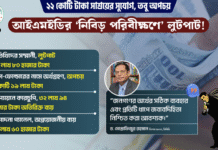

National Board of Revenue (NBR) Chairman Abu Hena Md Rahmatul Muneem has said that no organisation can raise questions over legalisation of untaxed money, popularly known as black money, and its subsequent investment availing amnesty in the budget for 2020-21 fiscal.

He also said that the legalisation of black money has led to an increase in the money flow in the capital market in recent weeks.

“If any organisation raises questions regarding this matter that will be unjust and that should not be. We have talked to the organisations that could raise questions about legalising untaxed money, and asked them not to do so,” he said.

The NBR chairman said this while inaugurating the installation of Electronic Fiscal Device (EFD) in 100 business entities from the NBR conference room virtually today. Eighty EFD will be installed in Dhaka, (40 machines each for Dhaka North and South) and 20 machines for Chattogram.

The NBR chairman said that although his organisation has yet to get significant response from the black money holders to whiten their money, the capital market is getting good results from this amnesty.

“There is no remarkable response for this amnesty in the tax return so far; [after the deadline of income tax return submission] we will be able to see how much untaxed money is invested in the capital market,” he said.

Regarding any questions about the invested legalised untaxed money, he said that the aggrieved person can take the help of the law.

“The government through enacting law asked to invest the undisclosed money. No one can question this, but I think that no one has to take the help of the law,” he said.

Regarding the introduction of ‘Electronic Fiscal Device’ or EFD, the NBR chairman said that to stop the anomalies in VAT collection, the NBR has introduced this device.

“By this, the hassle of the businessmen will be reduced, expenditure in revenue collection and doing business will be lessened, there will be no scope for tax evasion,” he said.

He mentioned that by the next three months 1,000 more EFDs will be installed while 100,000 EFDs will be there by the next June.