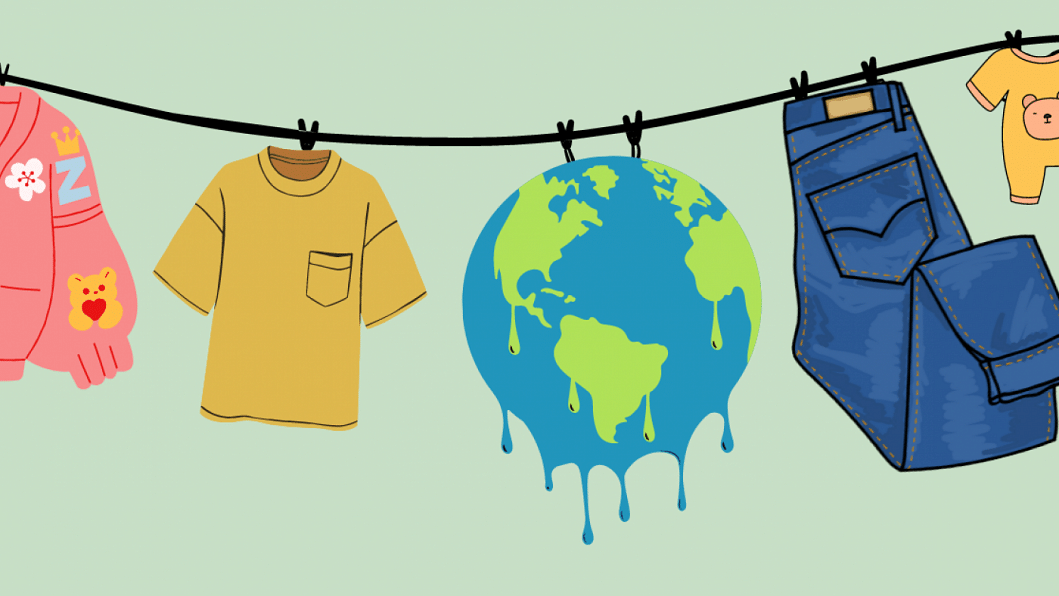

At the end of 2022, the European Union and European Parliament agreed to what will become the world’s first Carbon Border Adjustment Mechanism (CBAM). In simple terms, CBAM is a tariff on the import of carbon-intensive products. Initially, these products will include those that require a highly carbon-intensive manufacturing process – cement or fertiliser, for instance. But this list could soon be extended. This seems to be the direction to which we are all headed, with regulators around the world becoming more and more focused on limiting carbon emissions and carbon neutrality.

The objective of this new levy is to deter carbon-intensive processes and encourage manufacturers to “green” as much of their manufacturing processes as possible. It aims to prevent what is known as “carbon leakage.” This happens when the EU’s efforts to reduce carbon emissions are hampered by increased emissions from outside the EU bloc via relocation of production to the countries with less ambitious climate policies by EU standards. Also, these efforts could be offset through increased imports of carbon-intensive products.

Why is this important for Bangladesh? Because the EU is the largest export market for the RMG products manufactured in Bangladesh. Our RMG sector is not included in the industry sectors covered by CBAM yet. But it may be only a matter of time. The European Parliament has already signalled a clear intention to include plastics and chemicals by 2026 as well as all sectors covered by the EU Emissions Trading System (ETS) by 2030. In addition, indirect emissions such as those caused by the production of energy used in the manufacturing process will also be included in calculating the carbon content of an imported product “under certain circumstances,” according to an EU statement.

While there is some uncertainty as to how and if RMG export will be covered by the EU laws around carbon markets, I think our industry should start planning now for such a possibility.

First and foremost, if the EU were to apply a tariff on RMG import due to the emissions associated with their production, this tariff would need to be built into the price of such products. In other words, the tariff should be passed onto the consumers in the importing country.

Also, how will CBAM’s imposition on RMG and textiles work for those ethical suppliers who have already determined to become carbon-neutral? Will they take a “wait and see” approach, rather than make investment now to become carbon neutral? Why make an expensive investment now if the EU bands everyone together for this purpose in the future? Bangladesh has already learnt that making huge investments with regards to green factories has little to no direct payback. The CBAM could further dampen the motivation to make more investment – unless how it will be implemented on RMG import is announced soon.

But these are perhaps secondary issues; we need to think about the bigger picture here. This is the ongoing sustainability drive of some of our largest trading partners, and the implications of this for Bangladesh is big. If ever we needed a wakeup call about the need to reduce carbon emissions associated with our main export market, the CBAM is surely that.

At present, our RMG production is still far more carbon-intensive than that in the EU. In fact, we are more carbon-intensive as an industry than Turkey, the US and even neighbouring Pakistan. To give an example, if one were to shift textile production from Bangladesh to the EU, the carbon emission associated with this activity would be reduced by around 45 percent. That’s because the EU has made far more progress than Bangladesh in the use of renewable energy.

Consider this from the perspective of a fashion brand looking for a production source, which has carbon emission targets to meet. More and more, fashion retailers are documenting the amount of emissions associated with their products, for regulatory and environmental reasons. What if a brand decided to shift all of its production to the EU and out of Asia because it felt that this would be the only way it could meet its supply chain emission targets?

If you think that sounds far-fetched, think again. Targets for carbon emissions are closing in fast on some of Bangladesh’s largest trading partners. Some have set targets for 2030. Things are moving more quickly than anybody could have imagined on this issue.

The answer for Bangladesh is quite simple. We must, with utmost urgency, shift our energy mix into predominantly renewable energy. We don’t have time to waste on this issue, and it means our policymakers, legislators, planners and industry leaders must start working together to devise a smooth transition into a clean energy future. We need a plan and we need to implement it quickly.

As I said earlier, the EU could one day be placing a tariff on RMG products manufactured in Bangladesh because of the emissions involved in their production. That would be a problem, but we may be able to solve it by raising prices.

However, if our customers begin sourcing elsewhere because our energy mix is not environmentally friendly, that is a different challenge altogether – and one that we need to take a proactive stance on.

Mostafiz Uddin is the managing director of Denim Expert Limited. He is also the founder and CEO of Bangladesh Denim Expo and Bangladesh Apparel Exchange (BAE).