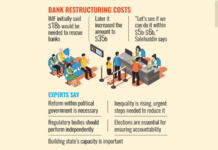

Eight state-run banks accounted for more than half of the Tk 88,589 crore default loans in the banking sector at the end of the first quarter of 2018 as their unbridled indiscipline continues to weigh down the entire industry.

At the end of March, the default loans of Agrani, Rupali, Sonali, Janata, BASIC, Bangladesh Krishi, Rajshahi Krishi Unnayan and Bangladesh Development Bank stood at Tk 49,112 crore, up 14.88 percent from the previous quarter, according to data from the Bangladesh Bank.

The classified loans of Agrani, Rupali, Sonali and BASIC were so overwhelming that they even failed to keep the required provisioning.

A large amount of the loans were sanctioned by the state-run banks even when they knew that they would become classified, said Khondkar Ibrahim Khaled, a former Bangladesh Bank deputy governor.

The bank personnel indulged in major irregularities while sanctioning the loans. “It is akin to embezzlement in broad daylight,” he said.

Once the loans became defaults, the banks had concealed the issue by rescheduling and restructuring them.

“But, it is not possible to cover up the irregularities forever,” Khaled said.

The reason for the culture of loan indiscipline at the state banks is that many incompetent people were appointed in consequential positions upon political consideration by the Awami League-led government upon assuming power in 2009.

Take the case of BASIC Bank, which was once a solid public bank. Things took an about-turn in September 2009, when Abdul Hye Bacchu, a person with strong political connections, was appointed the bank’s chairman.

Between 2009 and 2013, Tk 4,500 crore was swindled out of BASIC Bank — and Bacchu’s fingerprints were all over. Yet, he was not made accused in any of the 56 cases filed by the Anti-Corruption Commission over the loan scams.

“Politically-connected persons are largely responsible for depleting the state banks’ funds,” said Salehuddin Ahmed, a former BB governor.

The central bank should frame a policy to recover the ‘looted money’, Khaled said.

“The banks should be given a strict timeframe to recover the amount from the scammers — they should not be allowed to reschedule or restructure the loans if they fail to recover the amount within the period.”

Strict punishment should be taken against the banks, he added.

Instead of taking measures to prevent such practices, the government keeps on allocating funds for the banks from the state coffer to make up for the capital shortfall, completely disregarding sound advice, said a BB official requesting anonymity to speak candidly on the matter.

“The government should just stop to recapitalise the state banks as it has not brought any improvement in their financial health,” Ahmed said, adding that the banks should be forbidden from sanctioning fresh loans to habitual defaulters.

Of the eight banks, Sonali had the highest amount of default loans at the end of March: Tk 14,305 crore.

It was followed by Janata and Agrani: Tk 9,702 crore and Tk 5,676 crore respectively. Rupali came in next with its default loans amounting to Tk 4,603 crore.

Mohammad Shams-Ul Islam, managing director of Agrani Bank, told The Daily Star that the bank would take up a recovery programme after Eid-ul-Fitr.

“We are now sitting with the defaulters one-on-one to recover the bad loans. We will give more importance to recovering the loans from defaulters with political connections ahead of the national election.”

The defaulters will have to repay the money if they want to contest in the election, Islam added.

Default loans in any bank usually increase in the first quarter of a year as banks show a relaxed attitude during the period, said Mohammad Ataur Rahman Prodhan, managing director of Rupali Bank.

“None of the loans sanctioned last year has become default. But, we will take a strong initiative to recover the aged non-performing loans to strengthen our financial health,” he added.

Source: The Daily Star