Foreign funds in the Dhaka bourse has been declining for the last six months amid a confidence crisis among the investors stemming from a tussle between Grameenphone and the telecom regulator over an audit claim.

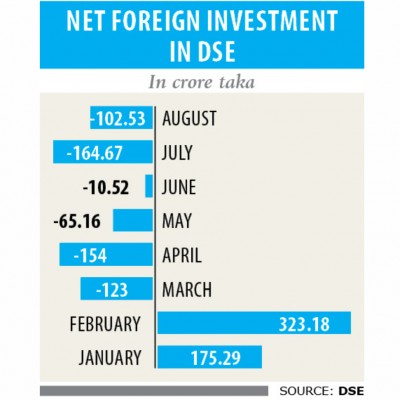

Net foreign investment plunged to Tk 102.53 crore in negative in August, when foreign investors purchased shares worth Tk 176.78 crore and sold securities worth Tk 279.31 crore, according to data of the Dhaka Stock Exchange.

The net foreign investment was Tk 164.67 crore in the negative in July.

Market insiders say the number of the trading days was lower last month because of the Eid vacation, resulting in lower turnover. But, the foreign investors were in a selling mood.

A merchant banker said foreign investors were hurt by GP’s recent fall after the Bangladesh Telecommunication Regulatory Commission (BTRC) declared the company a significant market power in February.

The foreign investors’ sell-off started in March and accelerated further last month when the BTRC decided to issue show-cause notices to GP and Robi, asking why their licences would not be cancelled for not clearing audit claims involving Tk 13,447 crore.

A stock broker said a large stake in GP belongs to foreign and institutional investors, so the government move has dented investors’ confidence, even though the company’s earnings rose in the first half of 2019.

GP’s earnings per share rose 10.49 percent year-on-year to Tk 13.37 from January to June, DSE data showed.

The tougher move against GP has impacted the foreign investment because it may reduce the earnings growth of the largest listed company, said Mohammed Rahmat Pasha, managing director of UCB Capital Management.

Another broker said coordination among all the regulators should be ensured for the sake of the stockmarket. Otherwise, any decision of this kind may affect the whole market. GP’s share fell 1.97 percent to Tk 303 yesterday, which is more than 27 percent lower than its February high of Tk 416.

The depreciation of the local currency against the US dollar in the last few months also prompted the foreign investors to sell more shares.

If a currency devalues, foreign investors have to sell more shares in order to ensure pre-depreciation level profit.

For instance, eight months ago if foreign investors had made Tk 80 in profit, they would have got $1. Since the taka has depreciated, they have had to make Tk 83 in profit now to get the same amount of dollar.

The local currency has depreciated to Tk 84.50 per USD from Tk 82 within a year.

Market analysts also blamed higher bad loans in the banking sector that has led to lower income in the sector for the sell-offs by the foreign investors. Pasha said non-performing loan is rising and banks are suffering from liquidity pressure. Foreigners are reluctant to invest in the banking sector.

In the second quarter of 2019, default loans stood at Tk 112,425 crore, up 1.40 percent from the preceding three months, according to data from the Bangladesh Bank.

Source: The daily star