Last update on: Sun Feb 16, 2025 10:08 AM

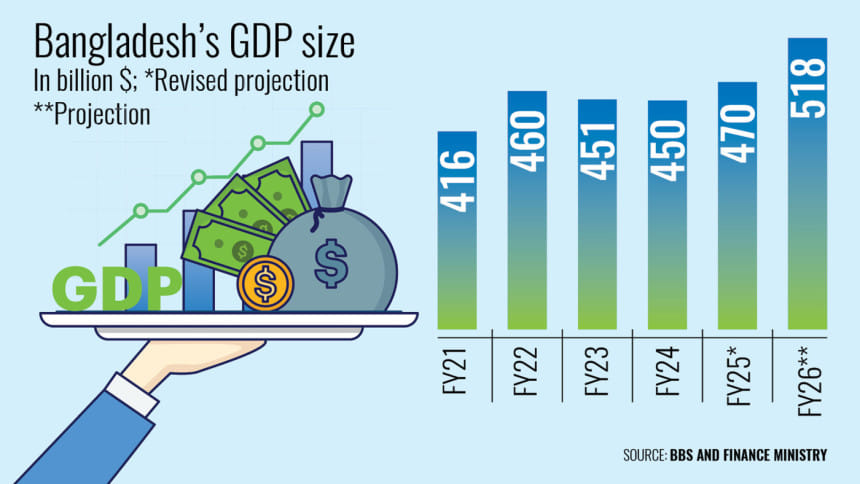

The finance ministry is likely to project that the country’s gross domestic product (GDP) will surpass the $500-billion mark for the first time in the upcoming fiscal year (FY), anticipating an economic rebound in FY 2025-26.

The ministry made the estimate during a recent budget-related meeting attended by Finance Adviser Salehuddin Ahmed, according to finance ministry officials.

The Finance Division estimates that Bangladesh’s GDP at current prices will reach $517.7 billion (Tk 6,315,923 crore) in FY26.

For the ongoing fiscal year, the initial GDP projection was $491 billion (Tk 5,597,414 crore) at current prices.

However, it is likely to be revised downward by $21 billion to $470 billion (Tk 5,645,114 crore), according to finance ministry sources.

This means the size of GDP will grow by 10.21 percent at current prices in FY26 than the revised estimate for the ongoing fiscal year.

However, according to the revised estimate, GDP may increase by 4.44 percent in the current fiscal year.

In the last fiscal year of 2023-24, Bangladesh’s GDP stood at $450 billion (Tk 50,026,537 crore), according to data released by the Bangladesh Bureau of Statistics (BBS).

The finance ministry expects the economy to rebound in the coming years, with GDP crossing the $500-billion mark.

Similarly, foreign multilateral lenders, such as the Asian Development Bank (ADB), World Bank, and International Monetary Fund (IMF), have projected higher growth in the coming years, despite lowering their economic growth projections for FY25.

For the next fiscal year, the finance ministry may project real GDP growth at 6 percent and inflation at 6.5 percent.

“This is a pragmatic projection, not an unrealistic one,” said Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh.

Rahman also expressed doubts about achieving the 6 percent real GDP growth target.

“Because investments have hit a snag with no sign of improvement anytime soon,” he said. “Besides, the development spending has also slowed and there is no guarantee that it will bounce back in the next fiscal year.”

In its latest monetary policy, the Bangladesh Bank (BB) projected private sector credit growth at 9.8 percent by June this year, which aligns with the finance ministry’s revised projection.

“This projection underpins expectations of a modest overall balance of payments surplus, driven by inflows from official multilateral development partners, sustained growth in export revenues, and remittance inflows,” said the monetary policy statement (MPS) published last week.

For the upcoming fiscal year, the finance ministry has projected that private sector credit growth will grow to 11 percent.

Along with the rising trend in exports and remittances, the overall volume of imports is expected to increase in the coming years.

Although import volumes were in negative territory before December last year, overall imports rose by 3.53 percent during the July–December period, according to central bank data.

In FY26, the finance ministry also expects imports to reach 10 percent.

“The government expects GDP size to cross the $500 billion mark, considering the above indicators,” said a top finance ministry official.

Contacted, Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), underscored the need for the national statistical agency to re-estimate the GDP size.

“Many reports, including the ‘White Paper on the State of the Bangladesh Economy’, have identified flaws in the BBS’s GDP growth estimates,” he said.

As a result, the actual tax-GDP ratio and debt-GDP ratio cannot be accurately accounted for, added Rahman.

“First, the BBS should develop a robust methodology for calculating GDP,” he emphasised.