Bangladesh is the world’s bright spot for off-grid solar firms as more than 30% people still have no access to the grid electricity, according to a new report of the World Bank.

Globally, the off-grid solar market will reach 99m households by 2020, a fourfold increase from 25m today, according to the Off-Grid Solar Market Trends Report 2016 released recently.

This is the third in a series produced by the World Bank Group’s Lighting Global Program since the young industry’s emergence seven years ago. The report was produced in collaboration with Bloomberg New Energy Finance and Global Off-Grid Lighting Association.

The report that provides a comprehensive view of the state of one of the most impactful sectors in the global economy today, said sales will grow at 34% annually to around $3.1bn in the same time.

The market is likely to grow fastest in Africa, where uptake has been more rapid so far and the off-grid population is expected to continue to grow.

In the baseline scenario, 44m African households will be using an off-grid solar system by 2020, compared with 39m in Asia.

A further 15m globally will be using PAYG system in that year, according to the baseline forecast, which assumes no new policy interventions or market support campaigns.

Most of the growth in this baseline scenario is likely to come from today’s large markets such as India, Bangladesh, Kenya, Tanzania and Ethiopia where consumers are starting to become familiar with the technology and an infection point of market penetration will be easier to reach.

Market trends in Asia

India dominates the Asian market, with sales of more than 1m units reported in both H2 2014 and H1 2015. that amounts to an estimated $54m revenue over the period, versus $5.2m for reported sales in other Asian countries. Sales of branded products in other Asian countries have been relatively muted, though this may change with new Lighting Asia programmes launched in Pakistan and Bangladesh.

Of the electronic appliance sales, it said fans are likely to show the fastest growth among DC appliances after TVs, with over 7m units projects to be in use by 2020, while most of the hottest countries on earth such as Sudan, Chad and Mali also low grid penetration, these are unlikely to be the fastest growing off-grid solar markets as they are still at a relatively early stage.

Some of the existing largest markets, such as Ethiopia and Kenya, are relatively cool, cutting demand for fans. Most users of solar-powered fans will therefore probably be in India, Pakistan, Bangladesh, Nigeria and Tanzania.

On Government’s initiatives on coverage of off-grid solar in the country, many governments building financial support to the off-grid solar industry (as has already been done in Ethiopia, Bangladesh and elsewhere) into their donor-financed energy access programmes can have a significant impact on rapid growth of the global off-grid solar sector.

About social, economic and environmental benefits of solar-based energy access.

An off-grid household can save $20-40 a year by purchasing even a mid-range portable light in Africa and Asian countries like Bangladesh.

A study of 852 Bangladeshi households found no impact on respiratory health but significant improvements in eye irritation because of improved air quality due to use of off-grid solar power.

A lively read for companies, investors, governments, and other key players interested in the opportunities and challenges presented by the dynamic off-grid solar market.

The report tracks the groundbreaking technological advances and innovative business models which have emerged to transform the lives of millions through affordable modern solar energy services.

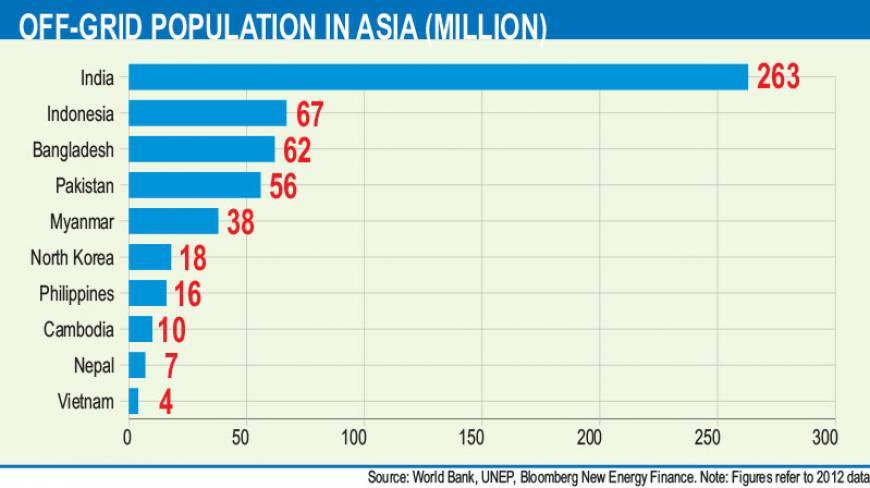

About 95% of the world’s 1.2bn people without grid access live in Sub-Saharan Africa and South and East Asia. South Asian nations such as India and Bangladesh deliver electricity to a larger share of their people, even though in absolute terms they have almost as many people without grid access as Africa due to their larger population.

The 1.2bn people living without access to the power grid spend about $27bn annually on lighting and mobile-phone charging with kerosene, candles, battery torches or other fossil-fuel powered stopgap technologies.

Key findings include:

The off-grid solar sector has seen impressive growth in the past five years.

From a near-standing start less than ten years ago, more than 100 companies are now actively focusing on stand-alone solar lanterns and solar home system kits targeted at those without modern energy access.

In Kenya, more than 30% of people living off the grid have a solar product at home, according to estimates. The pioneers have helped to create a vibrant market.

Pay-as-you-go (PAYG) makes solar kits affordable and helps capture consumer value PAYG firms sell solar kits against small installments instead of a lump-sum payment with a technology that locks the functionality in the event of non-payment by the consumer.

These PAYG companies have attracted four times as much investment in half the time, compared with those selling products for cash.

Financiers are betting that barriers to entry for new PAYG suppliers will remain higher than in the cash sale segment and that customer relationships will run deeper.

The sector has attracted more than $511m of investment to date (including to specialised intermediaries), with a sharp increase in recent years and most attention going to PAYG companies.

Source: Dhaka Tribune