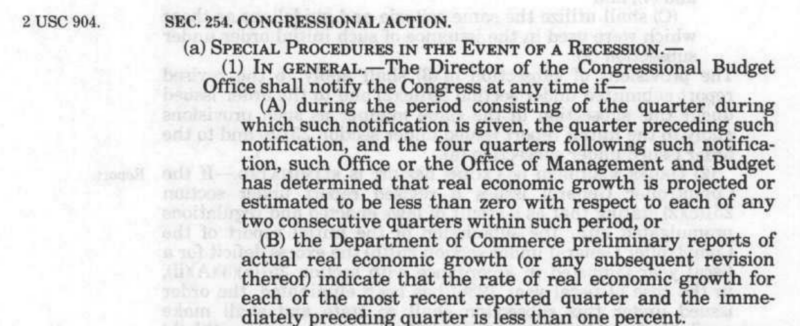

But then there is this gem, the “Balanced Budget and Emergency Deficit Control Act” passed in December 1985:

That section of the USC has since been modified, but no more specific definition has supplanted the definition of a recession as negative real GDP in two consecutive quarters, which is also the legal and/or technical definition in the United Kingdom, Canada, and basically the entire civilized world. Note there is nothing about employment or the NBER in the 1985 law.

Of course many federal statutes are being ignored right now, so ignoring politically inconvenient legal definitions might be expected. Call the situation what you will, the fact remains that the economy has been shrinking for half a year after rebounding robustly from the artificial Covid lockdown recession of 2020. In the 1970s, pop economists like Wilma Soss called such wide swings in economic performance due to policy switching and uncertainty the “whipsaw” effect (a term traders also used to refer to rapid reversals in securities prices).

While employment (the quantity of workers) is high (unemployment is low, with U3 at 3.6%), the real wage (the price of labor adjusted for inflation) is down. Traditionally, companies lay workers off during downturns. This time, workers are keeping their jobs by accepting lower real wages. Both governments and gurus consider declining wages as much a telltale sign of recession as high unemployment.

This graph of inflation-adjusted wages and salaries from 1979 to the present tells the tale. Usually real wages increase during recessions (the gray bars, from the NBER) but they have been plummeting since the Great Lockdown Shock of 2020:

The Labor Force Participation rate, the percentage of the working age population working or actively searching for work, is more difficult to parse, but it may also indicate labor market stress. It has clawed back some of its lockdown losses, but remains below its pre-pandemic level.

The decline in labor unions and the rise of more flexible work arrangements may have helped labor markets to clear (achieve equilibrium) on price (real wages) instead of on quantity (employment). It is probably a good development by keeping people out of soup lines, but it obscures the real pain that Americans feel when they have to make tradeoffs between rent, food, and energy. They know the economy stinks right now and they know who implemented the policies that made it that way.

The traders, policymakers, and Twitterati worthy of their desks, positions, and Blue Checks are not playing with tried-and-true definitions for transitory partisan gain. Instead, they are trying to figure out what the GDP figures for the third and fourth quarters might be. That means looking at standard leading economic indicators, AIER’s leading indicators, and/or getting creative like Wilma Soss did when she discovered that burlap orders were an under-utilized indicator.