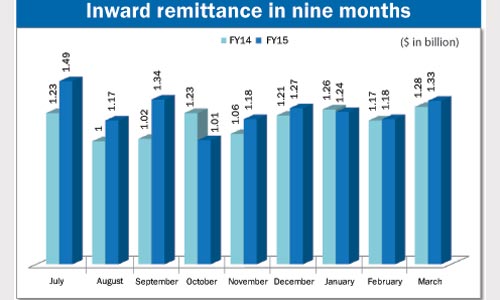

The country’s inward remittance increased by 7.21 per cent to US$ 11.25 billion in the first nine months of the current financial year 2014-15 from US$ 10.49 billion in the corresponding period of the FY14.

Bangladesh Bank officials told New Age on Thursday that the inward remittance had increased steadily in the first nine months of the FY15 as the banks had recently dealt a number of drawing arrangement with the foreign exchange houses due to the central bank initiatives.

According to BB data released on Thursday, the inward remittances increased to US$ 1.33 billion in March this year from US$ 1.28 billion in the same month of 2014.

BB executive director Md Ahsan Ullah told New Age on Thursday that the central bank had recently given a number of approvals to the banks to deal drawing arrangements with the foreign exchange houses to boost the inward remittances.

Under the drawing arrangement, the banks signed agreements with the foreign exchange houses to send the remittances to the country through the electronic network, he said.

The banks usually deal the arrangements in absence of their exchange houses in the foreign countries, he said.

The local banks have mainly made the recent agreements with the foreign exchange houses of the Arab countries which ultimately put a positive impact on the inward remittance in the first nine months, he said.

Besides, the rules and regulations of the international anti-money laundering have been strengthened to tackle the terrorist financing which discouraged the expatriate Bangladeshis to send the remittances through ‘hundi’ channel, he said.

Sometimes, the relatives of expatriates are deprived of receiving the remittances through to the ‘hundi’ system, he said.

He said, ‘The inward remittance in early this year faced a set-back due to the political unrest, but it got the desired momentum in March. The inflow of remittances will continue in the coming months if the political stability prevails’.

Ahsan said that the stable exchange rate of Taka against the US dollar was another cause of the increased trend in the inward remittances in the recent months.

The private commercial banks received US$ 864.06 million in inward remittance in March while the state-run commercial banks received US$ 435.29 million, foreign commercial banks US$ 15.88 million, and specialised banks got US$ 17.17 million, the BB data showed.

In March, Islami Bank Bangladesh received the highest amount of remittance — US$ 339.68 million — among the private commercial banks, while Agrani Bank got the highest amount of remittance — US$ 156.31 million — among the state-run banks.

Source: New Age