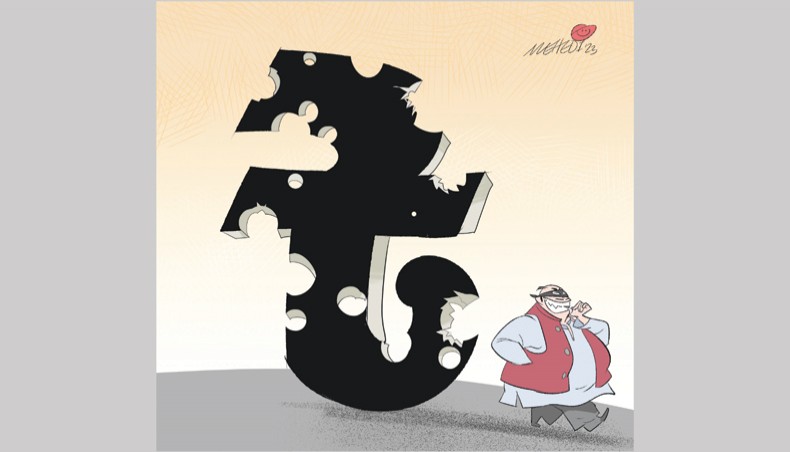

— New Age/Mehedi Haque

INFLATION has been a buzzword globally. Inflation is the rise in prices of goods and services and the gradual loss of purchasing power of people over a certain period of time in an economy. It has been a global problem and a worrisome issue for many countries around the world. Both developed and developing countries have been experiencing persistent, acute inflation.

Many countries have come out of a vicious cycle of inflationary spirals, absorbing monetary and fiscal policy. Bangladesh has long been experiencing nagging inflation fuelled by rising commodity prices since the inception of the Russia-Ukraine war. In the backdrop of rising prices of essentials, lower and middle-income people have been particularly hurt and are facing tremendous pressure to make their ends meet.

There are plenty of reasons associated with the recent price hike on essentials. Both external and internal reasons are responsible for the galloping prices of food and non-food items. By combining fiscal and monetary policy measures, the government and the central bank can mitigate the impact of persistent price hikes.

The Covid pandemic: Since the onset of the Covid pandemic, people in Bangladesh have experienced exorbitant prices for commodities. Not only Bangladesh but also the whole world saw disruption of supply chains, an economic recession, and a downturn in economic growth. Furthermore, the Bangladesh economy also faced myriad challenges. It had experienced economic recession, decline of exports, shut down of garment factories, job cuts, repatriation of Bangladeshi expatriates from different countries, decline of remittances, etc, which gave impetus to the rising prices.

Having observed the devastating impact of the Covid pandemic, international organisations forecast that developing economies would take longer to recover from the impacts of Covid-19. However, Bangladesh was one of the few states that recovered from the Covid pandemic much earlier than expected due to its resilient workforce and pragmatic government policy.

Russia-Ukraine war: The Russia-Ukraine war gave a big blow to our economy and fuelled soaring inflation. Before the Covid pandemic concluded, the world saw another bout of global crisis stemming from the Russia-Ukraine war. Russia invaded Ukraine on February 24, 2022. Since the outset of the Russian-Ukraine war, people across the world have been suffering from exorbitant price hikes due to disruption in supply chains and the imposition of various sanctions by the United Stats against Russia and vice versa.

The United States and its allies curtailed diplomatic relations and imposed various sanctions to deter Russia from the war. Due to the USA and its allies’ imposition of sanctions against Russia, its economy was badly affected and saw a downturn in economic growth and GDP. Russia and Ukraine were the major suppliers of global food grains. Furthermore, Russia was the biggest supplier of global oil and gas. Following the war, food and non-food inflation have been skyrocketing. Due to the volatility of international politics, the US’s slapping of sanctions on Russia, rising prices in the global market, the Fed’s raising of the policy rate, etc, Bangladesh has to pay more dollars to buy goods and services, which has been adding inflationary pressure to its economy and stressing the balance of payments.

Although Bangladesh is not a party to the Russia-Ukraine war, its economy has been badly affected by the war. The prices of all foods and non-food items have jumped manifold. According to the latest BBS data in November 2023, overall inflation was 9.49 per cent, which was slightly down from 9.93 per cent in October. The present rate of inflation is much higher than the targeted inflation rate of 6 per cent earlier projected by the government in the 2023–24 budget. So tackling growing inflation is one of the biggest challenges for the government and also for the central bank.

However, the central bank has taken some steps to control the nagging inflation after getting prescriptions from economists. It has raised policy interest rates and uncapped the interest rates on deposits and loans. Moreover, Bangladesh Bank has stopped providing money to the government by printing money; the initiative was hailed by economists. In the outgoing fiscal year, the government borrowed Tk 80,000 crore to meet its budget deficit from the central bank by printing money.

The US policy interest increase: The United States’ policy interest rate increase came as galloping inflation emerged after a long hiatus. In order to tame the rising inflation, the US government took the initiative promptly to address the rising inflation emanating from the fallout of the Russia-Ukraine war. At one point last year, on June 22, the US inflation shot up to 9.10 per cent, which is the highest ever in recent time.

To curb rising inflation, the Federal Reserve Bank, the central bank of the Unite States, has been clinching on its monetary policy tools, such as policy interest rate intervention, to get rid of inflationary pressure and help people get relief from it. The Fed raised the policy rate several times and currently stands at 5.50 per cent. The Fed’s rising policy interest rate has effectively curbed inflation.

Now the US inflation rate has reached 3.20 per cent. The policy rate is the rate at which central banks borrow from and lend to commercial banks on an overnight basis. When the central bank raises the policy interest rates, loans become more expensive for the borrowers, and it becomes difficult to make profits with high interest rates. So borrowers feel uninterested in borrowing money from banks. By raising the policy interest rate, the central bank can mop out excess liquidity and money from the market when inflation is on the rise.

If the policy rate rises, banks will also increase their interest rates on deposits and lending at the same time. Due to the hike in policy rates by the Fed, it has had a negative impact on our economy. Our taka has lost nearly 30 per cent of its value against the US dollar, with foreign exchange reserves plummeting from $36 billion to $25 billion as import costs and debt servicing become more expensive.

Depletion of our foreign currency reserves: Another reason for terrible price hikes is the consistent decline in the foreign currency reserve. Due to a shortage and the gradual reduction in reserves, the country has been facing stress in its balance of payments. In order to stabilise our currency, boosting foreign reserves is a must. Hefty reserves help to keep our currency strong, reducing the volatility of the exchange rate. However, Bangladesh has been experiencing constant depletion of reserves since 2021.

So, being an import-reliant country, the government has to ensure sufficient reserves to keep the price stable. To bring down pressure on reserves, the government and central bank have put restrictions on imports of goods, which add fuel to inflation. The import restrictions have been reducing the supply of goods, ultimately making inflation scenarios worse. With a view to curbing imported inflation, the government has to ensure sufficient reserves.

Exchange rate volatility and devaluation of the taka against the dollar: The exchange rate volatility and depreciation of the taka against the dollar can be blamed for the current soaring inflation. Our exchange rate fixation is not floating, ie, it is not determined by market forces such as supply and demand and doesn’t take place on a regular basis. Before the crisis moment, the central bank did not adjust the exchange rate of the taka against the dollar at regular intervals

It tried to keep the rate managed. When the crisis moment came, the central bank devalued the taka by around 30 per cent in the last year to adjust the price against the dollar. Consequently, people see a huge rise in commodity prices. Moreover, the government has been forced to depreciate the taka against the dollar as reserves have been depleting fast.

Our reserves have been constantly depleting following the impact of the Russia-Ukraine war. In August 2021, the country’s reserves reached a peak of $48 billion, which has now dwindled and stands at around $25 billion. According to the IMF BPM6 calculation, usable reserves are now hovering at $19 billion. The effect of Russia-Ukraine gave a big blow to our economy and was fuelled by the rising prices of food grains along with oil and gas prices.

Consequently, the government has been paying more dollars to purchase food grains, oil, gas, etc. Moreover, raising policy rates by the US Fed made the dollars scarce. As a result, the government has been forced to depreciate the taka against the dollar, which has exacerbated the inflation scenario.

The government and the central bank can partake in the following fiscal and monetary policy measures to curb galloping inflation.

Monetary policy measures: though the central bank has increased its policy interest rate, it has failed to control the money supply due to the introduction of SMART. Experts are saying that the central bank should give the market a chance to fix the banks’ interest rates. It will help to curb inflation as people will not get cheap funds from banks due to interest rate hikes and excess liquidity, which is fuelling inflation and mopping up the market.

So, the central bank should take the initiative to reduce the money supply. This will help effectively tame inflation. The government has to effectively manage public debt. The government should refrain from borrowing from the central bank to meet its deficit. Borrowing from the central bank can escalate inflation.

Fiscal policy measures: The government can take some fiscal policy initiatives to tackle elevated inflation. It can reassess and control its spending by focusing on the essentials of the projects. By reducing unnecessary expenditures, the government can slash overall demand in the economy, helping to mitigate inflationary pressure. It has to formulate strategies to effectively manage public debts, as excessive debts may result in inflationary pressure. The government should reduce the tax burden on mass people. It can cut import duties to reduce the price of essentials.

Moreover, the government can implement fair shops or subsidised shops of essentials to save the ultra-poor, who are badly affected by price hikes. The government should take policies to enhance productivity, and the supply of goods and services can contribute to price stability. The government should enhance its vigilance, monitoring, and regulation so that unethical businesses cannot take advantage of the volatile nature of the market through market distortion, hoarding, or other mechanisms that contribute to the price increase of essentials. In order to prevent monopolistic practices and market manipulation, the government can implement and enforce regulations.

Last but not least, both fiscal and monetary policy measures can assuage the persistent price hikes. Proper implementation of policies is crucial to easing the excruciating inflationary pressures.

New Age