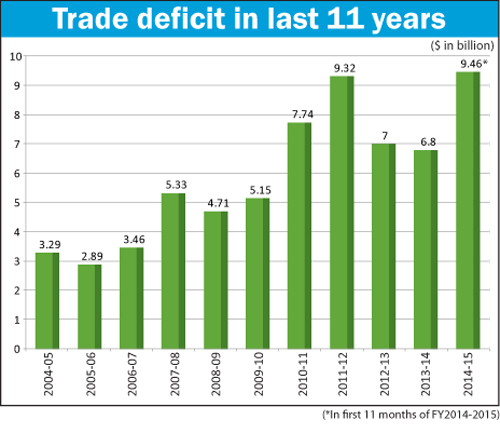

The country’s trade deficit – gap between export earnings and import payments – is set to cross $10 billion mark for the first time in the just concluded financial year 2014-15 after hitting an all-time high of $9.46 billion in the first 11 months of the year.

The dismal performance of the country’s trade balance is the result of the lower export earning growth against the higher import payment, said economists and experts.

Bangladesh Bank data showed that the trade gap in the first 10 months (July-April) of the FY15 was $8.49 billion which soared to $9.46 billion July-May.

‘With the current trend, the trade deficit is set to cross $10 billion mark for the first time in the remaining one month in FY15,’ a BB official told New Age.

The trade deficit in July-May of FY15 is 53.16 per cent higher than that of $6.17 billion in the corresponding period of the FY14.

BB data showed that the country registered a record gap of $9.32 billion in the FY12 after which the deficit decreased to $7 billion in FY13 and $6.80 billion in FY14.

Former finance adviser to the interim government Mirza Azizul Islam on Tuesday told New Age that falling export growth of readymade garments, the main export product of the country, dented the overall earnings in July-May of the FY15 while import payment registered an increased trend during the period.

He said that the country’s export sector lacked diversification in both products and foreign markets.

He feared that the export earnings might continue the sluggish trend in months to come as the current fiscal year’s budget had not taken an initiative to diversify the products and markets.

The export earnings registered a 2.83-per cent growth in the first 11 months of FY15 against 12.84-per cent growth in the same period of FY14.

The export earnings stood at $27.76 billion in July-May against $27 billion during the same period of the FY14.

The shipment of RMG products rose by 3.37 per cent in July-May compared with that of 14.83 per cent during the same period of the FY14.

The import payments registered a 12.20-per cent growth in the first 11 months of FY15 compared with that of 9.77 per cent growth in the corresponding period of FY14.

The import payments stood at $37.22 billion in July-May against $33.17 billion in the same period of FY14.

Mirza Aziz said that the higher import growth was apparently good for the industrial sector, but the trend also raised suspicion of money laundering due to a lower private sector credit growth in recent months.

He said, ‘The import growth was much higher in the first 11 months of FY15 considering its little impact on the country’s industrial sector as the businesspeople had not taken significant initiative to expand their business during the period due to political crisis.’

He feared that some of the importers might be involved in money laundering through over-invoicing.

Because of slower export growth the current account balance registered a deficit amount of $2 billion in the first 11 months of FY15 against a surplus amount of $1.36 billion during the same period of FY14.

Centre for Policy Dialogue executive director Mustafizur Rahman told New Age on Tuesday that the large deficit in current account balance was a concern for the country’s macro-economic situation.

He said that the government should take initiative to increase export earnings and pick up the inward remittance to boost up the current account balance.

He said that the government had set a target to achieve an export earning growth of 10 per cent in the FY15, but export earnings grew by only 3.35 percent putting adverse impact on the trade balance along with the current account balance.

BB data showed that the net foreign direct investment increased by 20.41 per cent to $1.58 billion in the first 11 months of FY15 from that of $1.31 billion in the same period of FY14.

The dismal performance of the country’s trade balance is the result of the lower export earning growth against the higher import payment, said economists and experts.

Bangladesh Bank data showed that the trade gap in the first 10 months (July-April) of the FY15 was $8.49 billion which soared to $9.46 billion July-May.

‘With the current trend, the trade deficit is set to cross $10 billion mark for the first time in the remaining one month in FY15,’ a BB official told New Age.

The trade deficit in July-May of FY15 is 53.16 per cent higher than that of $6.17 billion in the corresponding period of the FY14.

BB data showed that the country registered a record gap of $9.32 billion in the FY12 after which the deficit decreased to $7 billion in FY13 and $6.80 billion in FY14.

Former finance adviser to the interim government Mirza Azizul Islam on Tuesday told New Age that falling export growth of readymade garments, the main export product of the country, dented the overall earnings in July-May of the FY15 while import payment registered an increased trend during the period.

He said that the country’s export sector lacked diversification in both products and foreign markets.

He feared that the export earnings might continue the sluggish trend in months to come as the current fiscal year’s budget had not taken an initiative to diversify the products and markets.

The export earnings registered a 2.83-per cent growth in the first 11 months of FY15 against 12.84-per cent growth in the same period of FY14.

The export earnings stood at $27.76 billion in July-May against $27 billion during the same period of the FY14.

The shipment of RMG products rose by 3.37 per cent in July-May compared with that of 14.83 per cent during the same period of the FY14.

The import payments registered a 12.20-per cent growth in the first 11 months of FY15 compared with that of 9.77 per cent growth in the corresponding period of FY14.

The import payments stood at $37.22 billion in July-May against $33.17 billion in the same period of FY14.

Mirza Aziz said that the higher import growth was apparently good for the industrial sector, but the trend also raised suspicion of money laundering due to a lower private sector credit growth in recent months.

He said, ‘The import growth was much higher in the first 11 months of FY15 considering its little impact on the country’s industrial sector as the businesspeople had not taken significant initiative to expand their business during the period due to political crisis.’

He feared that some of the importers might be involved in money laundering through over-invoicing.

Because of slower export growth the current account balance registered a deficit amount of $2 billion in the first 11 months of FY15 against a surplus amount of $1.36 billion during the same period of FY14.

Centre for Policy Dialogue executive director Mustafizur Rahman told New Age on Tuesday that the large deficit in current account balance was a concern for the country’s macro-economic situation.

He said that the government should take initiative to increase export earnings and pick up the inward remittance to boost up the current account balance.

He said that the government had set a target to achieve an export earning growth of 10 per cent in the FY15, but export earnings grew by only 3.35 percent putting adverse impact on the trade balance along with the current account balance.

BB data showed that the net foreign direct investment increased by 20.41 per cent to $1.58 billion in the first 11 months of FY15 from that of $1.31 billion in the same period of FY14.

Source: New Age