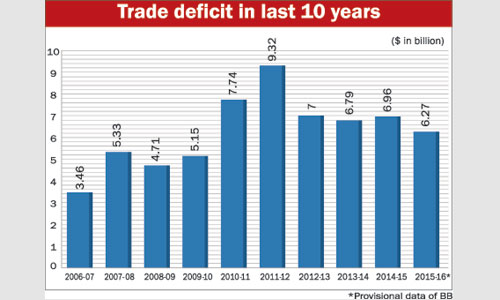

The country’s trade deficit decreased to $6.27 billion in the recently concluded fiscal year 2015-16 compared with that of $6.96 billion in the FY15 amid a fall in import payments against higher export earnings.

The export earnings registered an 8.94-per cent growth in the FY16 compared with a 3.08-per cent growth in the FY15, according to provisional data of Bangladesh Bank.

The export earnings stood at $33.44 billion in the FY16 while it was $30.69 billion in the FY15.

The imports registered a 5.45-per cent growth in the FY16 compared with 2.98-per cent growth in the FY15.

The import payments stood at $39.71 billion in the FY16 while they were $37.66 billion in the FY15.

The BB data earlier showed that the provisional trade deficit stood at $9.91 billion in the FY15, but the central bank later revised significantly the data as it (trade deficit) stood at $6.96 billion.

The central bank has mainly changed the import figure for the FY15 as the revised data decreased to $37.66 billion from the provisional data of $40.68 billion.

Former interim government finance adviser AB Mirza Azizul Islam told New Age on Thursday that the squeezed trade gap in the FY16 would not put much positive impact on the country’s macroeconomic situation as the import of industrial raw materials and capital machinery did not increase much to match the size of the country’s industrial sector.

‘It is highly important for a robust import growth for developing countries like Bangladesh. But, the country faced a lower import growth in the last fiscal year due to dull business situation’, he said.

The developing countries usually face a higher trade deficit than that of developed countries considering the investment opportunity, Mirza Aziz said.

A BB official said that the country’s businesspeople were not interested much in opening letters of credit to expand their business due to the ongoing dull business and a vulnerable law-and-order situation in the country.

The settlement of letters of credit for industrial raw materials posted a growth of 3.21 per cent in the FY16

compared with that of a 3.10-per cent growth in the FY15.

The settlement of LCs for the industrial raw materials stood at $15.66 billion in the FY16 against $15.18 billion in the FY15.

The BB data showed that the settlement of LCs for capital machinery posted a lower growth of 14.10 per cent in the FY16 compared with that of a 22.97-per cent growth in the FY15.

The import payments for the capital machinery stood at $3.53 billion in the FY16 against $3.09 billion in the FY15.

Export earnings in FY16, however, continued with good growth riding on readymade garments.

BB officials said that the affect of lower import growth of industrial machinery and raw materials could be felt in the current fiscal year of FY17.

Source: New Age