Last update on: Wed Jun 4, 2025 08:00 AM

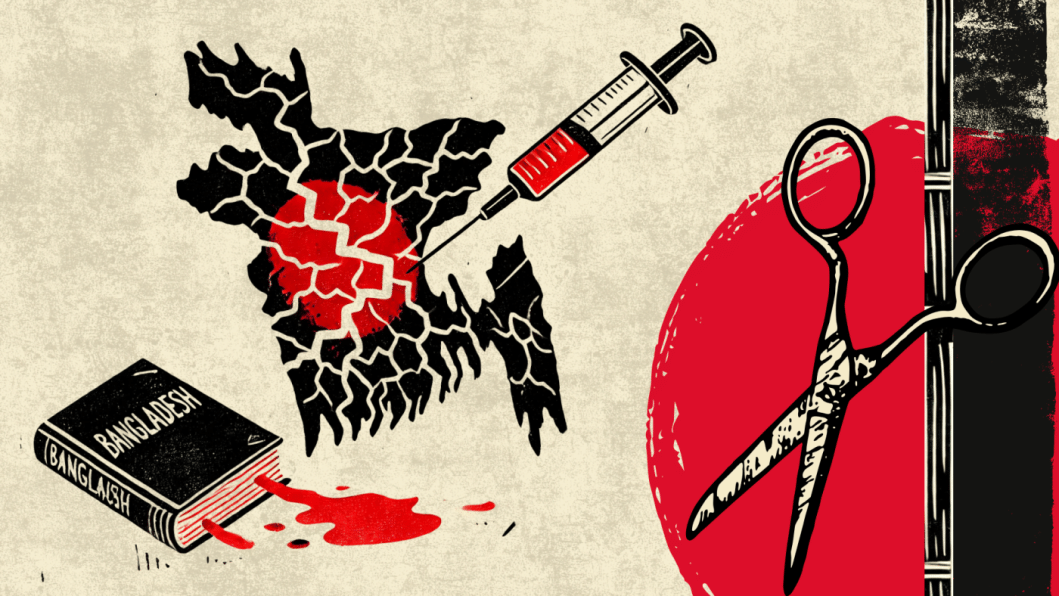

The proposed budget for 2025-26 fiscal year is at an opportune moment in Bangladesh’s economic and political economy. Inflation is in the higher range, job creation is sluggish, investment confidence is declining, and the overall macroeconomic situation remains shaky. Given these realities, the finance adviser’s address was commendable in terms of tone and content, marked by openness and realism rarely seen in budget announcements in Bangladesh.

But acknowledgement, though necessary, is not sufficient. Even as the speech acknowledges facts on the ground and expresses a willingness to address entrenched problems, the budget itself does not deliver the meaningful structural reforms the country desperately needs right now.

Even more respectful in tone, the FY2026 budget largely maintains the structural status quo. It once again reiterates the pattern of previous years in which institutional lethargy, lack of reform ambition, and bureaucratic inefficiency are the characteristics. For instance, there is no evident reform agenda for the tax system; however, in spite of ongoing issues of low revenue mobilisation, tax evasion, and overly complex and discretionary tax administration, the system continues to be plagued with problems. Likewise, public expenditure inefficiencies, government procurement delays, and weak implementation capacity remain unremedied.

More importantly, there is no mention of such critical accountability tools as outcome-based budgeting, performance audit, or project implementation audit, even when these are central to institutional credibility and implementation building.

One of the major turning points in public discourse last year was the student-led mass movement that demanded a focus on equity and decent employment. The finance adviser’s speech did reference these demands, but the budgetary response is at best fragmented and at worst inadequate.

Allocations for education, health, and social protection show no structural shift. Given the chronic underfunding in these sectors, modest increases fail to address growing needs. Furthermore, there is no visible commitment to invest in human resources for health and education, introduce modern skill-building initiatives, or leverage data systems for transparent delivery and accountability.

In terms of job creation, the budget makes reference to supporting SMEs, tech-based sectors, and manufacturing. However, these efforts are not supported by coherent sectoral strategies or legal and regulatory reforms that can truly enable business growth and attract private investment.

Meanwhile, the approach to investment promotion in the proposed budget is cautious and incremental. While there are tax incentives and sector-specific announcements, these are not matched with deeper institutional reforms to improve the investment climate. Key obstacles—uncertain taxation policies, weak contract enforcement, opaque trade practices, and judicial delays—remain unaddressed. There is no meaningful mention of liberalising foreign direct investment (FDI) policies, reforming exit mechanisms, or improving digital and logistical infrastructure, all crucial components of a competitive investment ecosystem.

As a result, the core elements necessary to restore investor confidence—policy consistency, regulatory clarity, and institutional reliability—remain absent.

Even the most well-prepared budgets cannot work if there is no strong institutional capacity. Alas, the implementation arm of the Bangladeshi state continues to be weighed down by established weaknesses. Planning and budget coordination are ad hoc. Line ministries are not capable of implementation. Project timelines slip, and funds go unspent or are squandered.

The FY2026 budget does not provide any planned solution to this capacity shortfall. It does not provide an agenda for institutional reforms—neither in new systems of accountability, upgrading human capital in ministries, nor procedures of inter-agency coordination. Without these reforms, the dangers of underspending, leakage, and misallocation exist.

The broader political context further complicates the budget’s prospects. The interim nature of the government, the unresolved tensions following the national election, and heightened international scrutiny place the current regime in a fragile position. In such a setting, there is a tendency to prioritise political stability and management over economic restructuring.

This brings forth an important political question: how sincerely will the current interim government prioritise resolving economic issues? Or will its primary focus remain on political management amid the post-election uncertainty and deadlock among major political parties? The political unrest, controversies surrounding the election, and reactions from the international community have all placed the government under pressure. If, under this pressure, the government sidelines economic priorities in favour of political manoeuvring, the prospects for economic stability will be jeopardised.

For Bangladesh to move beyond budgetary continuity and embrace transformation, four strategic pillars must be prioritised:

i) Employment generation: Targeted investment in labour-intensive sectors, alongside comprehensive skill development for youth in emerging industries such as digital services and green energy.

ii) Reducing inequality: Significant resource reallocation towards quality education, rural healthcare, and cash transfer programmes, particularly those addressing vulnerable populations.

iii) Improving the investment climate: A bold agenda for tax simplification, contract enforcement, policy predictability, and digital infrastructure is critical to reinvigorate investor confidence.

iv) Institutional strengthening: Integrate performance-based budgeting, expand e-governance in public procurement and monitoring, and reform project execution systems to enhance accountability and efficiency.

The FY2026 budget may be remembered for its honest rhetoric, but unless backed by real political will and institutional reform, it will remain a lost opportunity. Bangladesh cannot afford to treat the budget as an annual arithmetic ritual. Instead, it must become a vehicle for structural transformation, inclusive growth, and long-term stability.

If the next political government found that this non-political interim government had introduced a truly different kind of budget, it would be facing significant pressure to carry forward a new policy direction. This raises an important question: did the interim government miss a crucial opportunity to set a bold example in budget-making?

Dr Selim Raihan is professor in the Department of Economics at the University of Dhaka and executive director at the South Asian Network on Economic Modeling (SANEM). He can be reached at selim.raihan@econdu.ac.bd.

Views expressed in this article are the author’s own.