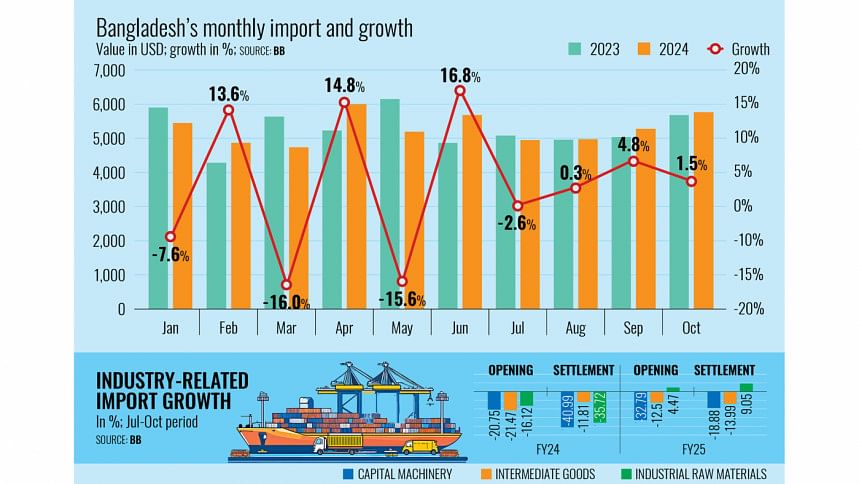

Despite capital machinery imports decreasing sharply, the resurgence in Bangladesh’s overall imports continued for a third straight month in October due to increased production in industries, especially export-oriented sectors, signalling that there may be some light at the end of the tunnel.

The country’s imports had dropped sharply for the past two fiscal years, declining 10.61 percent in FY24 and 15.76 percent in FY23.

However, there are some indicators that the trend may be reversing. Overall imports increased by 2.04 percent during the first four months of the current fiscal year. In the same period last fiscal year, it registered a 20.64 percent decline.

In October this year, imports increased by 3.11 percent whereas they fell by 10.40 percent in the same month last year.

Bangladesh began to see a surge in import costs after demand surged following the lifting of restrictions imposed during the Covid-19 pandemic. The breakout of the Russia-Ukraine war only led to these costs to inflate further.

To combat this, the Bangladesh Bank adopted various import-control measures, which caused a further slowdown. These restrictions began to be slowly lifted by the interim government, which assumed power following a political changeover in early August.

On a positive note, investors and economists said imports had rebounded this fiscal year despite dropping due to nationwide unrest in July and August, when mass protests halted normal business operations.

Bangladesh’s Purchasing Managers’ Index (PMI), which provides a gauge of economic dynamism, indicated an accelerated economic expansion driven by the agriculture, manufacturing, and services sectors in the past two months after three months of contraction.

The PMI rose 6.5 percentage points to 62.2 in November from a month ago, according to the Metropolitan Chamber of Commerce and Industry (MCCI) and Policy Exchange Bangladesh (PEB), which jointly prepare the index.

Despite the positive outlook, the economy continues to face challenges from political uncertainty and disruptions due to protests, it said.

“The sharp decrease in capital machinery imports indicates that new investment plans are literally on hold,” said M Masrur Reaz, chairman and chief executive officer of the Policy Exchange of Bangladesh.

“It is a matter of grave concern. Employment opportunities will not grow as there will be no fresh investments,” he said, adding that industrial units were slowly returning to normal production.

According to central bank data on letter of credit (LC) settlements, the import of industrial raw materials increased by 9.04 percent during the first four months of FY25 after reducing by 35.72 percent during the corresponding period last fiscal.

This data matched export figures, which increased by 8.33 percent in the first four months of the year.

The increasing import of industrial raw materials means that industries are trying to squeeze the most out of their current capacity, Reaz said.

Anwar-ul Alam Chowdhury Parvez, president of the Bangladesh Chamber of Industries, said businessmen could not import raw materials last fiscal due to restrictions on opening letters of credit due amid a US dollar crunch.

However, this situation has been mitigated to some extent, which is why raw material imports increased slightly.

Still, he said there was no reason for optimism, labelling the increase “insignificant”.

“The growth is insignificant as exports dropped by 9 percent last fiscal year,” he said.

Another way to measure export growth is by analysing whether work orders have increased, but that has not happened in this case, Parvez said.

Despite the growth of existing industries, fresh investment remains sluggish.

According to data, LC settlements for capital machinery imports declined 41 percent while LC openings for the same dropped 21 percent in the first four months of this fiscal year.

“The decrease in capital machinery imports clearly indicates that fresh investment will not arrive in the coming days,” Parvez said.

Basically, investors are not confident about making new investments given political uncertainty and a lack of safety and security measures in industrial belts.

Until an elected government comes to power, there is no possibility for fresh investments, he said.

“If an elected government comes in power within the next year, it will take another year for fresh investments to start coming as businessmen will take time to observe the government’s policies,” he said.

Mohammed Amirul Haque, managing director of Premier Cement Mills, said: “The interim government has no experience of creating an investment-friendly environment.”

He added that the interim government had still not taken any concrete decision about how it would cater to Ramadan essentials. “So how will they create an investment-friendly environment?” he questioned.

If the government is unable to foster a conducive environment, there is no possibility of ensuring new investment, he added.

According to him, the new generation is being discouraged from investing in Bangladesh due to bureaucratic red tape.

Haque said businesses are currently struggling for survival rather than planning fresh investments.

“Even those who established manufacturing units cannot go into operations due to a lack of utility connections,” he said.

There are several entities that have invested in setting up factories, but those units cannot start commercial operations due to not getting gas and electricity connections. So, they are facing losses, he added.

Daily Star