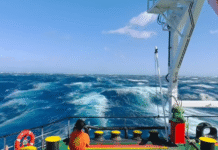

Workers are at work in an apparel factory at Chourasta in Gazipur. The photo was taken recently. —Sony Ramany

The potential of export to non-traditional markets has remained untapped for lack of preparation on the part of the government and the exporters and diversification of products.

Despite huge potential to gain more share in the markets, Bangladesh exports apparels to the destinations only 5 per cent of the demand.

Like the traditional markets – European Union, the United States and Canada – the export to non-traditional markets were also dominated by China with 49 per cent market share, according to the data of International Trade Centre.

Experts and exporters said that the huge potential of export to non-traditional markets still remained untapped for Bangladesh due to lack of proper initiative and preparation of both exporters and the government.

According to exporters, there was immense potential of apparel exports to Australia, Russia, Japan, China, India, Brazil, Chile, Colombia, Mexico, South Africa, South Korea and United Arab Emirates and the export to the destinations were increasing but at a slow pace.

The International Trade Centre data shows that the 12 countries import apparel of about $69 billion a year and China alone meets 48.92 per cent of the demand with the export of $33.37 billion.

According to the data, Bangladesh exports $3.73 billion, 5.42 per cent of the demand, to the 12 countries.

‘Initiatives have been taken from the government to increase export to the non-traditional markets and we have offered 3 per cent cash incentive against export proceeds but our exporters head to the western markets,’ commerce minister Tofail Ahmed told New Age on Sunday.

He said that the mind-set of the exporters was important to tap the potential new markets.

According to the data, in 2016, Japan imported apparel of $26.24 billion – $17 billion from China, $3.08 billion from Vietnam and $902.96 million from Bangladesh.

South Korea imported apparel of $8.17 billion in 2016, including $3.28 billion from China and $2.41 billion from Vietnam.

Bangladesh’s position was 6th in the market with only $199 million export, the data showed.

Bangladesh’s apparel export to Russia in 2016 grew 20.90 per cent to $585.70 million from $484.43 million in 2015.

The export to Russia was still poor compeered to the export value of China who supplied apparel of $2.13 billion against the total apparel import of $5.26 billion in 2016.

‘We see huge export potential to the non-traditional markets but the export growth to the destinations have remained stuck for last two years because of high duty in many countries and losing competitive edge to the competing countries,’ Bangladesh Garment Manufacturers and Exporters Association senior vice-president Faruque Hassan told New Age on Monday.

Apparel export to some of the new markets, including Brazil and South Africa, was not getting momentum due to high tariffs, he said, adding that in some other markets, Vietnam and India ware gaining more space as their governments were providing support.

Faruque said that product quality and verity of products were also an important factor in gaining more market share in the non-traditional markets and now Bangladeshi entrepreneurs were making investment to upgrade the quality of products.

He also said that considering the geographic location and climate zone, the demand in new markets in South America, Africa and Asia could be met utilising lean production season for the exports to the traditional markets.

According to the data, Apparel import of UAE in 2016 stood at $4.09 billion and China was the highest supplier to the market with $1.48 billion followed by India with $730.14 million and Bangladesh with $237 million.

Australia imported apparels of $5.91 billion in 2016, including $3.87 billion from China and $586.52 million from Bangladesh.

China imported apparel of $5.94 billion, including $839.43 million from Vietnam, $808.77 million from Italy, $561.25 million from Korea and $472.69 million from Bangladesh, in 2016.

Chile and South Africa were promising markets for apparel export but Bangladeshi exporters lagged behind due to tariff barriers, said Exporters Association of Bangladesh president Abdus Salam Murshedy.

He said that not only Chile and South Africa, there were many promising new markets for Bangladesh but Bangladesh’s exporters failed to match their taste and choice.

‘In some cases we fail to supply products as per their requirements as Bangladeshi exporters fully depend on imported raw materials. China is gaining significant portion of market share as it has own raw materials and can produce products as per the market demand,’ Salam said.

He also said that losing price competitiveness and long shipment time were other barriers to the exploration of the potential new markets.

Salam sought government support for easing marketing and resolving tariff related issues in the non-traditional destinations.

‘To explore the new markets we need proper preparation and diversification of products,’ he said.

The data showed that South Africa imported apparel of $1.61 billion in 2016 with highest $821.33 million from China.

Bangladesh’s position in South Africa was 7th with $65.07 export, the data showed.

Chile’s apparel import was $2.5 billion in 2016 and the highest $1.93 billion was imported from China while Bangladesh exported to the destination only $62 million.

Echoing the commerce minister’s comment, former Bangladesh Knitwear Manufacturers and Exporters Association president Fazlul Haque said that mindset of the exporters was EU and US-centric.

‘New markets could be the alternative markets for Bangladesh but we could not gain the proper confidence of buyers in the countries,’ he said.

To tap the unexplored potential of the non-traditional markets Bangladesh needs to increase product variation and develop new design, Fazlul said.

Source: New Age