The proposed budget of FY2020-21 has given huge facilities to the owners of black money, that is, owners of wealth from undisclosed sources. These provisions were further consolidated with the passage of the finance bill on Monday.

In his budget speech, the finance minister had said if owners of black money invested in the share market, their investments would be locked in for three years. That has now been cut down to one year.

The finance minister has simply catered to the owners of undisclosed wealth. Business leaders had brought forward several demands, but the minister has paid no heed to their proposals. Thus the Finance Bill 2020 has been passed with no significant changes other than easing the share market investment conditions for black money.

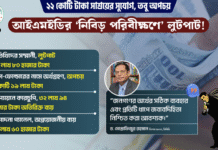

The finance minister had proposed facilities for black money to be whitened with just a 10 per cent tax, with no fine whatsoever. If this money was invested in the specified areas, the NBR or the government would not inquire about the source of wealth.

Along with the Tk 5,680 billion (Tk 5,68,000 crore) national budget, finance minister AHM Mustafa Kamal on 11 June also presented the Finance Bill 2020 in parliament. He delivered his concluding address on this in the House on Monday. The bill was passed by voice vote. The national budget is to be passed on Tuesday and it will come into effect on 1 July.

The finance minister said that over the past 11 years the size of the GDP had tripled, but, he admitted the tax-GDP ratio was low, below 10 per cent. In none of the other countries like Bangladesh was this ratio less than 18 per cent. He said even if this could be raised to 14 per cent, this would bring in Tk 1,200 billion (Tk 1,20,000 crore) annually. This required an automation of the tax system. He said that the automation had started last year but could not be completed due to coronavirus. He said it would be completed this year as soon as possible.

Further facilities for black money

The condition which had been given for a three-year lock-in of black money invested in the stock market was now cut down to just one year. The Dhaka Stock Exchange, the Chittagong Stock Exchange and even the Bangladesh Securities and Exchange Commission (BSEC) had proposed that the lock-in condition be withdrawn completely.

In the budget proposal, the finance minister had proposed facilities for black money to be whitened with just a 10 per cent tax, with no fine whatsoever. If this money was invested in the specified areas, the National Board of Revenue or the government would not inquire about the source of wealth.

In filing an appeal with the Appellate Tribunal and Appeal Commissionerate, instead of 10 per cent, a 20 per cent payment on the claimed VAT would have to be paid, according to the budget proposal.

The businessperson would first have to file the VAT case with the Appeal Commissionerate and if the appeal was rejected, another 20 per cent would have to be deposited if the plea was to be taken to the Appellate Tribunal.

In the amendments passed in Monday, only the second 20 per cent payment was repealed, which would hardly benefit the businesspersons. The expenses to file such cases would remain same as before. The 20 per cent would have still to be deposited in the first phase.

Other changes

There was a proposal for a 5 per cent tax of zero coupon bonds, but that was dropped. And the 10 per cent duty which had been imposed on the import of sodium raw materials, was increased to 15 per cent. The 15 per cent tax on the import of raw materials for a certain pharmaceutical drug was cut down to 5 per cent.