Bangladesh’s economy might fail to benefit from the government’s timely rollout of stimulus packages for cottage, small, medium and large industries as banks have lost the zeal to extend loans since interest subsidy was not paid out at the expected pace as initially thought.

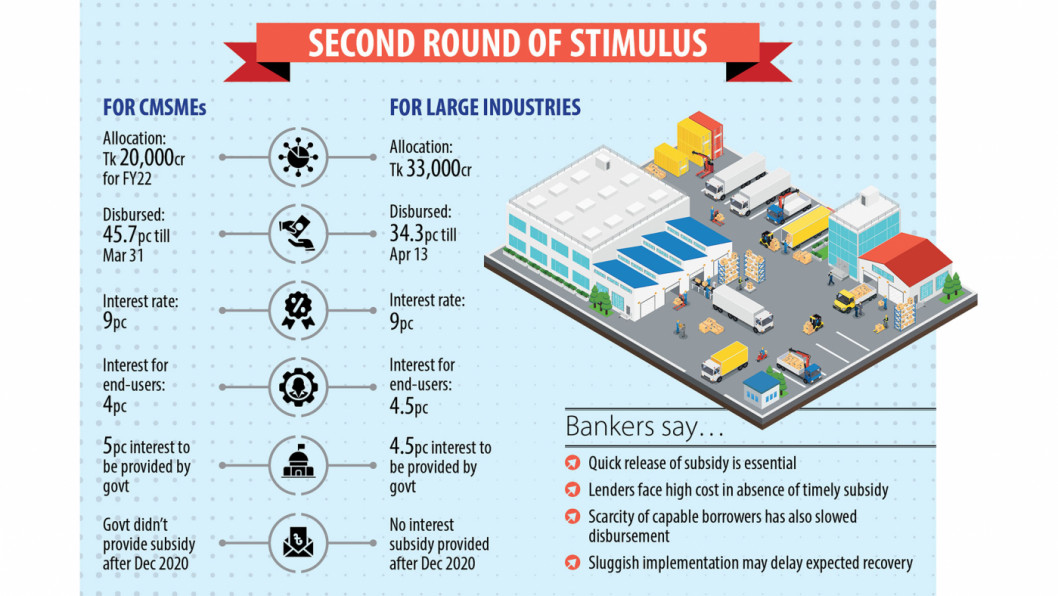

The unwelcome development came as banks and non-bank financial institutions disbursed only 34.3 per cent of Tk 33,000 crore funds allocated for large industries as of April 13 of the current fiscal year, according to data from the central bank.

Similarly, lenders loaned 45.7 per cent of Tk 20,000 crore set aside for the cottage, micro, small and medium enterprises (CMSMEs) between July and March.

Officials of commercial banks and the BB say that lenders had not received any interest subsidy from the government after December 2020, so they are not encouraged to disburse the loans.

Lenders were supposed to receive interest subsidies to the tune of Tk 286 crore between April 2020 and June 2021 on their CMSME loans, but they got only Tk 78.6 crore.

A central banker termed the process of providing the interest subsidy lengthy.

In April 2020, the BB unveiled the stimulus package worth Tk 20,000 crore for the CMSME sector to protect it from the impacts of the coronavirus pandemic. Of the sum, 77 per cent was disbursed.

Banks are allowed to charge a 9 per cent interest rate on their disbursed loans. The end-users get the loan at a 4 per cent interest rate. The government provides 5 per cent as an interest subsidy to lenders.

The tenure of the first round of the stimulus package expired in June last year, prompting the central bank to allocate another Tk 20,000 crore for the current fiscal year ending on June 30.

The BB official says that the central bank requested the finance ministry in February to release the subsidy for the period of January-June last year.

The ministry placed it to the Office of the Controller General of Accounts (OCGA), the debit authority of the fund, but it is yet to release the amount, he said.

The Daily Star tried to communicate with three senior officials of the OCGA, but they could not be reached for comments over mobile phones.

The BB recently sat with lenders to gear up the loan disbursement under the CMSME package. The lenders requested the central bank to take prompt measures for the release of the interest subsidy.

The scenario is the same when it comes to the stimulus package for large industries as lenders did not receive any subsidy after December 2020.

The central bank has not furnished the finance ministry with the subsidy data for 2021 and this year.

As per the government decision, lenders are permitted to enjoy an interest rate of 9 per cent on the loans under the stimulus package.

The end-users are getting the fund at a 4.5 per cent interest rate. The rest of the interest will come from the government.

The first round of the stimulus package for the large industries, involving Tk 40,000 crore, was unveiled in April 2020 and lenders collectively disbursed 82 per cent of the fund by the end of the last fiscal year. The size of the fund is Tk 33,000 crore this fiscal year.

Contacted, Mohammad Salauddin Tapadar, a joint director of the central bank who played a major role in formulating the packages, said the stimulus packages had given a boost to the economy at the height of the pandemic.

He, however, declined to comment on the sluggish release of the interest subsidies.

Md Serajul Islam, spokesperson and executive director of the BB, said that the central bank had to send recommendations to the finance ministry on the release of the subsidy after conducting inspections on the loans.

“We will disburse the fund just after getting approval from the Office of the Controller General of Accounts.”

Another BB official says that the economy will not rebound at the expected pace if the implementation of the packages remains sluggish.

Emranual Huq, managing director of Dhaka Bank, requested the authorities to release the subsidy as quickly as possible in a bid to speed up the implementation of the stimulus packages.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said that lenders had selected capable borrowers to disburse the loans during the first round of the packages.

“It is a bit difficult to find out efficient borrowers as many borrowers who had taken up loans have failed to pay back on time.”