The banks are still charging high interest on credit, although most of them have reduced the deposit rates, ending the rat race for accumulating funds.

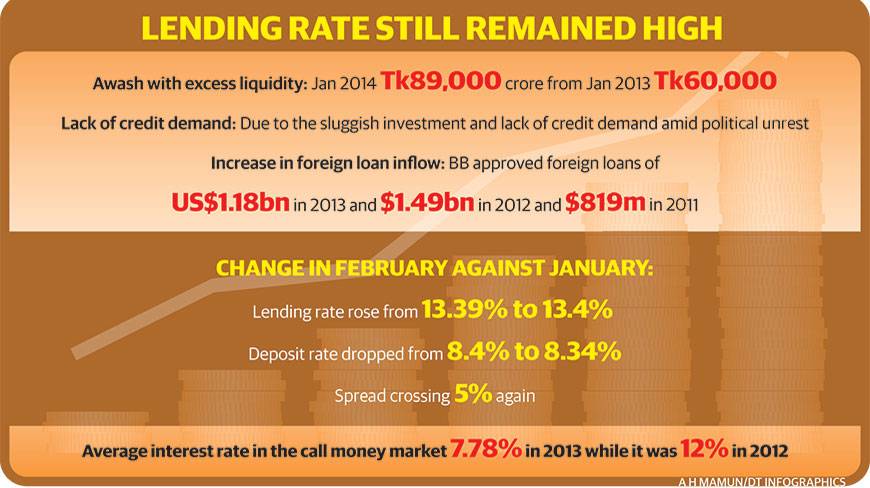

Lending rate of all the commercial banks still remained high despite awash with excess liquidity, lack of credit demand and increase in foreign loan inflow since last one year ahead of national election, bankers said.

They said the central bank had earlier undertaken a move to encourage foreign loan inflow in order to make pressure on local banks to cut their lending rates, but went in vain.

The average lending rate of all commercial banks increased slightly to 13.4% in February from 13.39% in January while average interest rate on deposits decreased to 8.34% from 8.40% during the same period of last year, according to the Bangladesh Bank data.

The interest rate spread between the lending and deposit rates crossed again the desired level of 5% in February only after a month it stayed below the level.

The gap between average lending and deposit rates of 19 local commercial banks went up to 5% in February from 4.99% in previous month due to increase in the lending rates, said a senior executive of the central bank.

Foreign loan inflow increased significantly in the last two years as big entrepreneurs were keen to take foreign loans below 5% interest rate against the local lending rate of up to 13.50%.

Bangladesh Bank approved a total of US$1.18b in 2013 and $1.49b in 2012 where only $819m foreign loans were entered into Bangladesh in 2011.

The excess liquidity in the banking sector has increased by Tk29,000 crore or 48% to stand at Tk89,000 crore in January 2014 from Tk60,000 crore in the same month last year.

It resulted in an average interest rate in the call money market of around 7.78% during the last year as compared to an average of above 12% in the previous year.

Excess liquidity piled up in the banking sector during the last one year due to the sluggish investment and lack of credit demand amid political unrest. As a result, all the commercial banks had lost their profits in 2013, said a senior executive of a private bank.

He said: “Banks were supposed to cut their lending rate in December, 2013, to reduce the spread. Though some banks have reduced their lending rates, most of the banks could not comply with the obligation due to their own increased maintenance expenses.”

All the banks could not take enough return from their deposit funds due to sluggish credit disbursement, but they had to pay interest rate against the deposit that they already committed. As a result, interest expense increased than income. Under the circumstance, the banks are not able to cut their lending rates, he said.

“But to compete with the international banks, ultimately all the commercial banks have to reduce lending rates as already big borrowers have started taking loans from the foreign loan market at lower rates.”

The foreign companies engaged in manufacturing or services output activities for three years or longer in Bangladesh can have access to term loan in Taka term from the domestic market subject to all applicable credit norms.

Source: UNBConnect