Last update on: Thu Jun 5, 2025 12:58 AM

Consumers are likely to pay more for a range of home appliances, from rice cookers and clothing irons to air conditioners (ACs), as the government phases out value-added tax (VAT) exemptions on locally manufactured electronics.

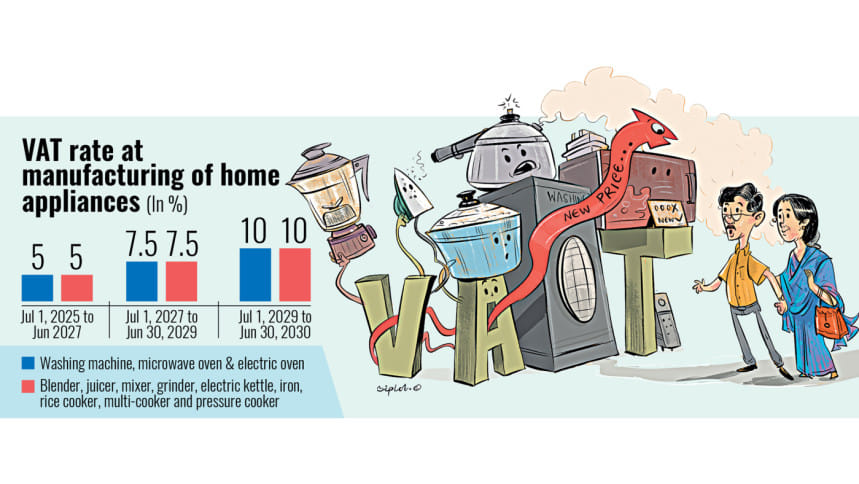

The government will gradually withdraw the existing VAT exemption at the production stage for several household appliances, such as washing machines, microwave ovens, blenders, juicers, and rice and pressure cookers, starting from the fiscal year 2025-26.

A 5 percent VAT will be applied to these items until June 30, 2027. The rate will rise to 7.5 percent on July 1, 2027, and reach 10 percent from July 1, 2029, remaining in place until June 30, 2030, according to two separate notifications issued by the NBR on May 27.

However, for refrigerators, freezers, ACs, and compressors, the exemption will end altogether, with a flat 15 percent VAT to be imposed from the next fiscal year.

This may push the prices of these appliances up, as these items currently enjoy a reduced 7.5 percent VAT, which will expire on June 30.

“We have not continued the reduced VAT rate for ACs and refrigerators because the producers enjoyed the benefits for nearly a decade,” said a senior NBR official.

Explaining the phased approach for other items, he said, “We have adopted a phase-out policy so that businesses can prepare themselves.”

He also mentioned that preferential treatment for home appliances will cease entirely by July 1, 2031.

Industry insiders say nearly a dozen local firms manufacture electronics to meet the local demand of the $8 billion home appliance market. Locally made products dominate the market due to their affordable prices compared with imported goods.

“The proposed VAT on electronic home appliances will likely lead to an immediate price increase of these essential consumer durables,” said Tanvir Rahman, chief business officer of Walton AC, a leading local electronics conglomerate.

In a move to take some pressure off manufacturers, Finance Adviser Salehuddin Ahmed, in his budget speech on June 2, proposed scrapping the 10 percent supplementary duty on imported raw materials, such as compressors used in cooling appliances. The waiver would remain in effect until June 30, 2028.

Still, Rahman argued that VAT at the production stage offers little comfort to local manufacturers, who are already burdened with additional cost pressures.

He pointed out that prices have been rising for the past two years due to the depreciation of the local currency against the dollar. “Manufacturers will be forced to adjust prices to absorb the added tax burden, which will inevitably increase overhead costs and pass the impact onto end users,” he said.

Rahman also questioned the government’s logic in treating these items as luxury goods.

“In reality, they have become essential household items for most families. The VAT will only make it harder for the average consumer to afford these necessities, especially during a time of economic strain,” added the top executive.

Salim Ullah Salim, director of marketing at Jamuna Electronics, expressed concern about the decision to withdraw VAT exemption at the manufacturing stage.

“While this may appear to be a long-term industrial strategy, the immediate effect on the ground is quite worrying,” he said. “Withdrawal of VAT exemption at the production stage could lead to price hikes for all consumer durables.”

“Production costs are already soaring due to gas and fuel supply issues, dollar-based raw material imports, and rising duties. The added tax pressure will worsen this,” Salim commented.

“With inflation high and incomes falling, even essential electronics are starting to feel like luxuries,” he added. “In a fragile market with shrinking sales and rising costs, any additional tax ultimately burdens the end consumer. The timing of this move could intensify that pressure.”

Nurul Afser, deputy managing director of Electro Mart Limited, said the decision to withdraw VAT exemptions would inevitably push up prices, placing more pressure on low- and middle-income families.

“This step will not only hurt consumers but also slow down the progress of the domestic electronics industry,” he commented.

Afser believes that rising prices could dent demand significantly. “With higher costs, many families may no longer be able to afford essential home appliances. The industry may face serious setbacks as a result.”

He urged policymakers to reconsider the move to support the sector’s growth momentum.