The net investment in the national savings certificates and bonds in the first half of the current financial year 2016-17 increased by 76.41 per cent to Tk 23,473.56 crore from Tk 13,305.59 crore during the same period a fiscal year ago.

Economists and Bangladesh Bank officials say clients continue to invest heavily in the savings tools in the recent period due to a lower rate of interest on the banks’ fixed deposit scheme.

Lack of investment opportunities amid sluggish business is also forcing the clients to invest in the government tools, they say.

The huge net investment in the savings certificates and bonds has already created a risky situation for the country’s macroeconomic situation as the government will have to face a budget mismatch, the experts observe.

The monthly net investment in the national savings certificates and bonds also increased to Tk 3,154.02 crore in December 2016 from Tk 1,979.73 crore in the same month of 2015.

Savings instruments worth Tk 33,743.28 crore were sold through banks, national savings bureaus and post offices in the July-December period of the FY17 against Tk 23,024.29 crore in the same period of the FY16.

The net investment in the NSCs surpassed its annual target of Tk 19,610 crore in the first five months of the FY17 as it (net investment) stood at Tk 20,319 crore during the July-November period.

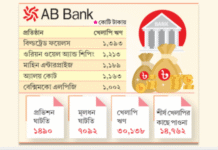

The net investment in the national savings tools hit a fresh record at Tk 33,688.60 crore in the FY16 against the government’s NSC borrowing target of Tk 15,000 crore as the rate of interest on the tools is almost double than the rate of interest on banks’ fixed deposit schemes.

On May 23, 2015, the government cut the rate of interest by around 2 per cent on its different savings tools to contain the upward investment trend, an official of Directorate of National Savings told New Age on Wednesday.

The government is facing pressure in paying interest to the clients who have invested in the NSCs in recent years as the interest rates for the savings tools are between 11.04 per cent and 12 per cent, he said.

Banks are now offering interest rates ranging from 5 per cent to 7 per cent to their clients for the fixed deposit schemes.

Banks are still continuing to cut the rates of interest on their deposit products as they have been facing excess liquidity in recent years due to a lower credit demand from the industrial sector amid dull business, the official said.

Former interim government finance adviser AB Mirza Azizul Islam told New Age on Wednesday that that huge investment in the national savings certificates and bonds had become a burden for the government.

The liabilities of the government have increased significantly due to the large amount of net investment, he said.

‘The government will face budget mismanagement due to the higher interest liabilities. For this reason, the government has to count a large amount of expenditure from its fiscal budget’, he said.

‘Since it is the most expensive borrowing tools for the government considering its rates of interest, the government should stop selling savings tools once its annual target is achieved,’ he observed.

Economists and Bangladesh Bank officials say clients continue to invest heavily in the savings tools in the recent period due to a lower rate of interest on the banks’ fixed deposit scheme.

Lack of investment opportunities amid sluggish business is also forcing the clients to invest in the government tools, they say.

The huge net investment in the savings certificates and bonds has already created a risky situation for the country’s macroeconomic situation as the government will have to face a budget mismatch, the experts observe.

The monthly net investment in the national savings certificates and bonds also increased to Tk 3,154.02 crore in December 2016 from Tk 1,979.73 crore in the same month of 2015.

Savings instruments worth Tk 33,743.28 crore were sold through banks, national savings bureaus and post offices in the July-December period of the FY17 against Tk 23,024.29 crore in the same period of the FY16.

The net investment in the NSCs surpassed its annual target of Tk 19,610 crore in the first five months of the FY17 as it (net investment) stood at Tk 20,319 crore during the July-November period.

The net investment in the national savings tools hit a fresh record at Tk 33,688.60 crore in the FY16 against the government’s NSC borrowing target of Tk 15,000 crore as the rate of interest on the tools is almost double than the rate of interest on banks’ fixed deposit schemes.

On May 23, 2015, the government cut the rate of interest by around 2 per cent on its different savings tools to contain the upward investment trend, an official of Directorate of National Savings told New Age on Wednesday.

The government is facing pressure in paying interest to the clients who have invested in the NSCs in recent years as the interest rates for the savings tools are between 11.04 per cent and 12 per cent, he said.

Banks are now offering interest rates ranging from 5 per cent to 7 per cent to their clients for the fixed deposit schemes.

Banks are still continuing to cut the rates of interest on their deposit products as they have been facing excess liquidity in recent years due to a lower credit demand from the industrial sector amid dull business, the official said.

Former interim government finance adviser AB Mirza Azizul Islam told New Age on Wednesday that that huge investment in the national savings certificates and bonds had become a burden for the government.

The liabilities of the government have increased significantly due to the large amount of net investment, he said.

‘The government will face budget mismanagement due to the higher interest liabilities. For this reason, the government has to count a large amount of expenditure from its fiscal budget’, he said.

‘Since it is the most expensive borrowing tools for the government considering its rates of interest, the government should stop selling savings tools once its annual target is achieved,’ he observed.

Source; new age