The International Monetary Fund has advised the Bangladesh government to trim down the amount of non-performing loans in the banking system, officials said.

IMF staff team, led by Rodrigo Cubero, visited Dhaka on November 4-17 and held discussions on the 2015 Article IV Consultation with Bangladesh under its Extended Credit Facility loan programme.

Cubero spoke at a press conference yesterday after a meeting with Finance Minister AMA Muhith. The IMF is going to successfully complete its ECF loan programme in Bangladesh last October, a first for the multilateral lender since 1990, as it approved the last two instalments totaling $258.3m.

The approval for the loans came at a board meeting of the IMF, chaired by its Deputy Managing Director Mitsuhiro Furusawa, on October 22 in Washington.

With this consent, the ECF loan programme ended on October 31, three months after the scheduled deadline of July due to Bangladesh’s failure to fulfill three of the conditions set by the lender.

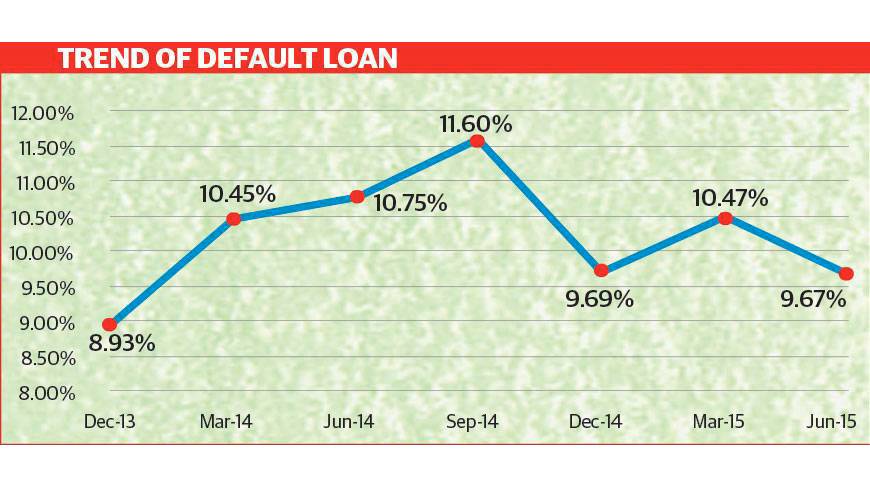

Rodrigo Cubero said the amount of default loans would decline if the authorities ensured transparency and accountability in the country’s banking system.

He said appointment of employees in the state-owned banks should be transparent and the board of directors should be more responsible in approving loans and monitoring the process.

“As government says is now working on the matter, we hope that the amount of default loans will come down to a tolerable level.”

He hopes that there could be a positive impact on the country’s economy if the government would implement the VAT law, as “we know that the government has taken a number of steps to implement the law.”

According to a IMF release, the real GDP growth has been robust, inflation eased, international reserves increased significantly, and the public debt-to-GDP ratio remained stable at a moderate level. In fiscal year 2015-16 inflation and real GDP growth rates are expected to be similar to fiscal year 2014-15, with growth supported by higher public sector wages, public investment and remittances.

It said: “The external current account is expected to remain in a moderate deficit. Over the medium term, provided that policies remain prudent, growth is projected to increase gradually to 7%, reflecting a further ramp-up in public investment and stronger private investment as regulatory and infrastructure constraints are eased and the financial sector strengthens.”

“This favorable record notwithstanding, the Bangladesh economy faces important challenges. The tax revenue-to-GDP ratio is one of the lowest in the world. Public spending on infrastructure and social safety nets is also low compared with countries at similar levels of development.”

Regarding the private sector investment, IMF team said the private investment has been constrained by infrastructure bottlenecks, particularly in energy and transport, and by a high regulatory burden.

It said the banking system is burdened by a high level of nonperforming loans and weak corporate governance (particularly in state-owned banks), which places an upward pressure on interest rates and hamper credit flows to the economy. And Bangladesh remains one of the world’s most vulnerable countries to natural disasters and climate change.”

As per the IMF “Maintaining high and inclusive GDP growth will require increased public spending on cost-effective projects in power and transport infrastructure and climate change adaptation, as well as on well-targeted social safety nets; steps to strengthen the business climate, including through streamlined tax and customs procedures and foreign exchange regulations; and continued progress in financial inclusion.

“To create the fiscal space for increased public spending in critical areas, it is necessary to improve tax revenues significantly. The mission commends the authorities’ progress in implementing the new VAT Act towards a launch in July 2016.”

“In addition to mobilising additional resources, the new VAT is designed to protect the poor and small businesses; to make tax administration more transparent; and to reduce taxpayers’ compliance costs.”

“VAT implementation should be complemented by continued efforts to strengthen tax administration, particularly through automation. Further steps to reform inefficient and regressive subsidies would also create room to boost safety nets for the most vulnerable.”

Source: Dhaka Tribune