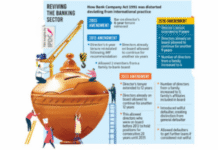

The Bangladesh Bank has raised ceilings of loans disbursed against credit cards and personal loans.

According to the revised regulations, banks can now disburse up to Tk 1 million, up from Tk 500,000, in loans against unsecured limit on credit card.

The central bank has also revised the regulations on personal loans. Banks can give up to Tk 500,000, up from the previous Tk 300,000 in loans without any securities.

Against liquid securities, the ceiling for personal loans, including those for purchasing consumer durables has been increased to Tk 2 million from Tk 1 million.

The last time Bangladesh Bank revised the ceilings of these loans were in 2004.

Central bank officials say the move comes amid increased demand for personal and credit card loans as well to help banks invest the excess liquidity.

Credit card loans carry higher interest rates than other bank loans.

Against the average single-digit lending rate, credit card loans cost between 12 percent and 30 percent interest.

Source: bdnews24