The central bank has cut key policy rates in an attempt to stimulate investment and the economy.

Bangladesh Bank on Thursday announced the reduction in interest rates on repurchase agreement (repo) and reverse repo in its monetary policy for the January-June period.

The repo and reverse repo rates have been lowered by 50 basis points to 6.75 and 4.75 respectively.

In the policy, the central bank also lowered the growth projection in lending to the private sector for the second half of the financial year.

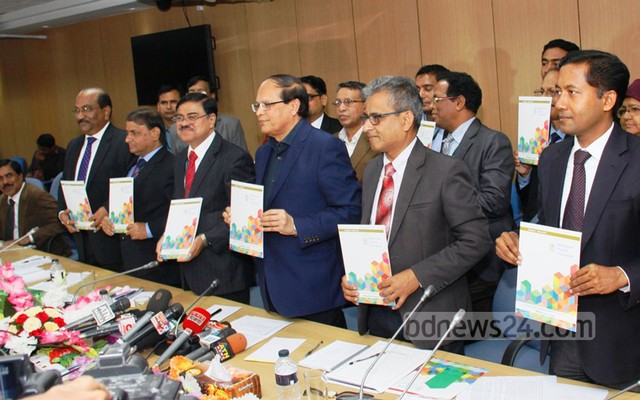

Announcing the policy, Bangladesh Bank Governor Atiur Rahman said, “We have lowered the policy rates… to realign policy rates with the market rates.”

The central bank had been maintaining repo and reverse repo rates at 7.25 percent and 5.25 percent respectively since 2013.

Rahman said, “Interbank call money rate is now 3-4 percent. Inflation and other interest rates are also low. In such a situation, high repo rates might be counterproductive. That’s why the policy rates have been cut.”

The central bank’s Chief Economist Biru Paksha Paul said the decision had been made to stimulate the economy through an increased credit flow to the private sector.

“Repo and reverse repo rates had been the same for last three years. The rate has been cut to lower the cost of fund,” he said.

The new monetary policy has set growth rate in the private sector credit flow at 14.8 percent, 0.2 percent lower than that for the previous six months.

Credit flow to the private sector saw a growth of 13.7 percent in July-November period.

Governor Rahman said broad money and private sector credit growth had been projected at 15 and 14.8 percent respectively, slightly lower than the last policy target but higher than the actual outcome.

He said the policy recalibration — lower policy rate and prudent credit and broad money targets — could sufficiently accommodate growth without compromising the inflation performance.

“As always, we remain vigilant and ready to adjust our position as facts on the ground and the outlook on the horizon evolve,” he added.

Investment has been experiencing a sluggish trend for last few years despite several positive indicators of the economy.

Bankers say credit flow to the private sector is slow, leaving the banking sector on the pile of idle funds.

On the other hand, entrepreneurs say it was difficult for them to expand businesses with double-digit interest rates.

A commercial bank can lend up to 81 percent of the deposit it collects.

According to the central bank, deposit-lending ratio was 68.75 percent until Aug 27 last year.

Bangladesh Bank Deputy Governor SK Sur Chowdhury expects a high growth in investment in the next six months.

“There is a liquidity of Tk 200 billion in the banking sector. Of the funds, 94 percent is invested in interest-bearing securities. Only Tk 37 billion is idle liquidity,” he said.

But he said banks could have not invested such huge funds in securities had they found any scope of ‘good investment’.

A private banker has termed the monetary policy ‘positive’ and suggested more initiatives for creating an environment congenial for investment.

“A cut in policy rates will certainly have positive impact on the entire banking sector. It will lower the cost of fund. But a congenial environment for investment is more important,” he said.

The central bank said Bangladesh might attain a higher GDP growth rate in the current financial year than last FY’s though it projected a lower growth rate in lending to the private sector.

It said the growth rate might be 6.8-6.9 percent and even reach 7 percent if the country enjoyed political stability.

“Our growth will then be even more robust, fuelled by two engines – export and domestic demand,” said the governor.

Bangladesh Bank said inflation might be limited to 6.1 percent in the financial year.

Source: Bd news24