The International Monetary Fund warned Thursday that geopolitical risks in Ukraine and the Middle East are looming over a global economy already hit by slowdowns in the US and China.

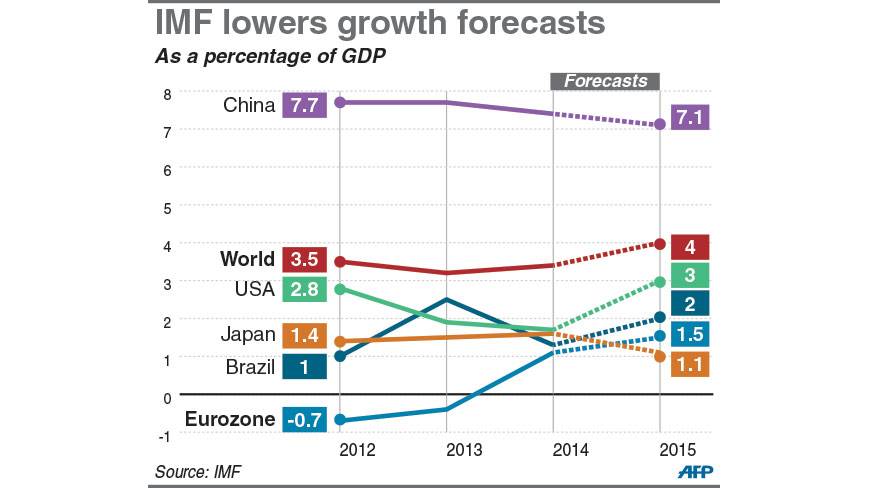

After “negative surprises” from the United States and China, the global economy is now expected to grow only 3.4% this year, the IMF said, lowering its April estimate of 3.7%.

In 2013, the world economy grew 3.2%.

The downgraded 2014 growth outlook reflects a “weak first quarter, particularly in the United States, and a less optimistic outlook for several emerging markets,” the IMF said in an update of its semiannual World Economic Outlook (WEO).

“Geopolitical risks have risen relative to April: risks of an oil price spike are higher due to recent developments in the Middle East while those related to Ukraine are still present.”

Heavyweight oil producer Iraq is under siege from an Islamist offensive, and fierce fighting between Israel and Palestinians in Gaza has raged for more than two weeks.

The Ukraine crisis was exacerbated by the downing last week of Malaysia Airlines flight MH17 over rebel-held territory in eastern Ukraine that killed all 298 people aboard.

Russia, the target of US and European Union economic sanctions for its role in the separatist fighting, was likely to see its economy brought to the brink of recession this year, the IMF said.

It slashed its Russian growth forecast by 1.1 percentage point, to 0.2%, saying “activity in Russia decelerated sharply as geopolitical tensions further weakened demand.”

Eye on Russia

“If things got worse and the conflict escalated then anything having to do, for example, with gas supplies to western Europe, could have much larger effects but for the moment these effects are not there,” said Olivier Blanchard, the IMF’s chief economist, at a news conference.

Separately, IMF spokesman William Murray warned the US and EU sanctions could have a severe impact on trade in the region, “particularly in eastern and central Europe and central Asia.”

Blanchard noted that the Gaza conflict “doesn’t seem to have large effects beyond the effects on Israel.”

As for the United States, the world’s largest economy, IMF on Wednesday lowered its 2014 growth forecast to 1.7%, from 2% in mid-June and 2.8% in April.

The US economy, accounting for nearly a quarter of the world’s output, shrunk by 2.9 percent in the first quarter, in part because of severe winter weather.

“It’s really a story of something which has just happened and that is behind us,” said Olivier Blanchard, the IMF’s chief economist, in discussing the WEO update.

The IMF projected US growth will pick up in the remainder of the year, but not enough to offset the first-quarter drag.

China, the world’s second-largest economy, will expand less than previously thought, the IMF said, lowering its forecast to 7.4% from 7.6%.

“In China, domestic demand moderated more than expected,” it said.

The growth estimate for the eurozone, still struggling to recover from recession, was unchanged at 1.1%, and the IMF reiterated concern about weak inflation in the 18-nation European bloc.

“In major advanced economies, there is a risk of stagnation in the medium term,” the IMF warned, recommending that major advanced economies maintain “accommodative” monetary policies.

Emerging-market economies would slow a bit more than previously estimated, to a 4.6 percent growth pace.

“Emerging market economies – particularly those with domestic weaknesses and external vulnerabilities – may face a sudden worsening of financial conditions and a reversal in capital flows in the event of a shift in financial market sentiment,” the IMF said.

Such a scenario occurred in 2013 when investors abruptly withdrew capital from emerging-market economies anticipating that the Federal Reserve would raise its key US interest rate, stuck near zero since late 2008. That did not happen, but the Fed is expected to hike the federal funds rate in mid-2015.

“I don’t think we’ll see major financial chaos in the future … but there are going to be bumps,” Blanchard said.

Despite the worse-than-expected global growth outlook for 2014, the IMF left its 2015 forecast unchanged at an annual rate of 4%, the fastest pace since 2011.

Source: dhakatribune